Updated on July 06, 2024 06:09:37 PM

Registration of LLP Companies are basic of the GST Taxation regime. Getting GST Registration is mandatory otherwise LLP has to face penalties. There are many benefits of the online GST Registration like availability of Input Tax Credit, being able to work interstate, able to get competitive edge, can work interstate and many others. LLP is a new idea just introduced. They have flexibility in operation and structure. Reading through this page will give you insight about the LLP Company.

Professional utilities helps to get the GST Registration in quick and hassle free manner.

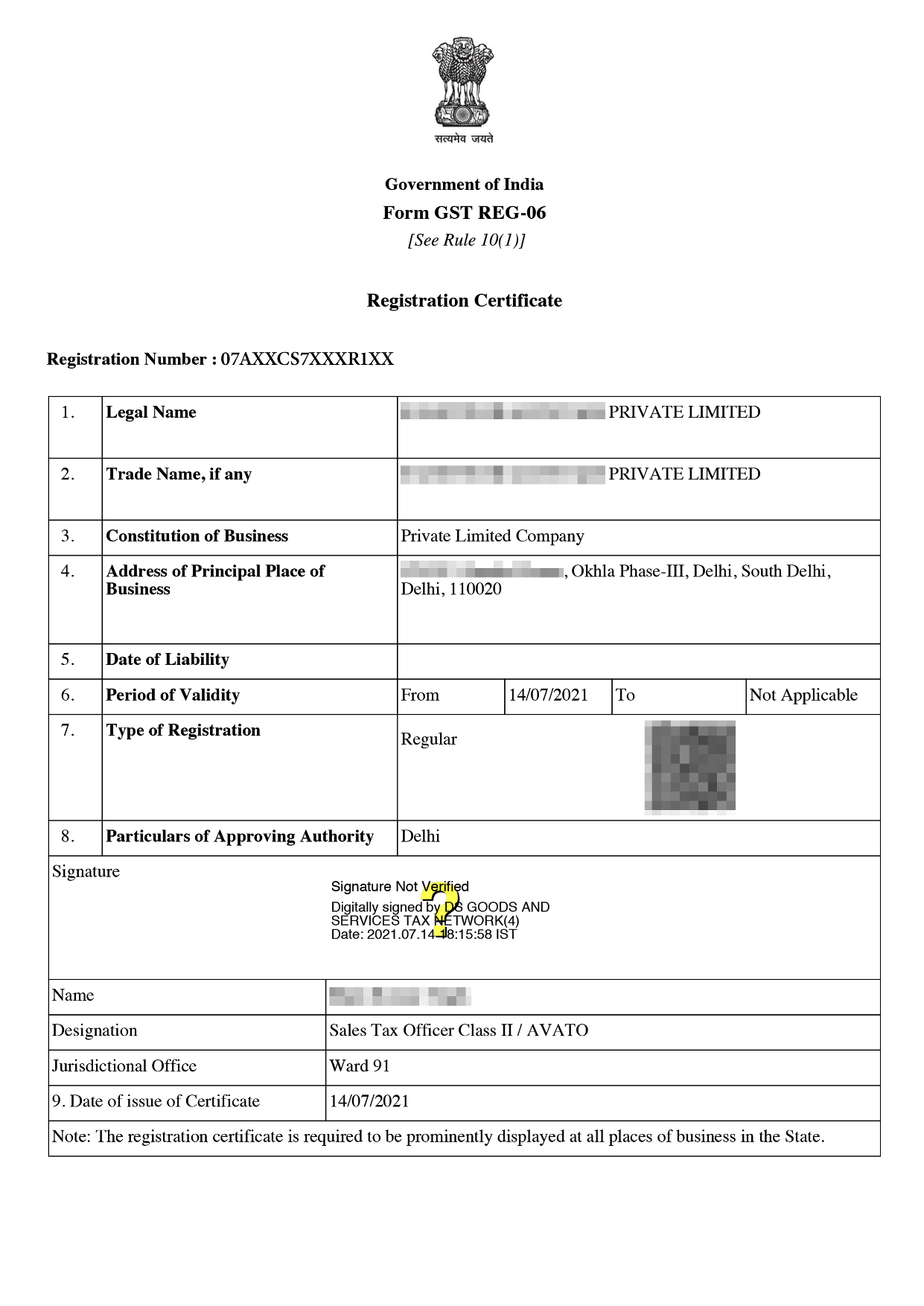

GST Registration Certificate Sample

The LLP must register for GST whenever its turnover exceeds 40 lakhs in supplies of commodities and 20 lakhs in supplies of services. In GST Registration LLP obtains the GST Number from the tax authority. To avail input tax credit and collect tax on behalf of the government.

A limited liability partnership, or LLP, is a type of hybrid corporate business form that combines the benefits of a limited liability company with the adaptability of a partnership. The LLP can keep operating even if the partners decide to split ways.

The Entities or individuals registering for GST Registration must submit the following paperwork.

ID Proof of Business

Residence Proof

Photograph of Partners

Passport of NRI

Document of LLP

Digital signature Certificate

The step in process of GST Registration of LLP Companies -

There are many benefits of GST Registration for an LLP as mentioned below -

LLP Companies should get GST Registration which has turnover more than 40 lakhs in supply of goods and 20 lakhs in supply of services.

Professional Utilities helps to get GST Registration at Rs. 749/-.

LLP is a hybrid structure and has a distinct entity from the partners. There are many documents required by the LLP to register under GST

such as PAN Card, Aadhar Card, Photo, Rental Agreement, Digital Signature Certificate and many others. There are many benefits of the GST registration such as Input Tax Credit, Increase in Transparency, decrease in cost of product and many others.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Although GST is not a requirement for LLP registration, the partners may need to register for GST once the LLP is registered, depending on the amount of turnover and other variables.

A person who is required to register under the GST Act under section 9(3) must be subject to tax liability. According to the LLP Act, 2008 section 2(d), an LLP is regarded as a body corporate.

LLP is a different type of corporate business structure that combines a partnership's flexibility with a company's restricted liability. Changes in partners won't stop the LLP from continuing to exist. It has the legal authority to make agreements and possess property in its own name.

For GST registration and filing in India, DSC is necessary. To verify the identity of the certificate holder, the government-authorised certifying authority issues digital signature certificates (DSCs), which are secure digital keys. In every GST form, the phrase "DSC" is required to identify the taxpayer.

Speak Directly to our Expert Today

Reliable

Affordable

Assured