Updated on July 06, 2024 11:03:56 PM

Business identification for tax purposes or any other compliance, which is done by registering the Taxpayer, is one of the essential necessities of any tax system. GST Online registration accomplishes the same goal of identifying the firm. Businesses that register for GST are given special identification numbers, or GSTINs.

GST Registration Online aids in obtaining input tax credits for one's inbound supplies as well as tax collection on behalf of the government. Without registration, the business is unable to recoup taxes already paid or claimed as credits, nor can it charge customers for taxes.

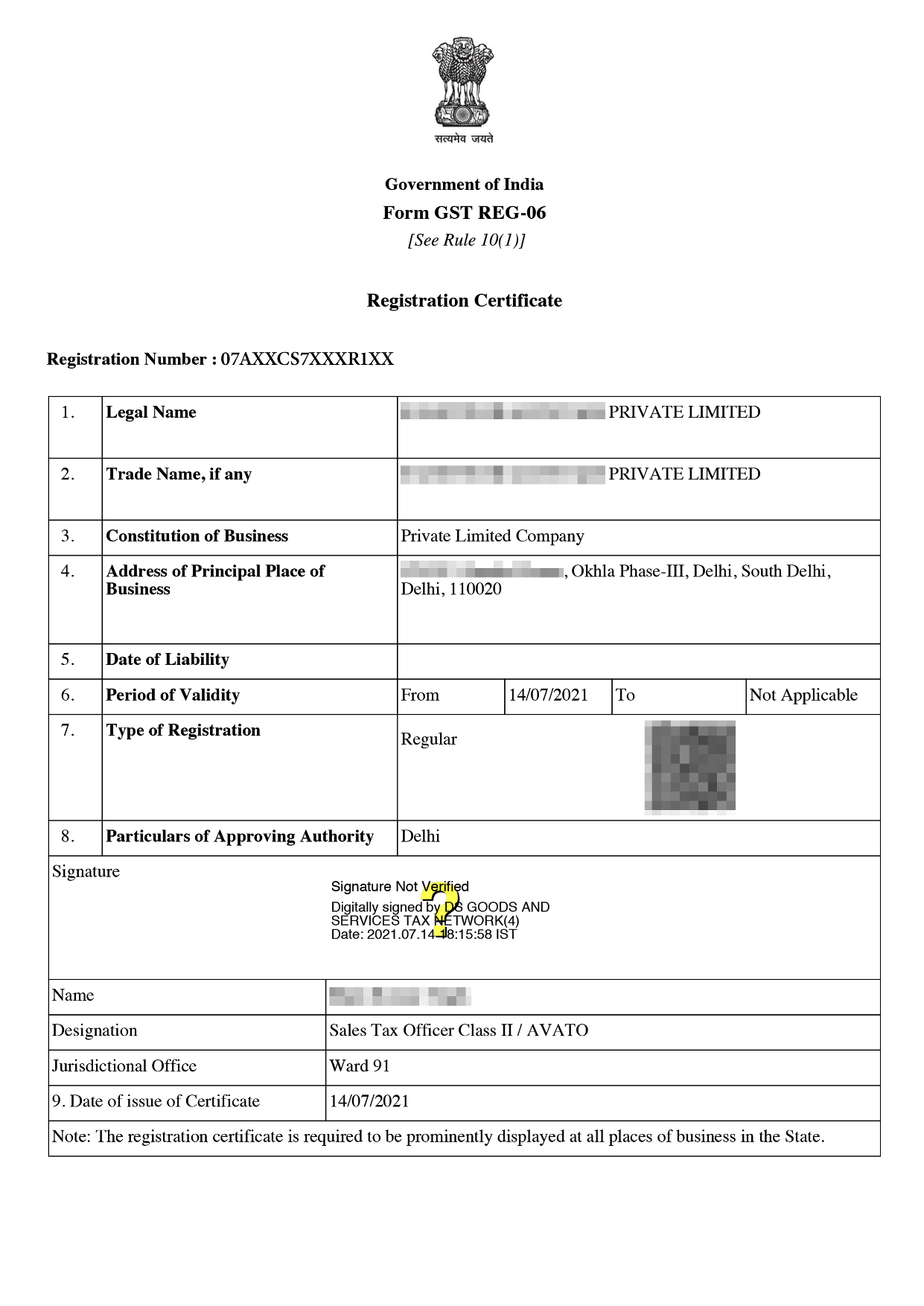

GST Registration Certificate Sample

Businesses must register for GST in order to receive a unique Tax Identification Number (GSTIN), which is required for companies with annual revenues of at least Rs. 40 lakhs and Rs. 10 lakhs in states located in hilly regions and the North East.

