Introduction

Considering tendency of taxpayers to adopt tax evasion measures, Income tax provisions provide for deduction of tax at source / collection of tax source. Tax rates for such deduction are provided under Section 192, Section 194 and 195(non-residents). Person responsible for making the payment is entrusted with the responsibility of deducting the tax at specified rates either at the time of credit in the books or payment to the recipient, whichever is earlier and only pay the balance amount to the recipient. This ensures tax is collected in advance, checks tax evasion and also helps track income of recipients in the future.

However, this scheme of deducting tax at source itself may create hardship to few taxpayers who may not be have a taxable income at all. Such scenarios could arise where:

- Taxpayer has incurred a loss for the current year;

- Taxpayer has carried forward losses of previous years available for set off in the current year;

- Taxpayer is eligible to claim certain exemptions or deductions during the year;

The above could result in the taxpayer not having any taxable income at all for the year. While TDS rates are determined in general considering larger income population as a whole and income category, it might lead to undue difficulties to certain taxpayers as above who would not have any taxable income yet tax gets deducted at source for them which they end up claiming as refund. No doubt these taxpayers are eligible for an interest on such refund, funds unnecessarily get blocked till refund is received. Moreover, they have to go through the process of filing their return to claim it (in a case where it was not otherwise mandatory for them to file it under law).

Therefore, with an objective to remove this undue hardship on such taxpayers, income tax law provides for an option to obtain a certificate from the Assessing officer confirming either a lower rate of TDS compared to the rate specified under the law or a NIL rate of TDS, depending on facts and circumstances of each case based on the application made. Section 197 governs these provisions. In this article we will discuss provisions on applying for a certificate for lower deduction of TDS.

Income Covered Under Section 197

Section 197 application can be made by the recipient of income in case of the following category of receipts where TDS is required to be made under the following Sections:

- Section 192 – Salary income

- Section 193 – Interest on securities

- Section 194 – Dividends

- Section 194A – Interest other than interest on securities

- Section 194C – Contractors income

- ection 194D – Insurance commission

- Section 194G – Commission/remuneration/prize on lottery tickets

- Section 194H – Commission or brokerage

- Section 194-I – Rent

- Section 194J – Fee for Professional or technical services

- Section 194LA – Compensation on acquisition of immovable property

- Section 194LBB – Income in respect of units of investment fund

- Section 194LBC – Income in respect of investment in securitization trust

- Section 195 – Income of non residents

Eligibility for Making an Application Under Section 197

Application can be made where income of any person attracts TDS as per above mentioned sections and income of the recipient justifies non-deduction or lower deduction of income tax based on his estimated final tax liability.

Timeline for Making the Application

Income-tax provision does not provide for a deadline to make an application under Section 197. However, as TDS is made on income of on-going financial year it is advisable to make an application at the beginning of financial year in case of regular income throughout the financial year and as and when the need arises in case of one-off incomes.

Procedure for Making the Application Under Section 197

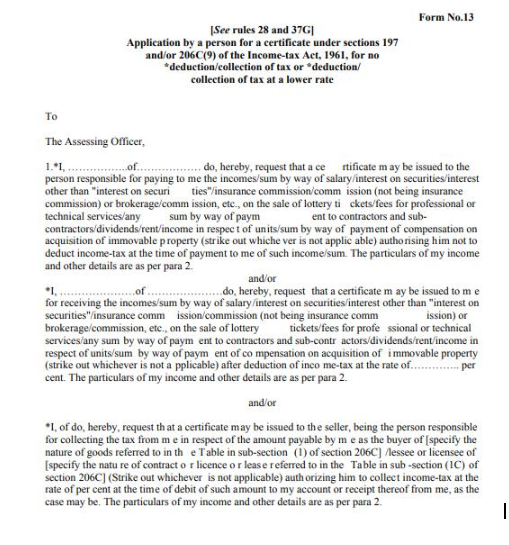

- An application for nil/lower deduction of TDS using the FORM 13 is required to be filed with the Assessing Officer(TDS) for seeking permission. Such Form 13 can be filed either online or manually. Regions of Mumbai, Tamil Nadu and Karnataka have enabled online filing of Form 13 for faster processing of applications for issue of certificates of lower/nil deduction of tax at source u/s 197(1) of Income Tax Act 1961

- Suggested that the tax payers file complete and correct details required for processing the application in the first instance.

- If the application satisfies the AO, he would process the issue of the certificate;

- The copy of this certificate can be attached to the invoice given to the deductor, and he can use this to justify the lower tax deduction.

