Updated on May 06, 2025 02:36:56 PM

A society is a non-profit organization constituted by individuals coming together for a specific cause, like the distribution of education, culture, sports, religion, or social welfare. Although societies are not established to earn profit, they can still be under the GST routine if they conduct certain activities that are taxable.

According to Indian GST rules, a society has to register for GST if its annual revenue is above ₹20 lakh (or ₹10 lakh in special categories of states). It also has to register if it renders services such as training, consultancy, event management, or grants tied to given deliverables. Even if the revenue falls below the threshold, a society may register voluntarily to collect advantages such as input tax credit, legal compliance, and enhanced responsibility.

After the society is registered, it is allotted a GSTIN (Goods and Services Tax Identification Number), which it will use for all tax work. GST registration also facilitates societies to operate in multiple states, deal with the government or business houses, and maintain transparent accounts. In short, GST registration keeps societies legally on the go and facilitates their smooth functioning.

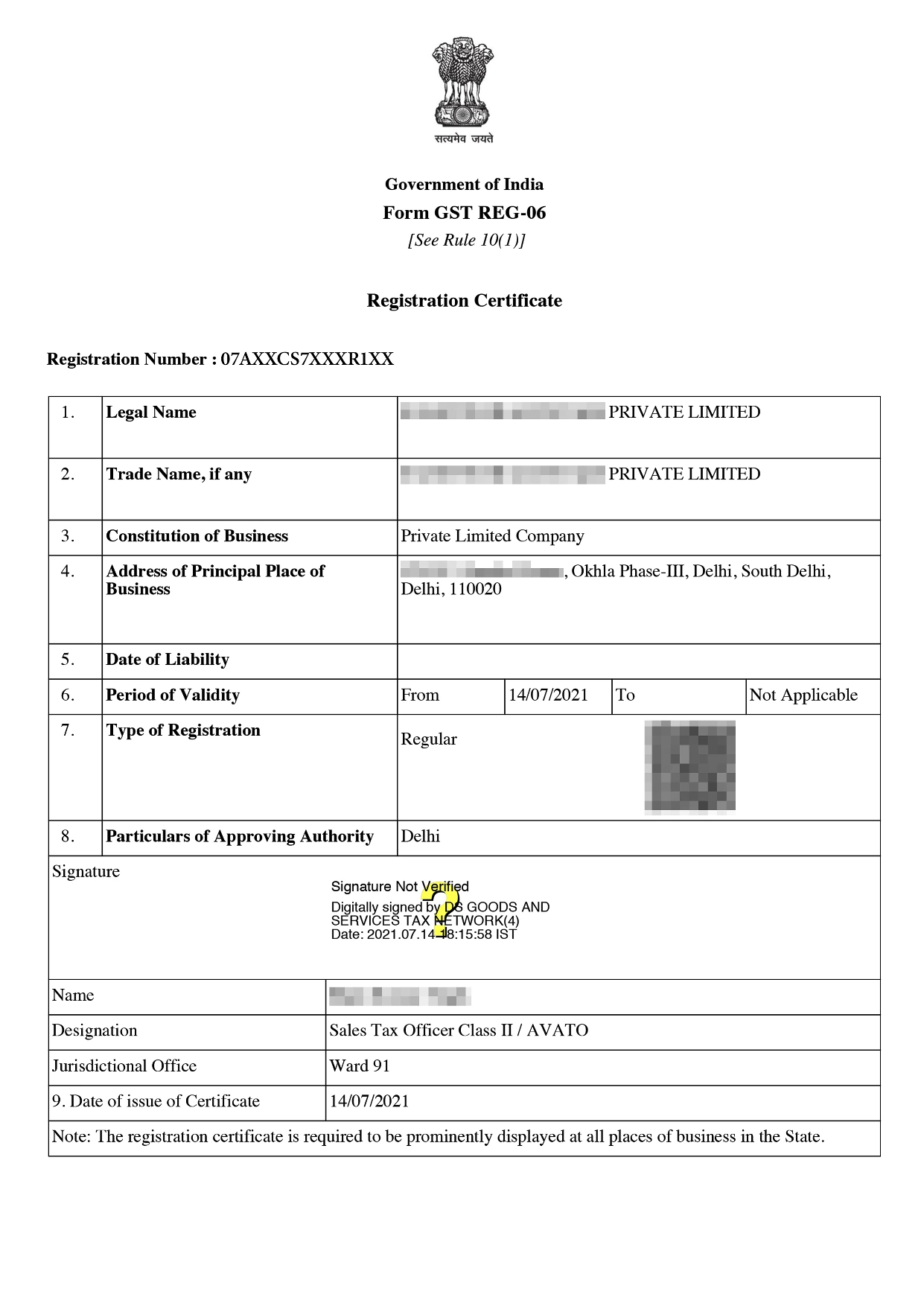

Online GST Registration Sample

The GST Registration of a Society is the process by which a registered society joins the Goods and Services Tax (GST) regime in India. Even though societies are typically established as non-profit entities with charitable or social purposes, they can still be compelled to register for GST based on their activities and income patterns.

