All taxpayers registered under GST are eligible to shift any balances available in the electronic cash ledger using Form GST PMT-09. To understand its complete process and usage, you can refer to All about Form GST-PMT-09.

Taxpayer can now easily rectify wrongly paid taxes, interest, penalty, etc. or other amounts. In case a tax payer has paid wrong tax i.e. paid CGST instead of SGST through cash then he has to use PMT 09 to rectify such error. Form PMT – 09 is now available on GST portal.

Procedure to file PMT 09:

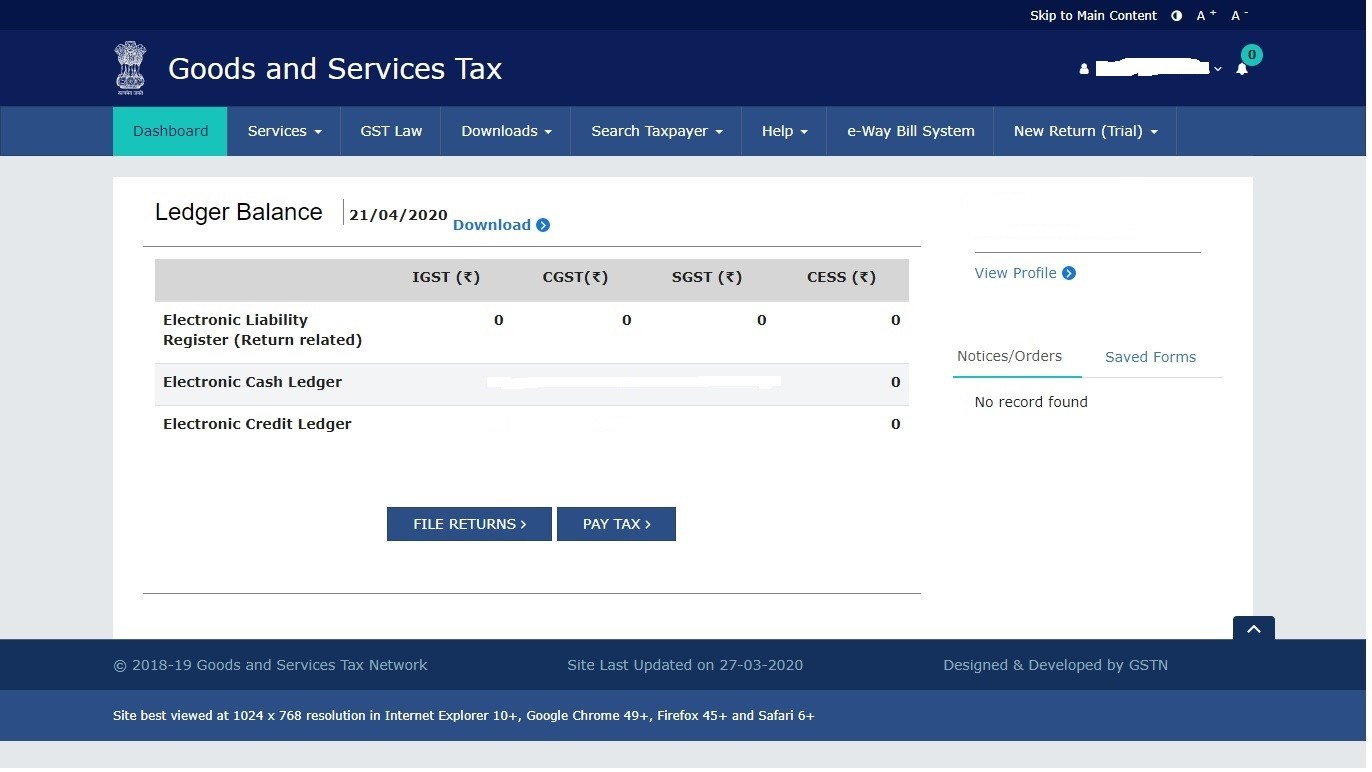

Step 1: Go to www.gst.gov.in and Log in to GST portal

Now Go to Dashboard

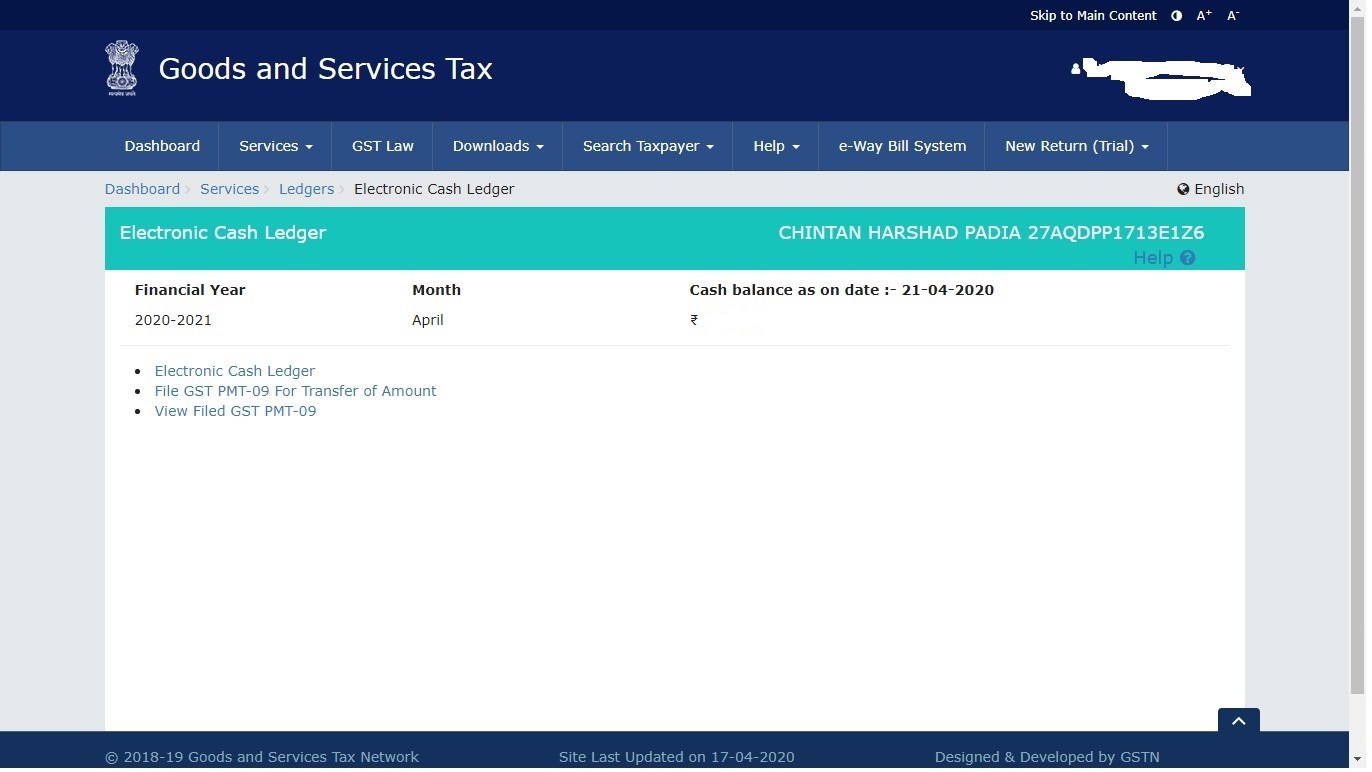

Step 2: Now under “Service” tab Go to “Ledger” tab and click on “Electronic Cash Ledger” option

It will redirect to electronic cash ledger

It will redirect you to PMT 09 form.