Validity of an Application Made Under Section 197

Section 197 is issued for a particular financial year and stands valid from the date of issue and throughout the financial year unless cancelled by the assessing officer (TDS) before the expiry.

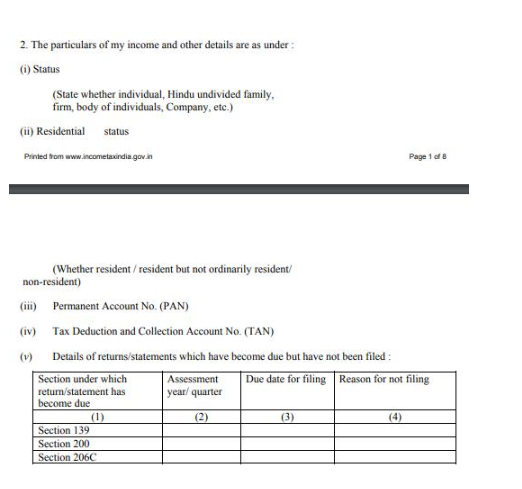

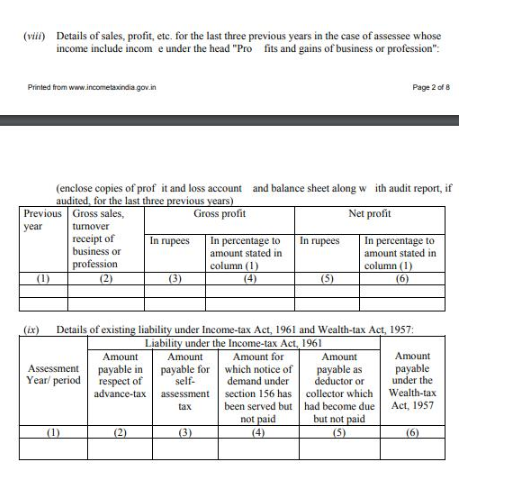

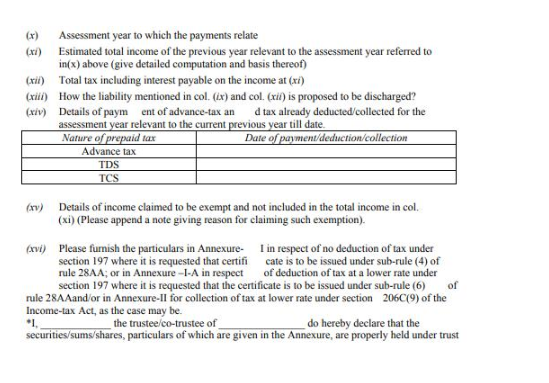

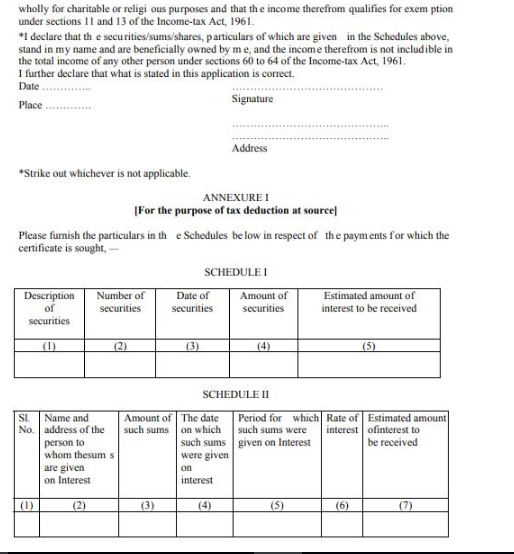

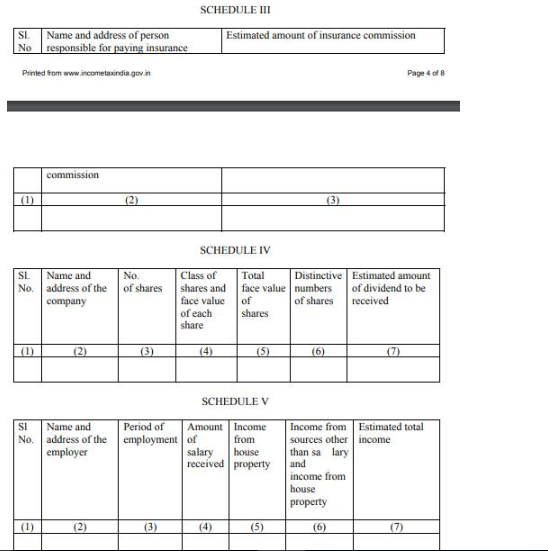

Documents to Submitted with Form 13

- Signed Form 13

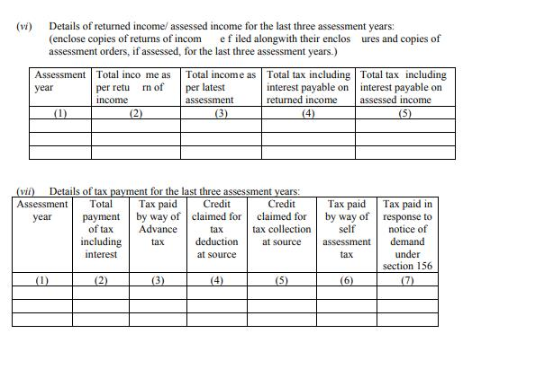

- Copies of return of income along with enclosures and acknowledgment for previous 3 financial years

- Copies of assessment orders for previous 3 financial years

- In case of assessee having business or profession income, copies of financial statement along with audit report if any for previous 3 financial years

- Projected profit and loss account for the current financial year

- Computation of income statement for previous 3 financial years and estimated computation for the current financial year

- Copy of PAN card

