Updated on July 06, 2024 06:26:40 PM

GST Registration in Puducherry is established for development of the economy. By getting GST registration in Puducherry taxpayers have many benefits such as increase in the profit, simplification of the procedure, less compliances, elimination of cascading effect, increase in efficiency of the logistics and many other. By going through this page will give full insight about the GST Registration in Puducherry.

Professional Utilities helps you to get GST Registration in a smooth and hassle -free manner.

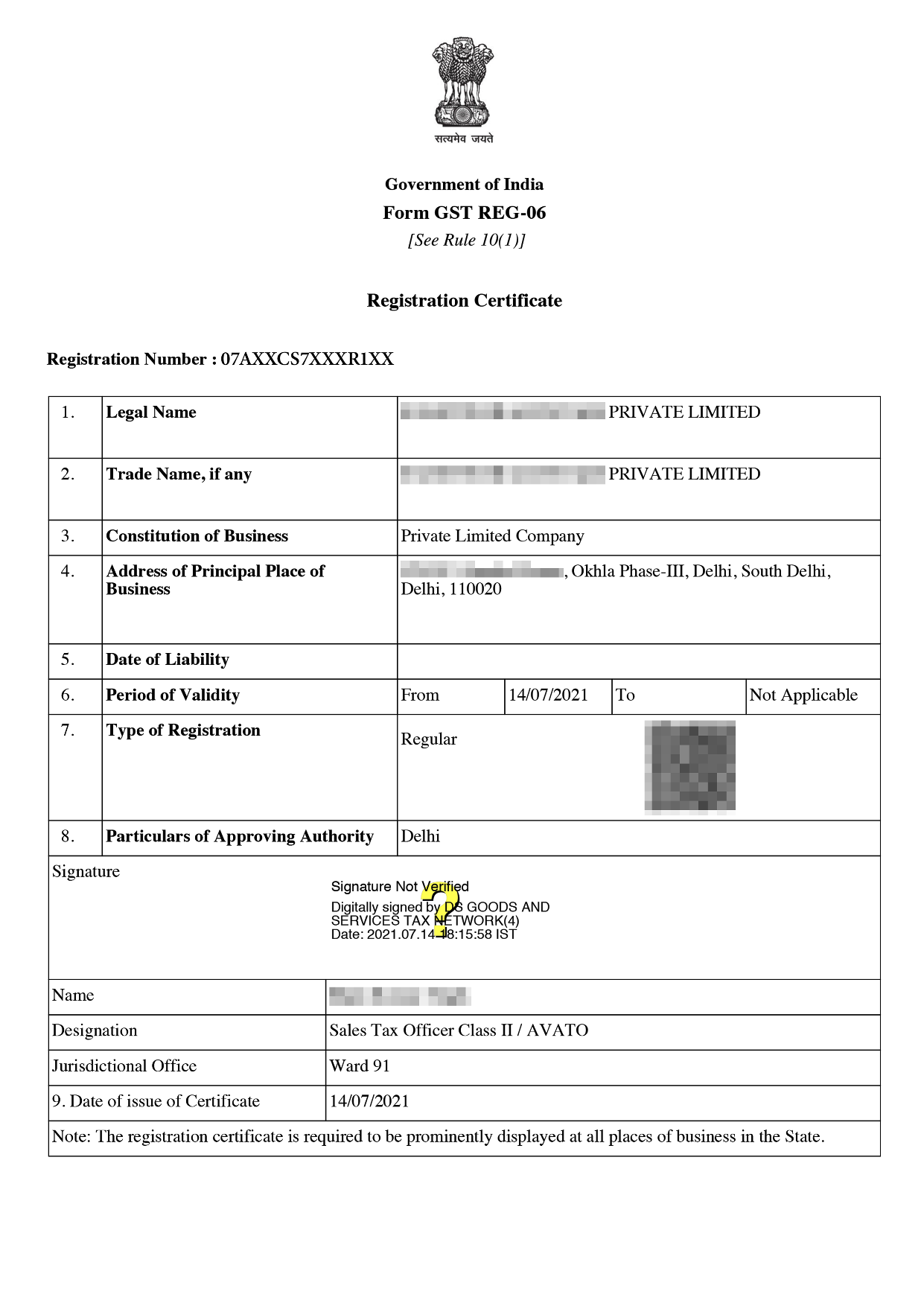

Online GST Registration Sample

Companies need to get GST Registration in Puducherry which has turnover in supply of the goods more than 20 lakhs and in supply of services more than 20 lakhs. Puducherry is a Union territory having their own legislation so GST will be imposed.

There are various methods of registration for various Entities.

The cost of GST registration in Puducherry is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| GST Registration Online | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

If you meet the requirements to register under GST, you must register by following the steps listed below.

The GST registration in Puducherry has numerous advantages. as outlined below.

GST Registration in Puducherry is implemented to pave the way to economic development. By reducing the flaws of the previous tax regime. There are many benefits of the GST Registration in Puducherry like reduction in cost of product, increase in income of the government, improvement on efficiency of the logistics and many other.

GST Registration is obtained by filling of the form along with the documents as per the requirement. By getting assistance from professional utilities at 1499/- get registration quick and fast.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisations who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services.

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today