Step 3: Filling PMT 09 form

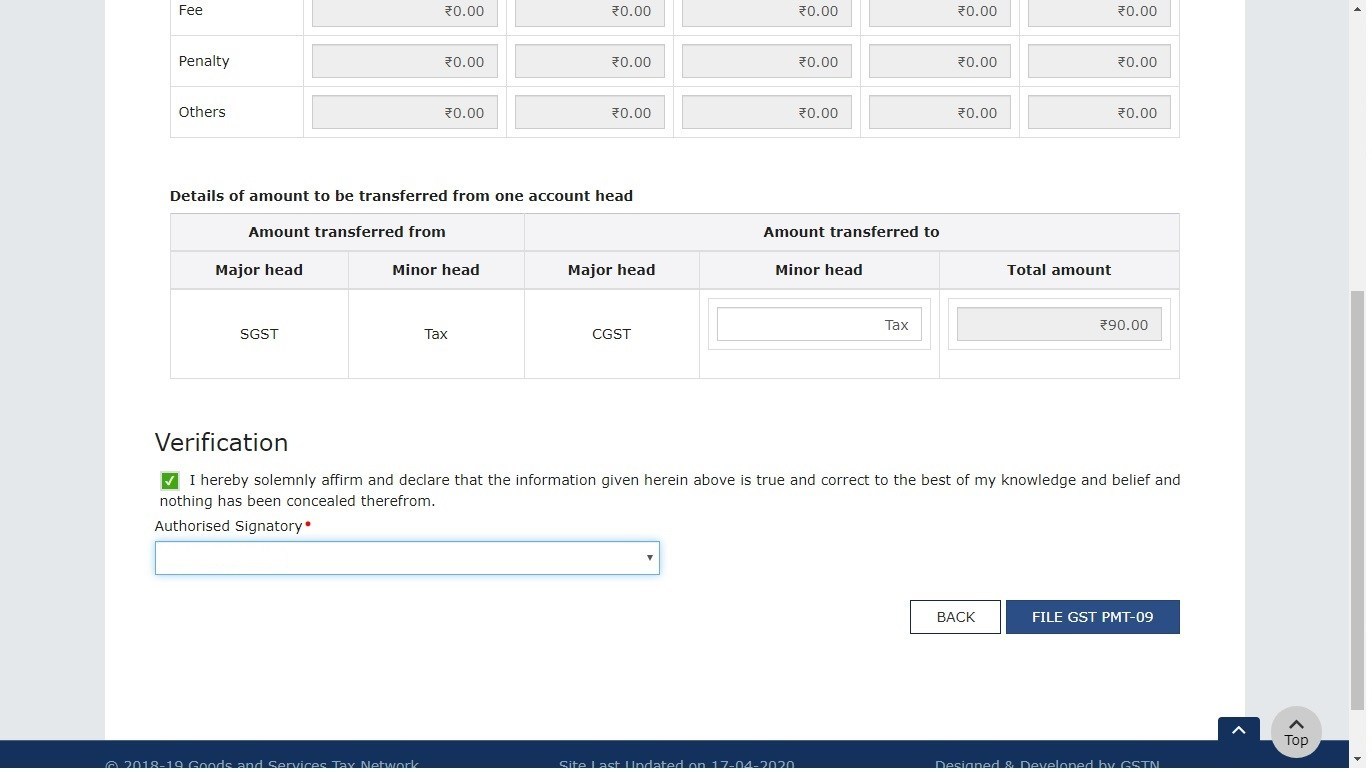

- Select the Major head from which the amount of tax to be transferred i.e. CGST, SGST, UTGST or IGST

- Now, select the "Minor head" from which the tax is to be transferred i.e. Tax, penalty, late fees or Interest.

- Now enter the amount which is to be transferred

- Now, select the Major head to which the amount of tax to be transferred i.e. CGST, SGST, UTGST or IGST

- Now enter the amount which is to be transferred in the minor head (amount entered in point no 3)

- Now click on "Save" button. This will save the record. After clicking save button a warning message will pop up which say, "Are you sure, the amount indicated as above is intended to be transferred? Click on "Yes" the process will get validated successfully

Step 4: Filing of form:

Now click on “Proceed to file” button

Select the “Terms and condition” Check box

Select the authorized person from the drop down and click on “File GST PMT 09”

