GST Registration is a crucial legal necessity for Indian companies whose turnover exceeds the prescribed limits or those with business in interstate trade or commerce via e-commerce. Although one can register online via the GST portal, the procedure can be too complicated. It takes one through document preparation, selection of the proper business category, and comprehension of legal regulations. This is where one's assistance from a Chartered Accountant (CA) comes extremely handy.

If a CA helps in GST registration, the process turns out to be smooth, correct, and totally compliant with law. CAs are professionals with knowledge of tax regulations and laws, so they prevent usual errors that may cause rejection or fine. They take care of everything ranging from verification and gathering the proper documents to selecting the proper category of tax and filing the application correctly.

Such a support is very beneficial to startups, small firms, and partnership ventures that cannot afford a separate legal or tax department. Besides registration, CAs also assist with filing GST Returns, input tax credit claims, and keeping the business informed of current tax updates.

In other words, obtaining GST registration through a CA saves time, eliminates mistakes, and provides peace of mind.

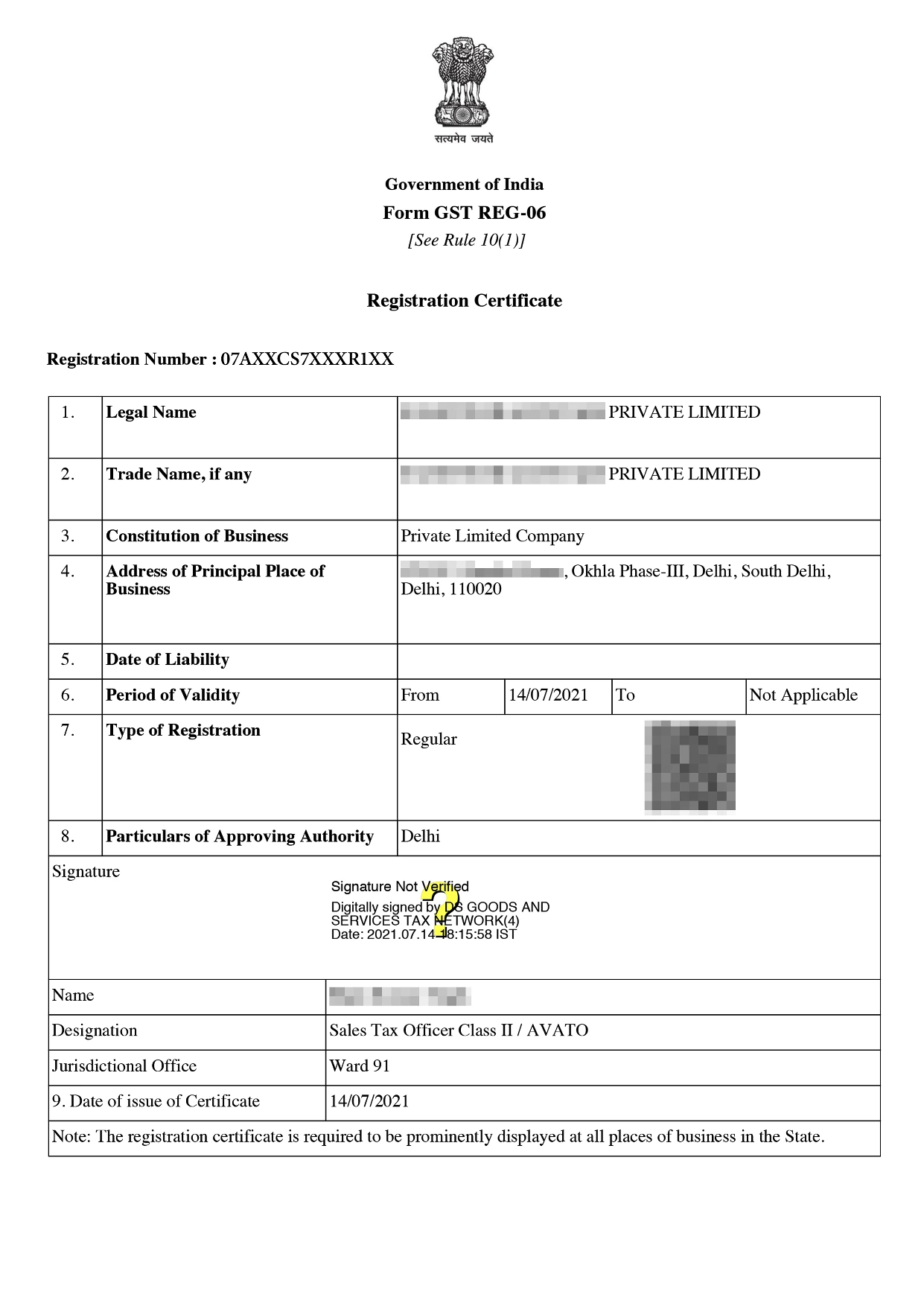

Online GST Registration Sample

Table of Content

GST Registration Helped by a Chartered Accountant means registering your company under Goods and Services Tax (GST) with the expert help of a qualified CA. Although GST registration can be carried out by business owners themselves online, it usually comprises legal and technical processes that may be perplexing, particularly for new entrepreneurs.

A Chartered Accountant makes it easier by taking care of everything in the registration — from collecting and verifying documents to filing the application and answering any questions from the GST department. They also assist in selecting the proper tax category (regular or composition scheme) to ensure legality and avoid errors that may prolong approval or attract penalties.

Here are the key benefits of obtaining your GST registration through the assistance of a Chartered Accountant, ensuring accuracy, compliance, and peace of mind for your organization:

To successfully register a Assisted by Chartered Accountant under GST, the following documents are required to validate identity, address, legal existence, and financial details:

| Document Type | Purpose/Details |

|---|---|

| PAN Card of the Business/Applicant | Mandatory for tax identification and GST registration. |

| Identity Proof of Owner/Partners/Directors | Aadhaar Card, Voter ID, or Passport of all key individuals involved in the business. |

