Updated on February 17, 2025 12:31:43 PM

Digital Signature Certificate is a secure digital key (USB e-Token) that is issued by the certifying authorities to validate and verify the identity of the person or entity holding this certificate. It uses public-key encryptions to create the signatures and contains the signature in digital format.

A digital signature certificate (DSC) contains information about the user’s name, pin code, country, email address, date of issuance of the certificate, and name of the certifying authority.

A Digital Signature Certificate (DSC) is an encrypted electronic signature that represents a person's identity. The DSC is issued to individuals by a certifying agency appointed by the Controller of Certification Agencies (CCA). To file various government forms online, such as GST returns, company annual returns, income tax returns, and other statutory forms, individuals need to obtain a Class 3 DSC. Similarly, companies registering on the MCA portal and filing returns or attaching necessary documents are required to include the relevant persons' DSCs.

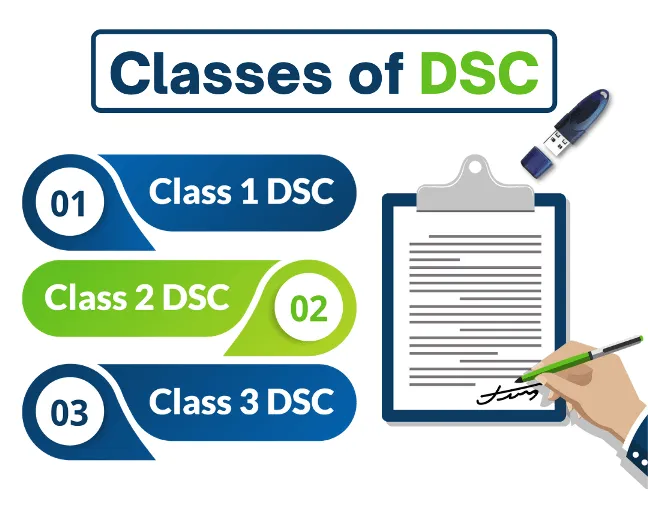

There are three types of Digital Signature certificates issued by the certifying authorities:

A Digital Signature Certificate (DSC) is an electronic form of a physical signature, serving as proof of identity for individuals and organizations in digital communications. It ensures the authenticity, integrity, and non-repudiation of electronic documents and transactions.

The MCA mandates DSCs for the following individuals:

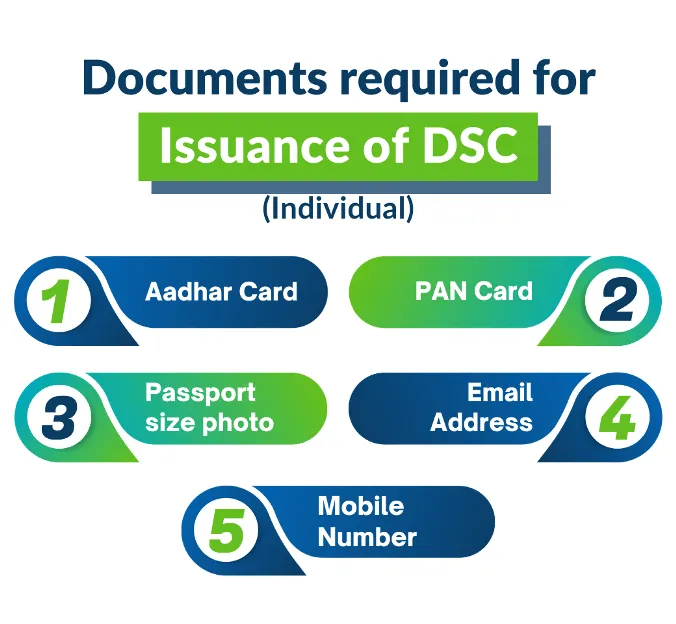

To apply for a Digital Signature Certificate (DSC), you will need to provide certain documents and information. The following documents are typically required:

The cost of obtaining a DSC for individuals is Rs. 2,000 only and the charges for obtaining a DSC for organization for authorized signatory is Rs. 4,000 only. It would take around 1-2 days for issuance of Digital Signature Certificate.

| Obtaining a DSC | Cost |

| for individuals | Rs. 2,000 |

| for organization | Rs. 4,000 |

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

It is a physical signature in an electronic format.

A Digital Signature can be obtained by any person (Indian Citizen and Foreign Nationals) and any type of business entity (Partnership, LLP, Company, Trust and others).

A Digital signature can be obtained within 1-3 working days from date of submitting the application along with the required Documents.

No, physical verification is not required for issuing a Digital Signature.

Speak Directly to our Expert Today

Reliable

Affordable

Assured