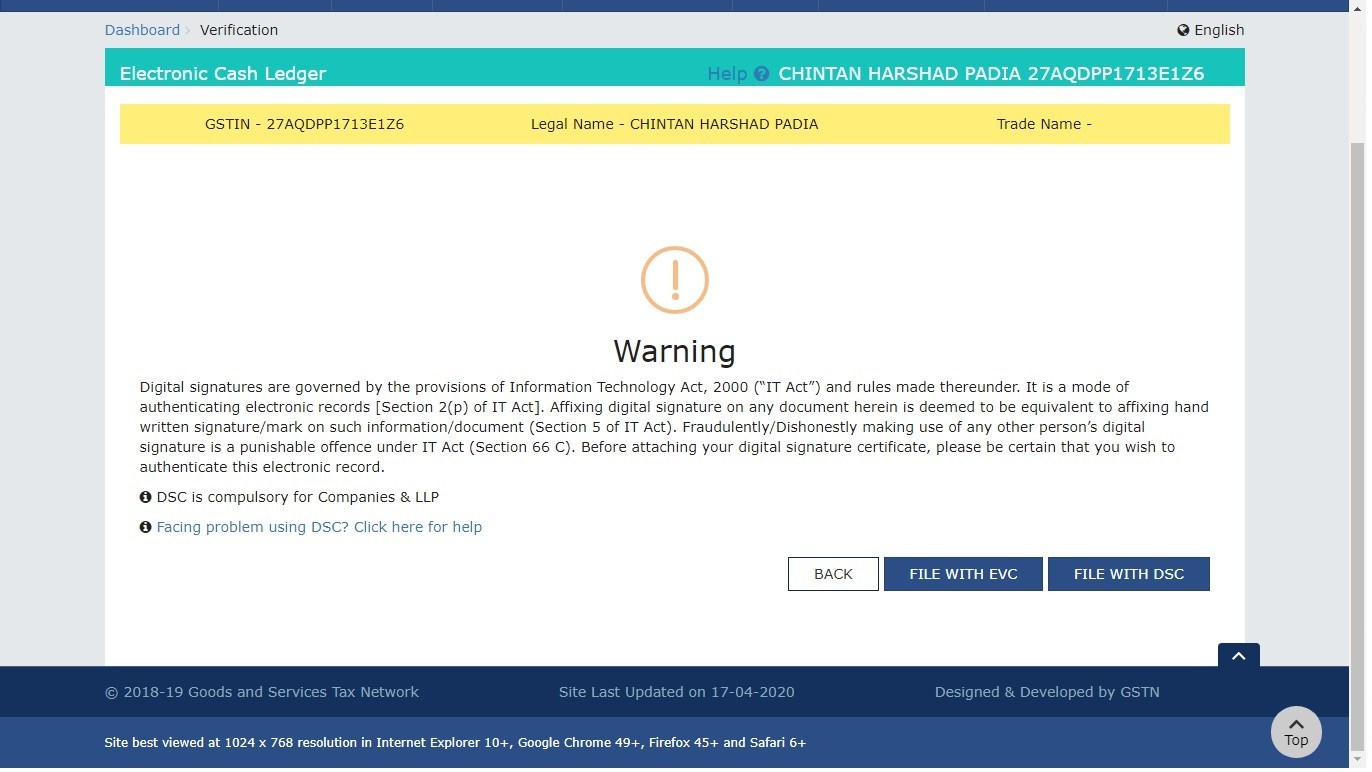

After clicking the button, a warning will pop will which is as follows “Are you sure, the amount(s) indicated as above is intended to be transferred? Click on “Yes”

Now select the preferred mode of filing i.e. through DSC or EVC and submit the form

Example on how Transfer Cash Balance Works,

1) Mr. X had to pay Rs. 600 as CGST and SGST under the major head and Rs. 200 both under CGST and SGST as late fees under the minor head and he has wrongly paid Rs. 200 under Penalty under the minor head and Rs. 600 under interest column.

In the above case Mr. X can file PMT 09 to transfer the amount from the minor head i.e. from Penalty to CGST and SGST. This transfer can be done from major head to minor head as well.

An amount paid under one minor head can be transferred to another minor head. In the above example the wrongly paid penalty can be transferred to late fee minor head by filing PMT 09.

2) Mr. A has to pay Rs. 1,200 as IGST under Major head and Rs. 300 under interest under the minor head. He has wrongly paid Rs. 300 under late fees and Rs. 1,200 under SGST column

In the above case Mr. A can file PMT 09 to transfer the amount from the minor head i.e. from interest to penalty.

An amount paid under one major head can be transferred to another major head. In the above example the wrongly paid CGST can be transferred to IGST by filing PMT 09.

Important Points to be Noted before filling

- This challan only allows shifting of the amounts that are available in the electronic cash ledger.

- The amount once utilized and removed from cash ledger cannot be reallocated

- Major head refers to- Integrated tax, Central tax, State/UT tax, and Cess.

- Minor head refers to- Tax, Interest, Penalty, Fee and Others

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)