Updated on June 19, 2025 02:53:20 PM

GST Registration Certificate is an essential document. It is proof of business registration that it has complied with GST Law. This certificate needs to be displayed at primary as well as additional places of the business of the taxpayer. Businesses may have to pay the penalties. Below mentioned page will give you full information about the GST Registration certificate.

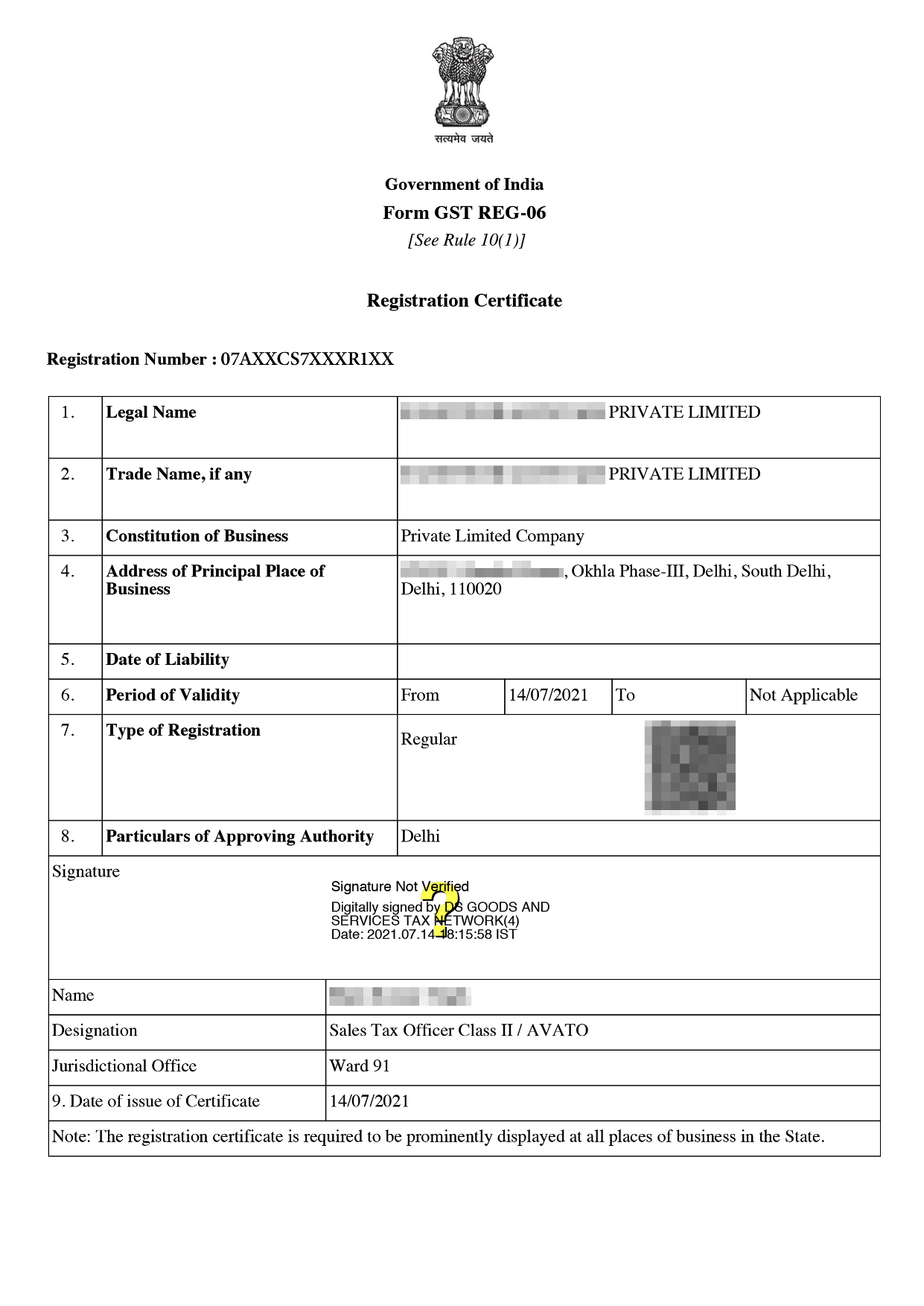

GST Registration Certificate Sample

Table of Content

GST Registration certificate is Form GST REG - 06. It is a valid document of proof issued by the Indian Government under GST Law. It is an authorised and legal document of being registered delivered to every taxpayer who has successfully registered under the Goods and Service Act.

GST Registration Certificate contain the below mention components -

Different set of documents are required for different types of business entity such as public limited company or private limited company, sole proprietor, partnership firm

Documents required for Proprietorship the GST Registration in Gurgram are mentioned below -

If a Registration application is submitted then the Effective date of the GST Registration Certificate is thirty days from date such entity becomes liable to register under GST.

If no registration application is submitted then the effective date is the date of granting certificate.

The GST Registration Certificate is valid until it is cancelled or surrendered. There is no time limit for the GST Registration Certificate.

The GST Registration certificate issued to different types of users has different validity like

For Casual and Non Resident User- Certificate is valid for 90 days

For Normal User- It does not expire until it is surrendered or cancelled by GST Tax Authority or Taxpayer himselfs.

Validity can be renewed or extended as per the requirement of the taxpayer at the end of the validity period.

Step 1 - Applicant needs to fill GST REG - 01 FORM PART- A ( GST REG - 01 has two parts PART - A and PART -B). In Part - A information related to name, Mobile Number and Email ID are filled and verified and TRN No. is issued. Then in Part - B of GST REG - 01 FORM information related to the partners name, Business detail, authorised signatory detail etc are filled and ARN No. is issued which need to be saved for future reference.

Step 2 - All documents related to registration need to be filled to complete the registration form .

Step 3 - Form and documents which are submitted are verified by the officer. They are rejected or accepted whatever the officer feels. Applicants are given 3-4 days to submit the required justification.

Step 4 - In GST REG - 06 GST Registration Certificate is issued to the applicant. Download the GST Registration Certificate.

There are certain changes that need to be done in the GST Registration Certificate due to mistakenly entered, not correct or only updating of any information.

Field in which changes can be made are -

Go to the Amendment of registration core field after login into GST Portal

In GST REG 14 enter the changes along with supporting documents.

In GST REG 15 Approval is given

If it is not accepted then additional information is asked in GST REG 03, additional information is given in GST REG 04 And rejection of the application is given in GST REG 05

Conclusion

GST Certificate is a legal document issued by the GST Authorities after registration. It needs to be displayed clearly at the place of business. Any failure to display a certificate can levy penalties.it has many benefits such as it ensures compliance with GST Regulation, allows to track tax collected, and many others. GST Registration is used for many purposes like applying for loan, input tax credit and tenders participation.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions

The GST Registration Certificate is issued by the the Goods and Services Tax Network (GSTN) of India issues the GST registration certificate in the country.

No If small business turnover does not exceed 40 lakhs there is no need to get the GST Registration Certificate.

No. without logging into GST Portal GST Registration certificate can not be downloaded . After the processes of the registration, taxpayers receive an email containing GSTIN. That is used for the login.

How many days does the GST Department take to issue a GST Registration Certificate and GSTIN ?

Tax officers accept the application then they response in 7 working days. Then the GST Department sends first-time login credentials and GSTIN to registered mail.

Speak Directly to our Expert Today

Reliable

Affordable

Assured