Updated on January 15, 2025 03:22:19 PM

All firms in Maharashtra must register for GST, regardless of whether they are brand-new or already established. By combining several taxes under one tax, GST Registration has lowered tax compliance while also assisting with claiming Input Tax Credit.

Reading through this website will give you all the necessary and comprehensive information on GST Registration, including how to obtain it as well as details about its features and advantages. It is imperative that you register for GST; failing to do so could result in fines and other legal repercussions.

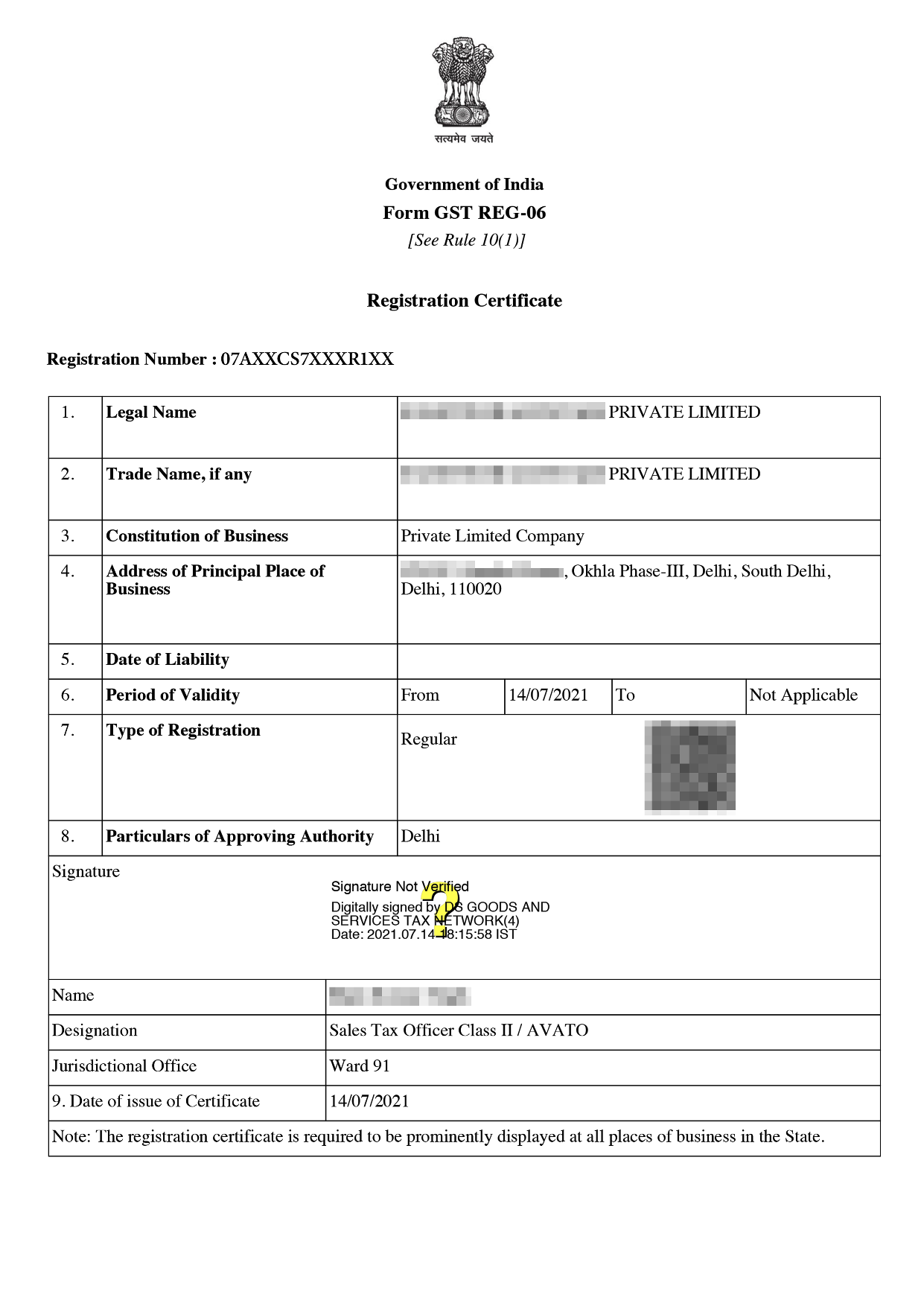

Online GST Registration Sample

GST Registration in Maharashtra is to get registration in GST where businesses exceed the minimum threshold. Minimum limit is 40 lakhs in case of supply of the goods and 20 lakhs in case of supply of services.

Businesses which exceed the minimum limit and do not get the registration have to face penalties and heavy penalties.

There are various types of registration, as follows:

Different sets of documentation are necessary for various business entities, including sole proprietorships, partnerships, public limited companies, and private limited companies.

Documents required for HUF are mentioned below

Documents required for Sole Proprietorship and Individuals

Documents required for Companies

Documents required for LLPs and Partnership:

The cost of GST registration in Maharashtra is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

In Maharashtra, obtaining a GST registration is required. It is a very straightforward and uncomplicated process to register yourself under the GST Act. There are specific measures that must be taken, as listed below:

The GST registration in Maharashtra has a number of features, some of which are listed below:-

There are many benefits of the GST Registration as mentioned below -

GST Registration in Maharashtra was implemented to reduce the tax compliances and simplify the tax regime. GST registration in Maharashtra has many benefits like increase in the income of the government, reduce price of the product, improve the efficiency of the logistics, reduce cascading effect. To get GST registration done required form and documents need to be filled by the applicant. Get GST Registration with Professional Utilities at a fee of Rs1499/-.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

No PAN Card is compulsory for GST registration. Registration under GST can not be done without a PAN Card.

The GST Registration is cancelled in cases such as when business constitution is changed and not updated or business is terminated.

Under GST RCM refers to the process under which GST is paid by the receiver instead of the supplier. It is the supplier who pays the tax and exception of this when the receiver pays the tax. This exception is applicable in notified goods and services or supply of notified goods.

No, you can get only one registration with one PAN Card. During the GST registration process multiple businesses can be added .

Speak Directly to our Expert Today

Reliable

Affordable

Assured