Standard deduction on Salary

The concept of Standard Deduction was for the very first time introduced by the late Finance Minister Sri Arun Jaitely in his Budget Speech of 2018. The tax benefit was introduced for salaried taxpayers. Various tax benefits were available to professional taxpayers in the form of deduction. Therefore, to benefit the salaried individuals a single solution of standard deduction was brought up.

It is a flat deduction given by the Government of India to resident salaried individuals. However, from the Financial Year, 2020-21 salaried individuals would opt for the concessional tax rates under the new tax regime will have to give away the standard deduction. Let's see how does it impact the salaried individuals.

What does Standard deduction mean?

The concept of the standard deduction was introduced in the Finance Act, 2018. Standard Deduction is a tax benefit available to the salaried individuals. To be precise Standard Deduction is an outright deduction available to a salaried individual of the prescribed amount. (For AY 2020-2021 the prescribed amount for Standard Deduction is Rs. 50,000)

But, in lieu of such benefit, the government did way with a few deductions previously given to taxpayers.

Before answering another pack of questions, it is important to know the reason for the introduction of such a deduction. The purpose is to provide equal advantages to salaried class individuals like any other professional income taxpayer.

The professional taxpayer's avail deduction of expenses incurred for earning income; to put both income holders at par government had introduced the concept of standard deduction on salary.

Hence, it is only a fair act by the government. But, again the question arises that the country has various salaried individuals who are covered under different slab rates. Providing a fixed deduction to all slab rates is fair or unfair, yet debatable!

How is Standard Deduction Computed?

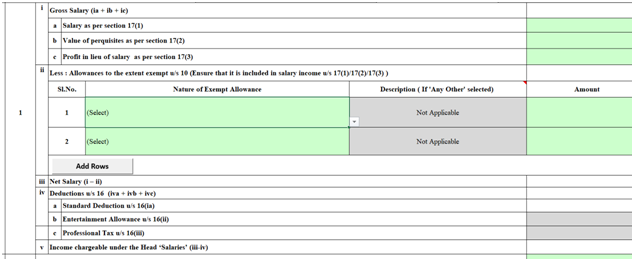

As per section 16(ia) of the Income Tax Act 1961 a salaried taxpayer can claim lower of the following amounts as Standard Deduction:

- INR 50,000

- Amount of Salary

This amount can be claimed as Flat Deduction from the Gross Salary of the Employee

What is the standard deduction for 2019 - 2020?

In February 2019, in the Interim Union Budget Piyush Vedprakash Goyal, now railway minister, had announced the increase in the standard deduction from INR.40,000 to INR.50,000 applicable for the FY 2019 - 2020.

Thus, for the AY 2020-2021 Standard deduction of INR. 50,000 in Income Tax computation can be availed by the taxpayers.

Can Standard Deduction be availed in the New Tax Regime with Concessional Rates?

It should be noted that after the introduction of a new tax regime in Budget 2020, taxpayers can either avail deductions previously available to them or they can opt for the new slab rates.

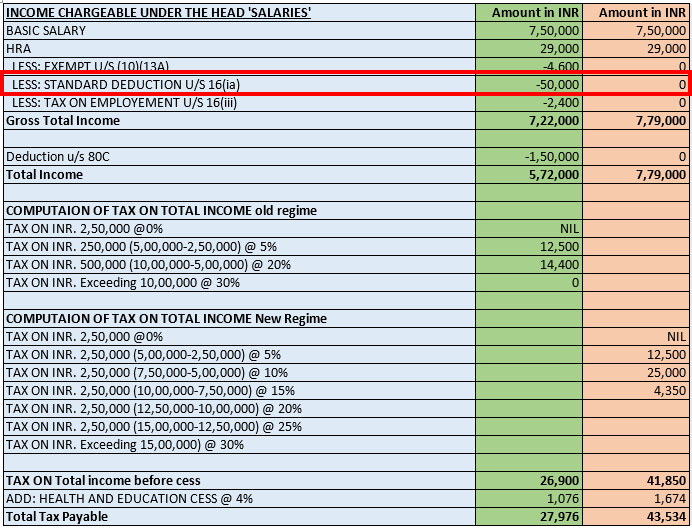

Thus, if you ask which Income tax regime is better, it will depend on case to case. Under the new regime, a standard deduction on salary shall be NIL. For better understanding, refer the below table which offers a comparative analysis of tax payable under New and Old Tax Regime:

The above representation is only for the purpose of standard deduction representation. It is not a full-fledged comparison of the old and new regime. In the above case, the taxpayer was able to avail deduction under chapter VI else the new regime would have been beneficial to him/her.

Is standard deduction applicable for all salaried employees?

There are various deductions available to a taxpayer. The standard deduction of INR.50,000 is available to every Salaried Resident Individual of India. Provided that the actual allowance received by the salaried person for transport and medical are already being considered in the gross salary of the taxpayer.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)