Updated on January 17, 2025 12:55:24 PM

CSR stands for Corporate Social Responsibility is now an integral component of the corporate culture as corporations worldwide recognize the necessity of aligning their activities with sustainable development objectives. In India CSR is a priority for the Ministry of Corporate Affairs (MCA) has taken an important step to ensure transparency and accountability for CSR spending. It is important for all NGOs irrespective of Trust, Society, or Section 8 Company to get CSR funds from corporations.

According to the Companies Act, 2013 and the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 businesses or organizations engaged in CSR activities must complete an eForm CSR-1 for their entire CSR projects. This registration process enables effective monitoring and tracking of CSR expenditures and ensures the funds go to their intended beneficiary. It is the eForm CSR-1 is a crucial document that can be used to verify and confirm the legitimacy of CSR projects and their impact on society.

CSR registration is required for NGOs that function as CSR implementing agency, allowing for effective monitoring of CSR spending. The online process, which requires certification from a CA, CS, or CMA, takes 2 days and costs ₹2,999. Following approval, NGOs can register on the CSR Exchange Portal within 30 days.

Form CSR-1 or “eForm CSR-1” is a registration form for getting CSR funding. It is termed as Form for “Registration of Entities for undertaking CSR activities”. Form CSR-1 shall be signed and submitted electronically by the entity.

It should be verified digitally by a practising professional like Chartered Accountant or a Company Secretary, or a Cost Accountant. All entities who are intending to undertake CSR projects have to file this Form on the MCA portal.

Some of the benefits of CSR-1 registration are:

The Ministry of Corporate Affairs has made the CSR-1 form available on its website and made it mandatory for all the social organisations seeking CSR funds or CSR implementing agencies to file it. As per the notification issued by the Ministry of Corporate Affairs, from April 1, 2021, CSR Funding will be released only to the NGOs that are registered with MCA by filing Form CSR-1.

The provisions of the 2019 Amendment to the Companies Act, 2013 about Corporate Social Responsibility (CSR) came into force on January 22. As per the new provisions, every entity covered under sub-rule (1) that intends to undertake any CSR activity will have to register itself with the Central Government by filing the form CSR-1 electronically with the Registrar of Companies with effect from April 1, 2021. These sub-rules provisions shall not affect the CSR projects or programmes approved before April 1, 2021.

On the submission of the Form CSR-1 on the MCA portal, a unique CSR Registration Number shall be generated by the system automatically. In this way, a list of all implementing entities is maintained by the MCA, increasing the chances of timely fulfilment of proposed activities. This past performance record of implementing agencies can be referred to by the companies and help them decide their engagement for future CSR activities.

Form CSR-1 need to be digitally signed by following persons:

NGOs that are eligible to file Form CSR-1 on MCA Portal for getting CSR Funding are as follows:

Process of CSR-1 registration:

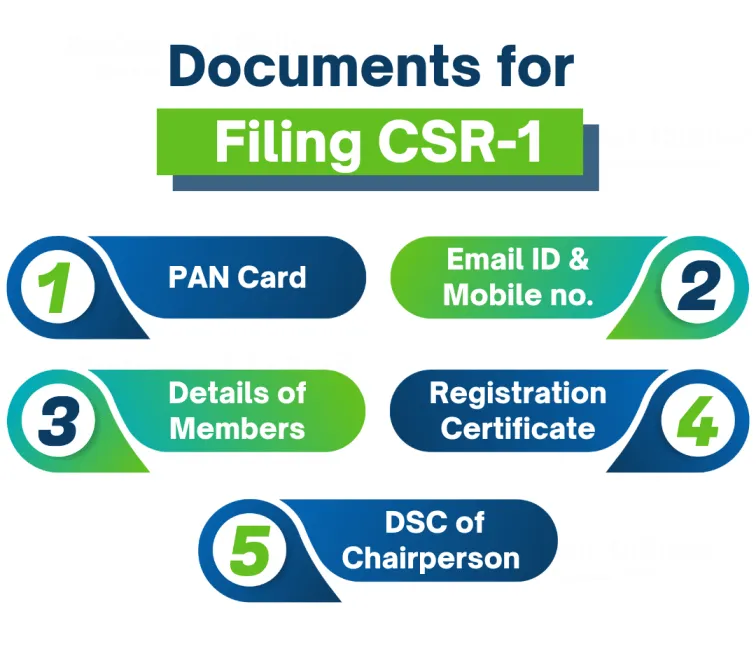

Documentation

Filing on MCA Portal

Inspection of the Form

Approval Letter from MCA

To register for CSR-1 in India, an NGO needs to follow these steps:

The fees of filing eForm CSR-1 is ₹2,999 but the cost may vary depending on the availability of chairperson's valid DSC.

The total time this process would take is around 2-3 working days.

CSR-1 registration is a requirement for non-governmental organizations (NGOs) seeking to serve as implementing agents for Corporate Social Responsibility (CSR) operations. It not only assures regulatory compliance, but also encourages openness, accountability, and effective monitoring of CSR spending. The registration process simplifies collaboration between firms and implementing agencies, creating significant social initiatives. Through a quick, inexpensive, and completely online process that requires professional approval by CMA, CA, or CS. CA, CS, or CMA NGO can sign up and, if accepted join with the CSR Exchange Portal to investigate and take part in worthwhile initiatives. This process ultimately increases the efficacy of CSR initiatives, which allows companies to significantly contribute to the advancement of society.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

As per the notification issued by MCA, from April 1, 2021, CSR Funding will be released only to the NGOs that are registered with Central Government by filing Form CSR-1.

For filing Form CSR-1, an NGO needs its registration certificate, PAN, details of members and DSC of director of the organisation. Apart from these basic documents, an NGO needs few attachments too which are as follows:

Yes, it is primary condition that, NGO must be registered under Section -12A and 80G of Income Tax Act 1961.

No, An entity eligible for filing CSR Form must be at-least 3 year old.

If NGOs or CSR implementing agencies don’t file CSR-1 Form, then they won’t get any CSR funding. With effect from April 1, 2021, it is mandatory for social organizations to register with the Central Government in order to get CSR fundings.

Filing Form CSR-1 is a complete online process. All the required documents along with the mandatory attachments are needed to be verified and digitally signed by a practicing professional like CA, CS or Cost Accountant. It is filed online on MCA portal with DSC of chairperson and a practicing professional.

All the existing NGOs which are registered under Section 12A and Section 80G of Income Tax Act 1961 has to file re-registration request under both section on or before 30.06.2021. Till 30.06.2021 all the existing registrations are valid and on the basis of which you can file Form CSR-1 on MCA Portal for getting CSR Funding.

Speak Directly to our Expert Today