Running a business without registering for the GST is illegal and carries severe consequences.

The eligibility of a person is crucial for the smooth and successful operation of the GST systems. Below are various eligibility requirements:

Under the Good and Services Act of 2017, businesses in the hills station and north east must have a combined annual revenue of no more than 40 lakhs for products, 20 lakhs for services, and 10 lakhs for suppliers of commodities.

Non-Resident taxable person - Non-Resident Taxable Persons are people who are not residents of India but who are able to supply products and services either directly or through agents, among other roles. They can only do this after registering and paying a fee equal to the GST. Online registration is valid for three months but can be extended.

Voluntary GST registration - Getting registered for GST on a voluntary basis is known as voluntary registration. Businesses who voluntarily register can issue tax invoices to customers, enabling them to claim invoice credit, raise their profit and business margin as a result of being able to claim the tax credit, and improve their ability to rent space and obtain bank loans. Within a year, voluntary GST registration may be hidden at any moment.

Composition Registration - Businesses with annual sales below $1.5 billion are eligible to participate in this programme. A predetermined rate of interest is applied on the turnover under this Registration. This is a straightforward strategy that eases the burden of the registration process.

Casual Taxable person - The taxpayer opening a temporary store or booth is registered under this registration. This registration pays a tax payment equivalent to the GST Liability matching the active registration periods and is valid for three months.

Compulsory Registration - For some businesses, such as e-commerce sellers, e-commerce operators, and interstate sales of taxable items, GST is required regardless of turnover.

Depending on their legal structure or the sort of GST registration they want, businesses need a distinct set of documentation. Depending on the business's constitution and kind of registration, there are various options.

Documents required for Company for GST registration online

The cost of GST registration is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

Note: The aformentioned Fees is exclusive of GST.

The qualifying parties must undertake a number of procedures in the GST registration process in order to register themselves under the GST Act.

Filling an application - filling out the GST Act registration form and creating a TRN No. PAN No., email address, and place of registration are put in GST REG-01 and are validated in this mobile number.

Submission of Documents - All documents must be filled out, properly signed, and validated with a digital signature in part-B of the REG-01.

Application acknowledgement - All submitted documents are electronically recognised in Form GST REG-02.

Verification and approval of GST application - Processing takes 7 to 10 days at this step, during which the officer verifies the forms and documents submitted.

The form GST REG-03 specifies any deficiencies and requests more information or documents, which will result in the issuance of a show-cause notice.

Within seven days of receiving the notice, the applicant must electronically submit the declaration and information on form REG-04.

In Form GST REG-05, the application is rejected electronically if no reason is provided within 7 days and the officer is unsatisfied with the explanation.

Issuance of GST certificate - Following Form GST REG-06 verification, a certificate of registration will be given, and applicants will receive a Goods and Services Tax Identification Number (GSTIN). The officer required by the Act will use an electronic certification code to verify and sign the registration certificate.

The certificate of GST registration is valid until it is revoked or returned. If a casual dealer registers, their GST registration is valid for up to 90 days and can be renewed and extended.

Business have to register on below mentioned dates -

With the introduction of the GST, many businesses saw development and prosperity. The following benefits of GST registration are just a few.

Any Entity that registers for more than the allowed amount of GST becomes obligated by law or subject to taxation for doing so, according to the GST Act. Without a GST registration, conducting business is illegal and carries severe penalties.

A person is subject to a fine of $10,000 or 100% of the unpaid tax, whichever is greater.

The Goods and Services regime was put into place in India to provide effective tax structures and processes. Value-added tax, luxury tax, service tax, entry tax, and octroi were all combined into one tax. Even if you are not eligible, there are advantages to applying for GST online. Register for GST online to take advantage of its many advantages.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Show cause Notice is formal notice under goods and services tax in India asking taxpayers to justify or explain inaction or particular action which is in violation of the GST Laws.Notice gives a chance to the taxpayer to provide evidence,explain their action or present an argument that show it is his fault or it was not intentional to violate.

No, GST is not applicable on exported goods and services because goods and services which are exported are not consumed in India and GST is levied on consumption.

Yes when turnover of business exceeds specified threshold limit then they need to register.

There is some of the reasons which cause delay in the GST registration such as -

Speak Directly to our Expert Today

Reliable

Affordable

Assured