Updated on January 15, 2025 11:46:47 AM

GST registration in Gurgaon is necessary for all businesses whether it is a new entity or an existing business. GST registration not only helps in claiming Input Tax Credit but has also reduced tax compliance by bringing various taxes under one tax.

Going through this page will provide all the required and complete knowledge about GST Registration, how to get it, its features, benefits and many other questions. Getting yourself registered under GST can not be ignored, otherwise it will lead to penalties and other legal issues.

Professional Utilities can help you get GST Registration in Assam at just ₹1499/- only.

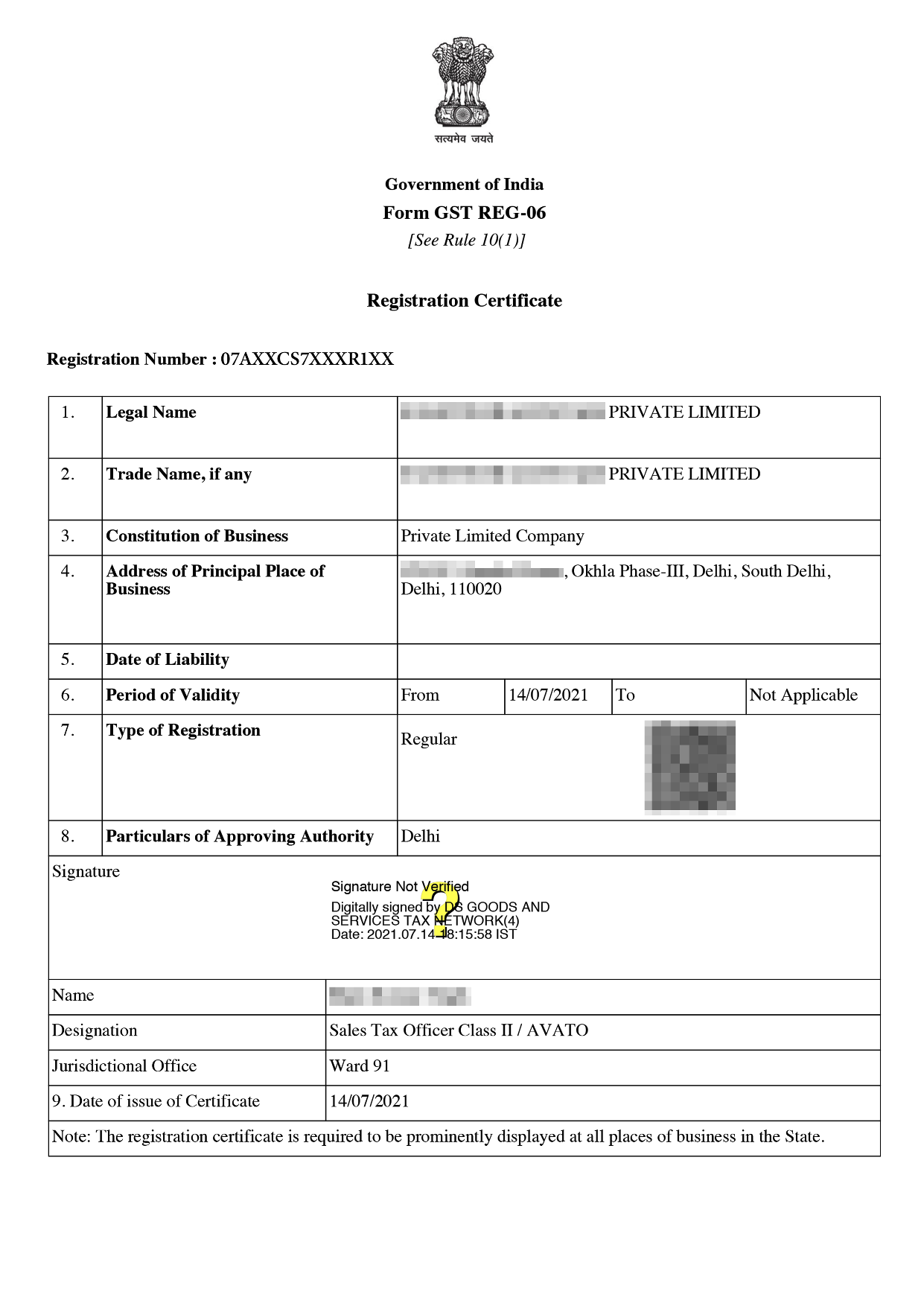

Online GST Registration Sample

GST Registration in Gurugram is a necessary tax registration process that involves obtaining a unique GSTIN from the government and allows businesses to collect tax on the behalf of the government and pay GST to the government.

Any business having turnover more than 40 lakhs engaged in supply of the goods or 20 lakhs in supply of service is required to register itself under GST.

There are different types of registration as mentioned below -

Different set of documents are required for different types of business entity such as public limited company or private limited company, sole proprietor, partnership firm.

Documents required for Proprietorship the GST Registration in Gurgram are mentioned below -

Documents required for HUF are mentioned below -

Documents required for Private Limited Company are mentioned below:-

The cost of GST registration in Gurugram is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

It is mandatory to get GST Registration in Gurugram. Procedure to register yourself under the GST act is very easy and simple. There are certain steps which need to be followed as mentioned below -

There are many feature of the GST registration in Gurugram as mentioned below:-

There are many benefits for getting registration in Gurugram as mentioned below -

All the entities supplying goods and services in gurugram are required to get registration in Gurugram. It has been introduced to benefit both governments as well as taxpayers. By simplifying the tax structure and allowing taxpayers to take input tax credit and also by increasing government revenue it has benefitted both.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

No PAN Card is compulsory for GST registration. Registration under GST can not be done without a PAN Card.

The GST Registration is cancelled in cases such as when business constitution is changed and not updated or business is terminated.

Under GST RCM refers to the process under which GST is paid by the receiver instead of the supplier. It is the supplier who pays the tax and exception of this when the receiver pays the tax. This exception is applicable in notified goods and services or supply of notified goods.

No, you can get only one registration with one PAN Card.During the GST registration process multiple businesses can be added.

Speak Directly to our Expert Today

Reliable

Affordable

Assured