| Photograph of Authorized Signatory | A recent passport-size photo is required for documentation. |

| Business Address Proof | Electricity bill, rent agreement, or NOC from the owner for the business premises. |

| Bank Account Proof | A cancelled cheque, passbook copy, or bank statement with the business name. |

| Partnership Deed / Incorporation Certificate | Applicable to firms, LLPs, or companies. |

| Digital Signature Certificate (DSC) | Required for companies and LLPs to sign documents online. |

| Email ID and Mobile Number | Needed for OTP verification and departmental communication. |

| Authorization Letter / Board Resolution | Authorizing a person (often the CA) to act on behalf of the business for registration. |

The GST registration process for Assisted by Chartered Accountant is completely online and can be completed through the official GST portal. Here’s a comprehensive step-by-step guide to help you through the process:

GST registration for a Assisted by Chartered Accountant is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

Obtaining GST registration through the assistance of a Chartered Accountant is a wise and cost-effective solution to keep your business compliant and legally sound. With professional expertise, you can prevent frequent mistakes, expedite the registration process, and obtain helpful assistance in managing documentation, tax structure, and subsequent filings.

A CA not only assists you in hassle-free registration but also provides post-registration facilities such as filing of GST return, support in audit, and compliance maintenance.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

A Chartered Accountant guarantees accurate registration, correct tax classification, and complete legal compliance with a time and rejection saving.

Yes, a CA can do everything—from documentation to application submission and reply to department queries.

Yes, CAs are familiar with the process and can register faster than self-filing.

After registration, a CA assists in return filing, tax planning, audit, and GST department notices.

Yes, DSC is required for companies and LLPs. Your CA can assist in generating and utilizing it.

Yes. A CA can scrutinize the problem, rectify mistakes, and refile the application with ease.

GST Registration for NGO is required when a non-governmental organization supplies taxable goods or services and crosses the prescribed GST turnover limit. GST registration enables NGOs to comply with tax laws, collect and pay GST legally, and operate transparently.

The steps to register for GST e-Invoicing include checking eligibility, visiting the Invoice Registration Portal (IRP), logging in using GST credentials, completing registration, and enabling e-invoicing for compliant invoice generation.