Updated on January 27, 2026 11:34:36 AM

GST Registration in Jammu & Kashmir was introduced to promote unparalleled economic integration with the rest of India. GST Registration has many benefits just like any other state such as increase in profit of business , credibility also increase and government has also benefited due to increase in its income.

Get effortless and smooth GST Registration in Jammu and Kashmir with Professional Utilities by filling the contact form.

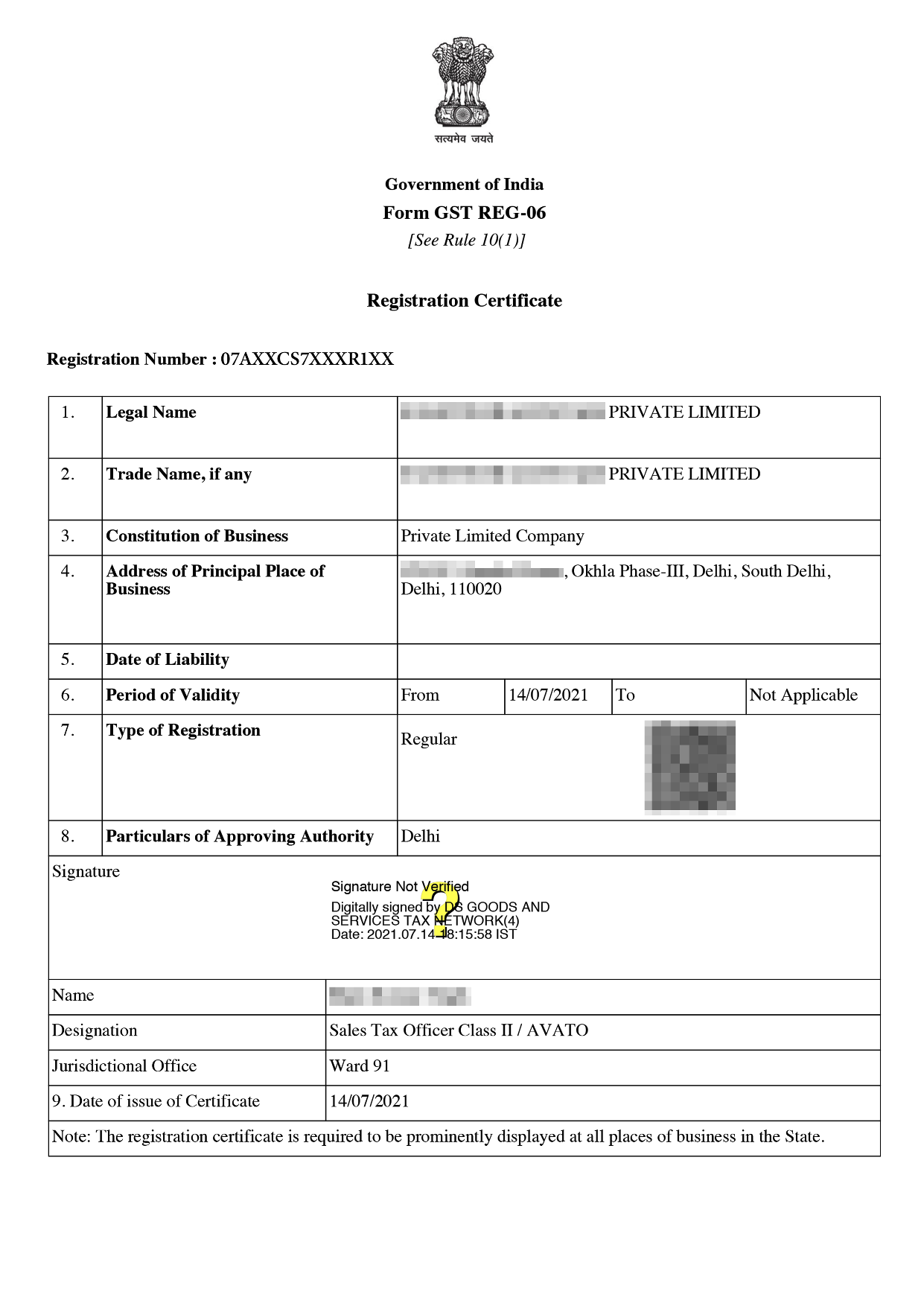

Online GST Registration Sample

Table of Content

Unlike any other state of India, businesses having turnover exceeding 40 lakhs engage in supply of goods and 20 lakhs in supply of services required to get GST Registration in Jammu and Kashmir. To reduce the complexity of the tax regime GST was introduced in which this is one way of identification.

In Jammu and Kashmir, the Goods and Services Tax (GST) regime is aligned with the rest of India.

There are many types of documents required for GST Registration depending on types of the business as mentioned below

Documents required for LLP and Partnership

Documents required for HUF are mentioned below -

Document required for Club or Society

The cost of GST registration in punjab is just ₹/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

To get GST Registration in Jammu & Kashmir below mention steps:

It has many features which make it suitable for the growth of the economy and taxpayer.

There are many benefits for getting registration in Jammu And Kashmir as mentioned below -

Conclusion

GST Registration in Jammu & Kashmir requires forms and many documents to be filled which are verified by the GST officer. It is very important to get GST registration to avoid many penalties and legal complexities. GST Registration in Jammu and Kashmir is basic identification granted to the business under the GST regime.To get the benefits and avoid the penalties choose Professional Utilities services at /-.

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services.

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today

Reliable

Affordable

Assured