GST (Goods & Service Tax) Registration in Delhi is an important step for businesses to follow tax rules and operate legally. The process is completely online, requiring businesses to submit key documents like their PAN card, business registration proof, bank details, and address verification. Once registered, they receive a 15-digit GSTIN, which helps them get tax benefits, understand gst apply fees, and grow their business.

GST started in India on July 1, 2017, replacing older taxes like VAT, excise duty, and service tax with one simple tax system. This change made tax payments easier, increased government revenue, and helped businesses trade smoothly across different states. When businesses in Delhi register for GST, they support economic growth and follow legal rules.

Getting GST registration can be confusing, so Professional Utilities can help makes the process simple. A skilled team can assist with document submission, handling notices, and getting quick approvals. With the right support, businesses can register for GST easily and at an affordable cost. With step-by-step support, businesses can avoid delays and errors, understand the gst apply fees, and making the GST registration process easy—whether it's filing returns or managing documents like a Delivery Challan under GST .

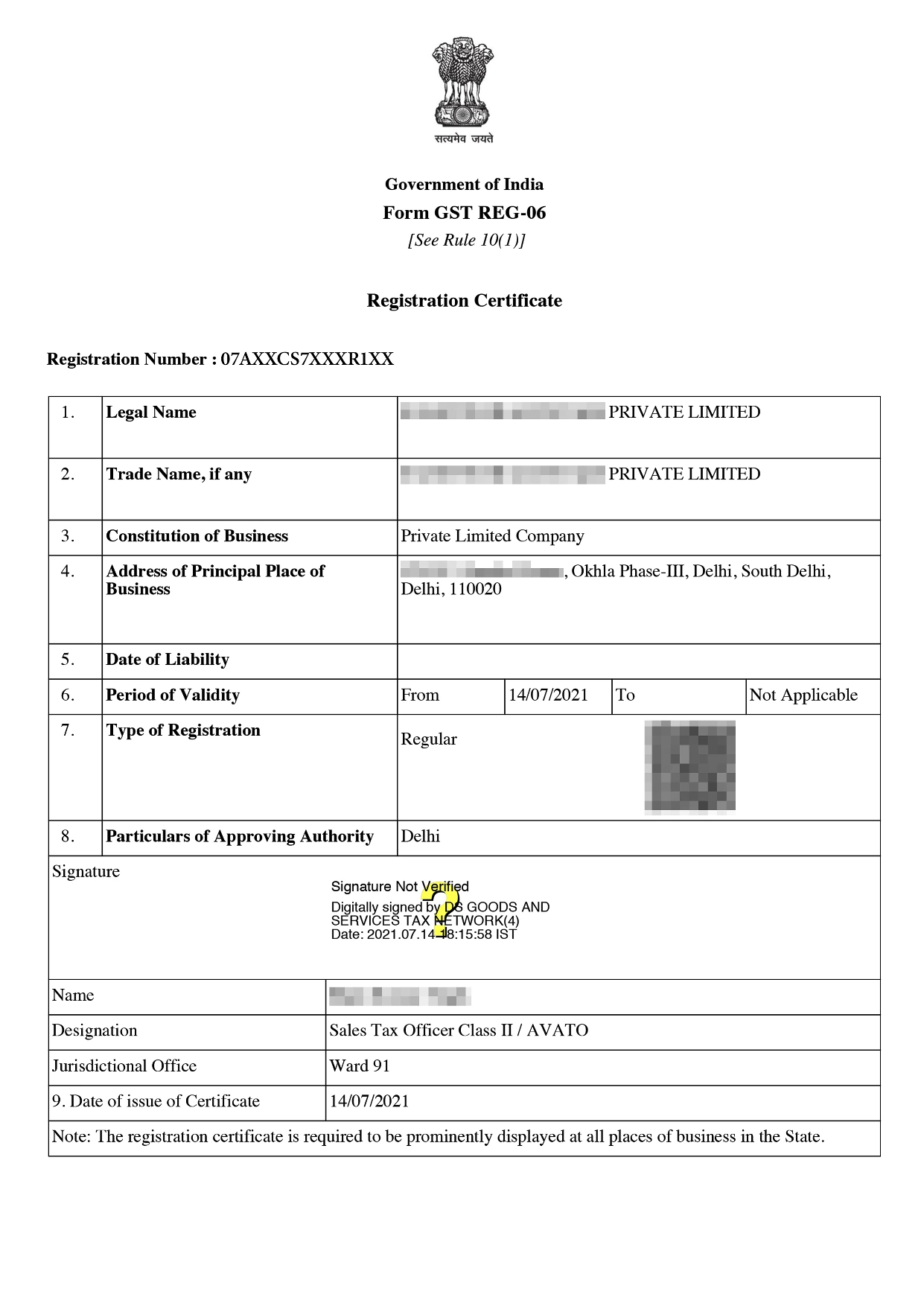

Online GST Registration Sample

Table of Content

Goods & Service Tax Certificate in Delhi means the process of registering business under the GST regime in the National capital Territory of Delhi. After registration GST Number is allotted to the business in which the first two digits are state codes.

Under GST Law, where suppliers affect supply, they have to register in each and every such state. If a business entity has branches in different states, then that business has to take separate state-wise registration for those branches in different states. If a business has many branches in one state, then it has to take one registration in one state.

Here are the key Benefits of GST Registration in Delhi that help businesses operate legally, build trust, and enjoy smooth tax management:

Here are given the various types of GST Registration in Delhi, designed to suit different business needs and turnovers-

Documents required for LLP or for Partnership Firm are mentioned below -

Documents required for HUF are mentioned below -

Documents required for Company are mentioned below:

The GST registration process involves a few easy steps to get your business registered under the GST system. Here’s a step-by-step breakdown:

The GST registration fees in Delhi is just ₹ /- only with Professional Utilities.Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹ /- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Discover the top features and benefits of GST registration that every business must know to stay compliant and maximize tax advantages:

Conclusion

GST Registration in Delhi helps in bringing many other taxes like service tax, entry tax. VAT, excise duty and luxury tax into one regime. It has simplified the taxation system and made day to day transactions manageable. GST Registration can be obtained with filling of the form and required documents. Contact Profesional utilities ro get GST Registration in Delhi at just Rs. /-

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

There are no GST apply fees in Delhi on the official government GST portal. GST registration in Delhi is completely free of cost, and the government does not charge any amount for filing a GST application. However, if you hire a consultant or Chartered Accountant in Delhi for assistance, their professional service charges may apply separately.

Absolutely, the GST registration is severally free on the government GST portal. The government has no registration fees for GST registration. Nevertheless, if you employ a consultant or CA, the professional service will have additional charges.

Sure, you can file returns as well as get a GST number without a CA. GST portal allows individuals to carry out the whole process on their own. But, it is advisable to have professional help so that you do not make a mistake and to keep everything in proper order.

Indeed, you can initiate your GST registration yourself using the official GST portal online. The process is online and basic documents like PAN, Aadhaar, proof of business address and bank details are required for the successful registration.

GST registration CA fees in Delhi typically fluctuate between ₹500 to ₹3,000, depending on the business complexity and included services. Proprietorships, companies, and businesses requiring extra documentation may be charged differently.

Yes, any normal person or business owner whose business is registered under GST can file GST returns. The GST portal is user-friendly and, therefore, individuals can easily handle their registration, return filing, and tax payment without professional help.

The government portal makes GST registration free of charge. The only time you will incur expenses is when you engage a CA or service provider whose fees usually range from ₹500 to ₹3,000 depending on the service package and type of business.

GSTR-11 is a GST return filed by non-resident taxpayers with a UIN. It is used to declare inward supplies received in India and claim a refund of GST paid. The return is filed monthly and includes details like supplier information, invoices, and tax paid.