- Tax Deduction Account Number of all parties responsible for paying you

- E-TDS return acknowledgment for previous 2 financial years

- Estimated income during financial year

- Any other documents depending on nature of income

- TDS default earlier

Once the application complete in all aspects is submitted to jurisdictional assessing officer (TDS), application shall be disposed of within 30 days from the end of the month in which such application is received. Assessing Officer will review the documents/information submitted and may ask for further queries and documents before issuing the certificate/rejecting the application.

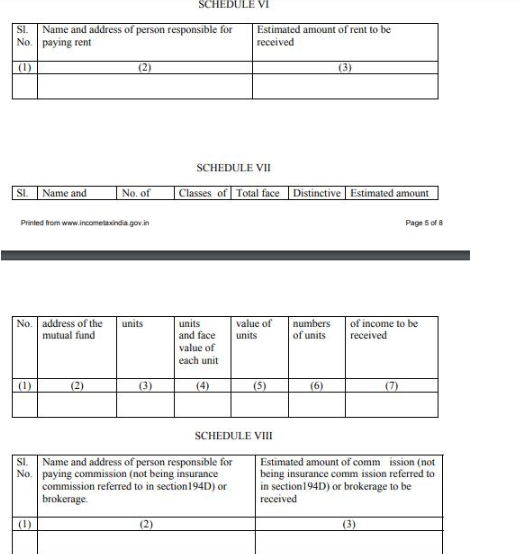

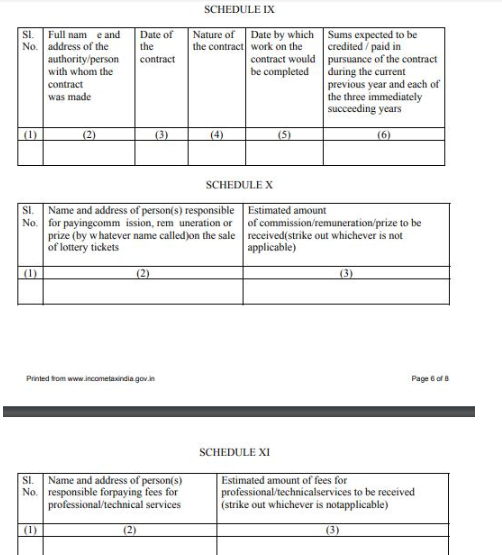

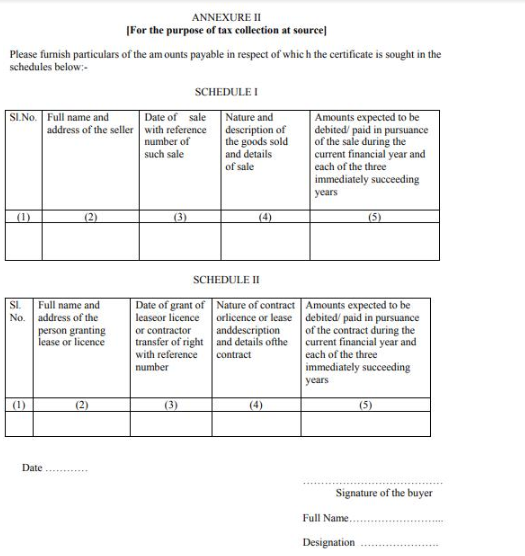

Sample Form 13

Section 197A

While Section 197 application can be made by any person including corporates, in case of certain specified income category, resident individuals/any person not being firm or company as the case may be, may also submit a self declaration in specified forms (Form 15G/Form 15H) for non-deduction of TDS.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)