Updated on July 06, 2024 06:26:40 PM

GST registration in Rajasthan is one of the basic requirements under GST Taxation. It was introduced to lessen compliance and to increase income of the government. By getting GST Registration businesses get many benefits such as reduction in the cost of the goods and services, improvement in logistics, increase in credibility and many others. Page mentioned below tells everything about the GST registration.

With Professional Utilities you can get GST Registration in Rajasthan quickly and hassle free.

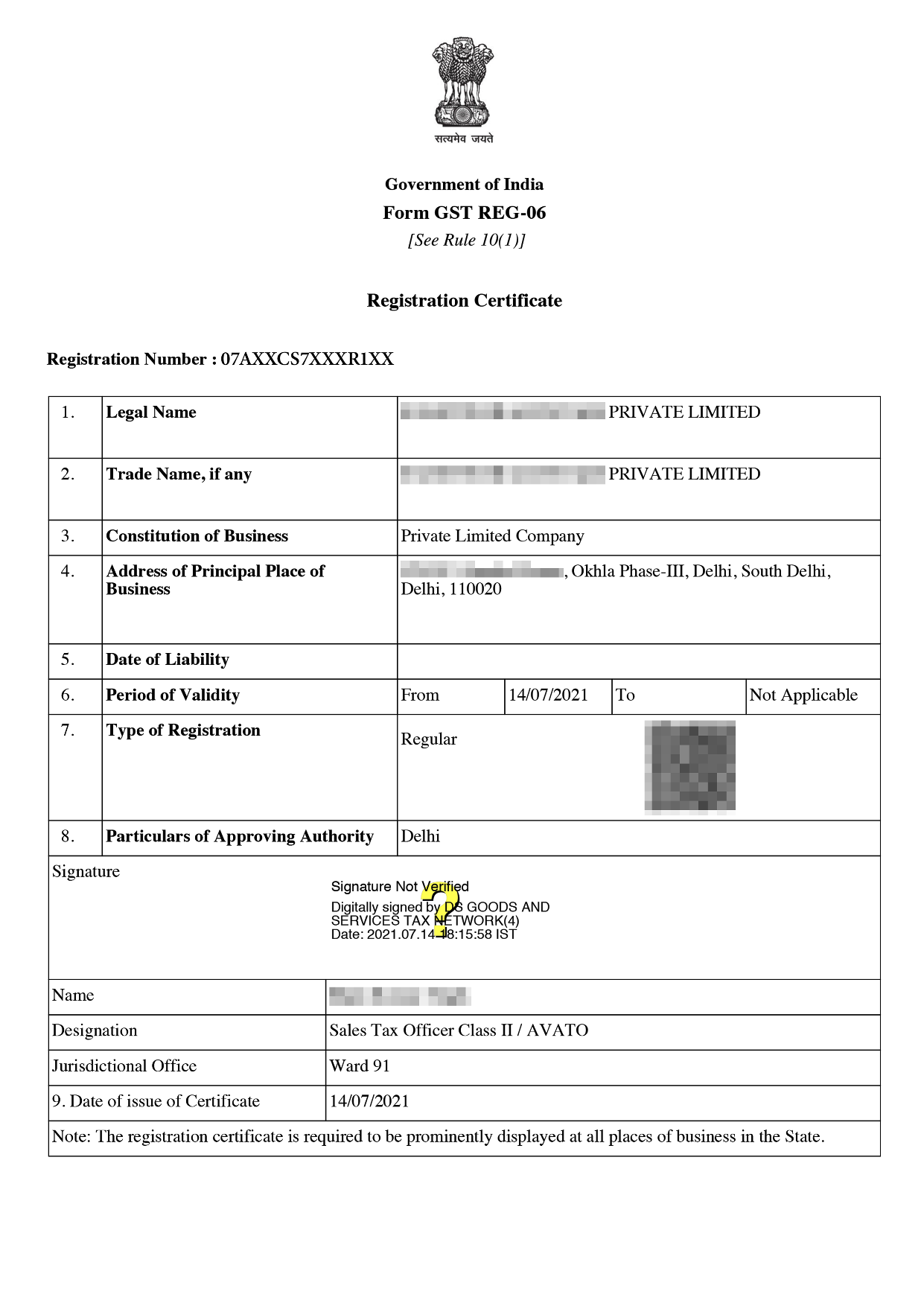

Online GST Registration Sample

Any person who has aggregate turnover of more than 40 lakhs engaged in supply of goods and more than 20 lakhs engaged in the supply of services are required to get GST Registration in Rajasthan.GST is a statutory requirement for business transactions along with many other benefits of registration.

There are many types of the person or entities that need to take registration in GST are mentioned below:-

The following documents required as mentioned below -

Documents for Sole Proprietorship/Individual-

Documents for Partnership firm/LLP -

Documents for HUF -

Documents for Company

The Fee for GST Registration in Rajasthan is ₹1499/- only.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Getting GST Registration involves below mention step -

These are the following feature of the GST registration in Rajasthan as mentioned below:-

Getting GST Registration in Rajasthan is very important. Big business opportunities can be lost if businesses do not have a GST Number.

GST Registration in Rajasthan is part of the indirect taxation which was introduced with the benefit of having unified tax throughout the country. There are many other benefits for GST Registration in Rajasthan like increase in credibility, reduction in price of the goods, less taxation compliances.

GST certificate in Rajasthan can be obtained easily just by filling out a form with required documents. After verification business gets the registration.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No, Two GST certificates can not be issued as per the regulations.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today