According to GST legislation, a society is required to register if its turnover for the year is over ₹20 lakh (or ₹10 lakh in special category states) or if it deals with taxable services or supplies of goods like consultancy, training programs, or conducting paid events. Even societies that are getting grants that are tied to specific services or deliverables are within the GST purview. Voluntary registration is also possible for societies wanting to increase transparency and benefit from input tax credit.

Though Societies are incorporated for not-for-profit objectives, GST registration provides various operational and financial advantages. Below are the key benefits of obtaining GST registration for Societies:

The GST registration process for a Society is completely online and can be completed through the official GST portal. Here’s a comprehensive 8-step guide to help you through the process:

Start by visiting the official GST portal: www.gst.gov.in.

Under the 'Taxpayers' tab on the homepage, click on ‘Register Now’ to begin a new GST application.

Provide your PAN, mobile number, email ID, and state. You’ll receive OTPs for mobile and email verification. After verification, a Temporary Reference Number (TRN) will be generated.

Log in with your TRN and complete Part B of the form. Include business details, promoter/director information, the principal place of business, bank account details, and authorized signatory info.

Upload the necessary documents in the appropriate format (PDF or JPEG). Ensure documents are clear and legible before uploading.

Once everything is reviewed and verified, submit the application using a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC).

Your application will be processed and verified by GST officials. You may be contacted if additional information or clarification is needed.

After successful verification, you’ll receive a GST Registration Certificate and your unique 15-digit GST Identification Number (GSTIN) within 7 to 10 working days.

To complete GST registration for a society, the following documents are required. These ensure legal identity, address proof, and authentication of the society and its authorized members:

| Document Type | Purpose/Details |

|---|---|

| PAN Card of the Society | Mandatory for GST registration and tax identification |

| Certificate of Registration | Proof of society’s legal formation under the Societies Registration Act |

| Memorandum of Association (MOA)/Byelaws | To outline the objectives and rules of the society |

| PAN & Aadhaar of Authorized Signatory | Identity proof of the person authorized to apply on behalf of the society |

| Photograph of Authorized Signatory | Passport-size photo of the authorized person |

| Address Proof of Registered Office | Electricity bill, rent agreement, or NOC from the owner of the premises |

| Bank Account Details | A cancelled cheque or bank statement/passbook showing the society’s name and account |

| Email ID and Mobile Number | For OTP verification and communication |

| Digital Signature Certificate (DSC) | Required especially for societies registered under state or central law |

GST registration for a Society is an important but detailed process. If you choose to do it yourself on the GST portal, there are no government fees. However, if you want to save time and avoid hassle, you can go for Professional Utilities' expert service. They help you with the complete registration process for just ₹1499, making it quick and easy.

| Particulars | GST Registration Fees (INR) |

|---|---|

| Government Fees | ₹0 (No charges for self-registration under GST law) |

| Professional Fees | ₹1499 (charged by Professional Utilities for expert assistance) |

Conclusion

GST registration is important in ensuring societies remain transparent, legally compliant, and fiscally accountable. While societies are not-for-profit organizations, undertaking taxable services or obtaining connected grants subjects them to the purview of GST law.

Through GST registration, societies not only gain input tax credit but also become more credible, are eligible for government tenders, and can work in conjunction with CSR partners better. It makes operations smoother, particularly when operating between states or providing services online.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

GST registration is compulsory if a society's turnover for the year crosses ₹20 lakh (₹10 lakh in special category states) or if it provides taxable goods or services.

Yes, even though not compulsory, a society can voluntarily apply for GST registration to benefit from input tax credit and enhanced credibility.

GSTIN (Goods and Services Tax Identification Number) is a distinct 15-digit number employed to file GST returns and perform lawful business transactions.

Voluntary donations in the absence of any service or goods in exchange are not subject to tax. Yet, donations connected with particular deliverables might attract GST.

Yes, if the society is registered under state or central law and is opting for GST registration online.

It takes 7–10 working days, subject to all documents submitted being accurate and duly verified without any problems.

If a society is eligible to register but does not, then it can be penalized. The penalty is 10% of the tax payable (minimum of ₹10,000), or 100% if fraud is involved.

GST could apply when grants or CSR funds are tied to certain services or activities. Free donations or grants without any service are exempt.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions