Updated on November 24, 2025 04:11:30 PM

GST registration is a must for every Private Limited Company that has goods or services for sale in India. GST registration will enable the company to comply with tax regulations, bring more transparency in the payment of taxes, and enable the business to claim input tax credit, i.e., pay less total amount of tax.

A Private Limited Company Registration must get registered for GST if its turnover is over ₹40 lakh per year for those businesses that operate in goods or ₹20 lakh for services. GST registration must be done if the company carries out interstate business, online selling (e-commerce), or import/export operations.

The whole GST registration process is online via the official GST portal. For registering, the company has to provide some vital documents. Once approved, the company gets a GSTIN (Goods and Services Tax Identification Number) that needs to be quoted on every invoice and taxation document.

It allows the company to claim tax credits, facilitates easier trading across states, enhances business goodwill, and puts them in their place about all taxation laws. Put simply, GST registration facilitates easier operation and progress of a Private Limited Company Registration in addition to ensuring it remains on the right side of the taxation laws.

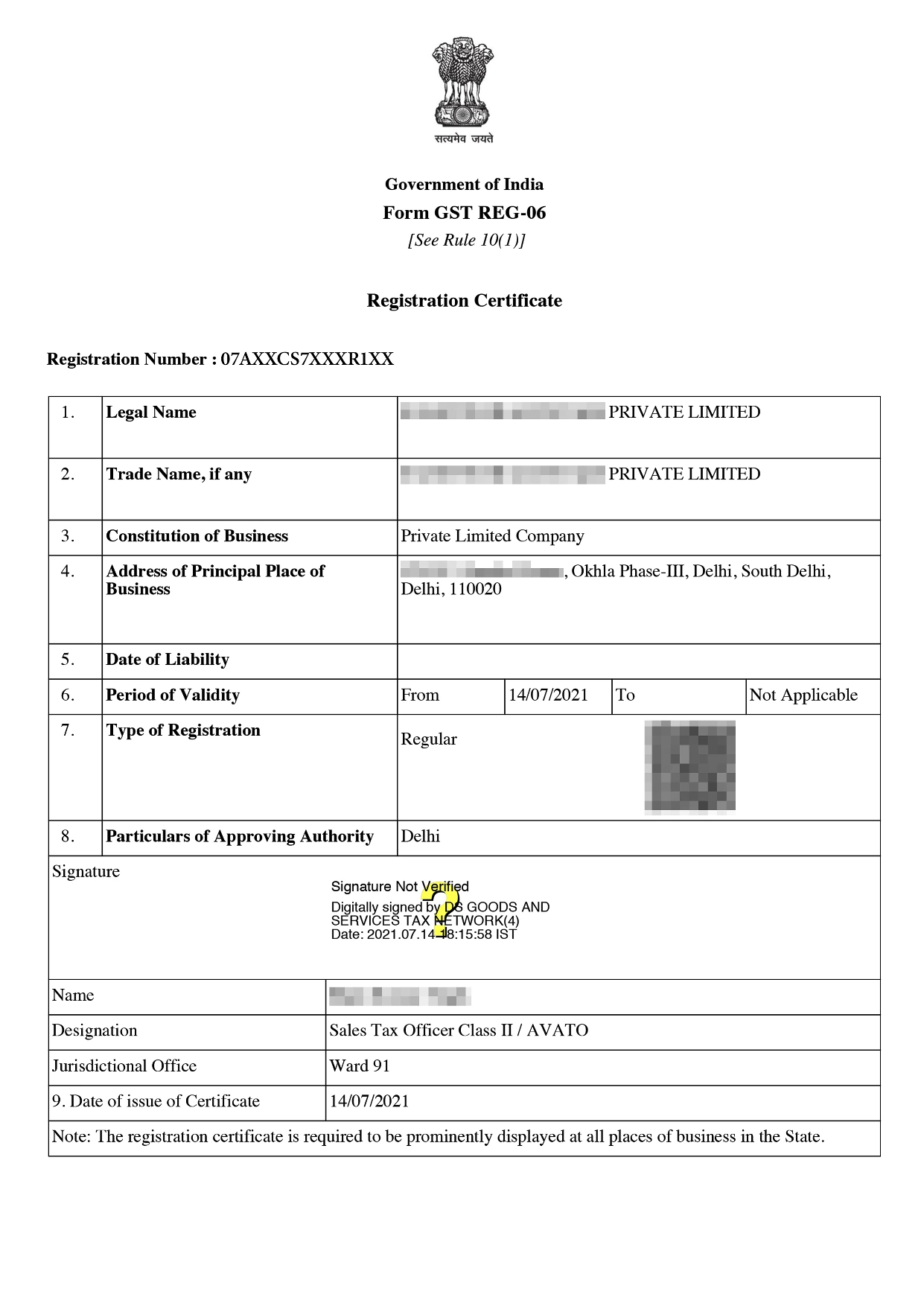

Online GST Registration Sample

Table of Content

GST Registration is compulsory tax compliance for Private Limited Companies involved in the supply of goods or services in India. It enables businesses to collect GST from customers legally and claim input tax credit (ITC) on purchases.

On registration, the company is assigned a GST Identification Number (GSTIN), which needs to be printed on invoices and tax returns. GST registration assists businesses in avoiding penalties, accessing greater market reach, and maintaining streamlined tax compliance. The process of registration is fully online on the government's GST portal and involves basic company documentation like the PAN card, incorporation certificate, bank information, and director details.

GST registration offers multiple advantages for Private Limited Companies, helping them grow legally, access tax benefits, and improve operational efficiency. Here are the key benefits:

The GST registration process for a Private Limited Company is completely online and can be completed through the official GST portal. Here’s a comprehensive 8-step guide to help you through the process:

Here’s a list of essential documents needed for a Private Limited Company to apply for GST registration:

