Updated on July 06, 2024 06:26:32 PM

GST Registration is one of the essential requirements for GST Taxation in Assam. It was implemented to increase government revenue and reduce compliance. Businesses who sign up for GST Registration have benefits including lower costs for goods and services, improved logistics, more credibility, and many other things. This Page contains information about GST registration in its entirety.

Professional Utilities can help you get GST Registration in Assam at just ₹1499/- only.

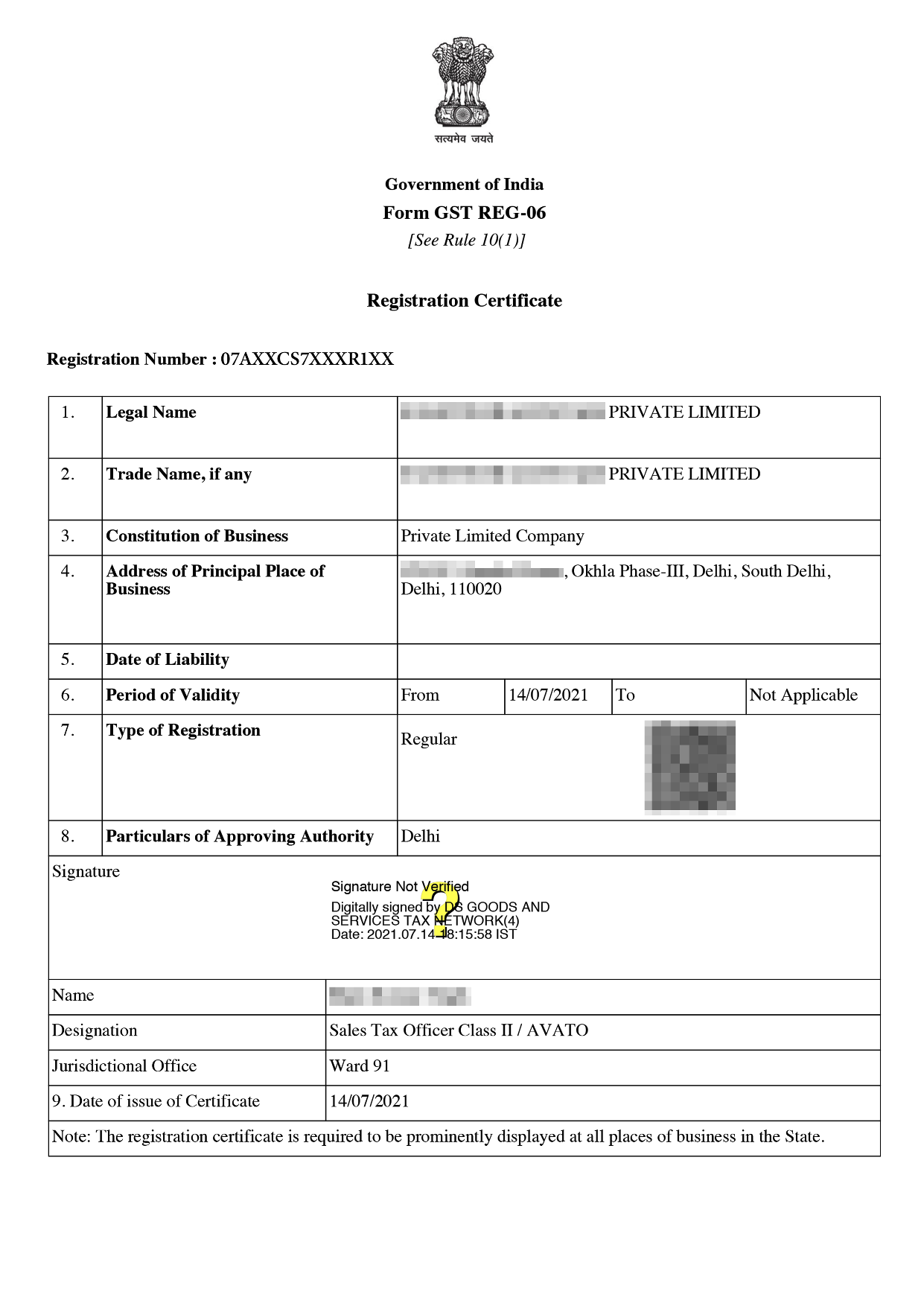

Online GST Registration Sample

In Assam, A person must register for GST if they have an overall turnover of more than 40 lakhs in the provision of products and more than 20 lakhs in the supply of services. Along with taking advantage, GST Registration in Assam is also necessary for any significant business transactions.

Several groups of people or entities, including some of those listed below, are required to register with GST.

The following documents required as mentioned below -

Documents for HUF -

Documents for Sole Proprietorship/Individual-

Documents for Company

Documents for Partnership firm/LLP -

The cost of GST registration in Assam is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

The steps to get a GST registration are as follows:

There are several features associated with registration, some of which are described below:

There are many benefit of the GST Registration in Assam as mentioned below -

GST Registration in Assam gives various benefits to the taxpayer such as reduction in cost of the product, less compliances to follow, increase in credibility of taxpayer. To get GST Registration forms and many documents are required to be filled and after verification GST Registration is issued.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today