| Document Type | Purpose/Details |

|---|---|

| PAN Card of the Company | Mandatory identity proof for GST registration |

| Certificate of Incorporation | Proof of business registration under MCA |

| MOA & AOA | To verify the company’s objectives and structure |

| Director’s ID & Address Proof | PAN, Aadhaar, Passport, or Voter ID of directors/promoters |

| Photographs of Directors/Signatories | Recent passport-size photographs |

| Business Address Proof | Utility bill, rent agreement, or NOC from owner (if premises are rented/shared) |

| Bank Account Details | First page of passbook or a canceled cheque with the company’s name |

| Digital Signature Certificate (DSC) | Required to digitally sign and submit the GST application |

| Email ID and Mobile Number | For OTP verification and communication |

| Board Resolution/Authorization Letter | Authorizes a person to apply and sign documents on behalf of the company |

GST registration for a Private Limited Company is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is an important process for any Private Limited Company in India to do business lawfully and effectively under the tax regime. It allows the company to charge GST from customers, avail input tax credit, and carry on business across states. Registration not only brings about compliance with GST legislation but also facilitates better business trustworthiness, tenderworthiness, and access to more extensive markets.

Though the process is thorough and document-based, it is quite manageable with proper guidance.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

Yes, it is compulsory if the turnover of the company surpasses the specified amount or it deals in interstate sales or e-commerce transactions.

₹40 lakh for goods and ₹20 lakh for services; for special category states, the threshold is ₹10 lakh.

Generally, it will take 7–10 working days following successful document submission and verification.

Yes, if the entity has operations in more than one state, then it will need to register for separate GST registrations for different states.

No, the government does not impose any fee for GST registration. Professional help, however, will attract service charges.

Yes, corrections can be made by replying to the notice received from the GST officer if any errors are detected.

GSTIN stands for Goods and Services Tax Identification Number, a unique 15-digit number assigned to registered businesses.

Yes, for Private Limited Companies, using a DSC is mandatory to submit the GST registration application.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions