Updated on July 06, 2024 06:26:41 PM

GST Registration in Tamil Nadu is a fundamental identification that was implemented to increase government revenue and decrease tax compliance. Numerous other advantages result from GST Registration such as improved transport facilities, elimination of cascading tax effects, increased corporate legitimacy, and the ability to claim input tax credits when buying a business. You will learn more about the GST Registration process, documentation, and cost from this page.

Get GST Registration in Tamil Nadu with Professional Utilities in a smooth and effortless manner.

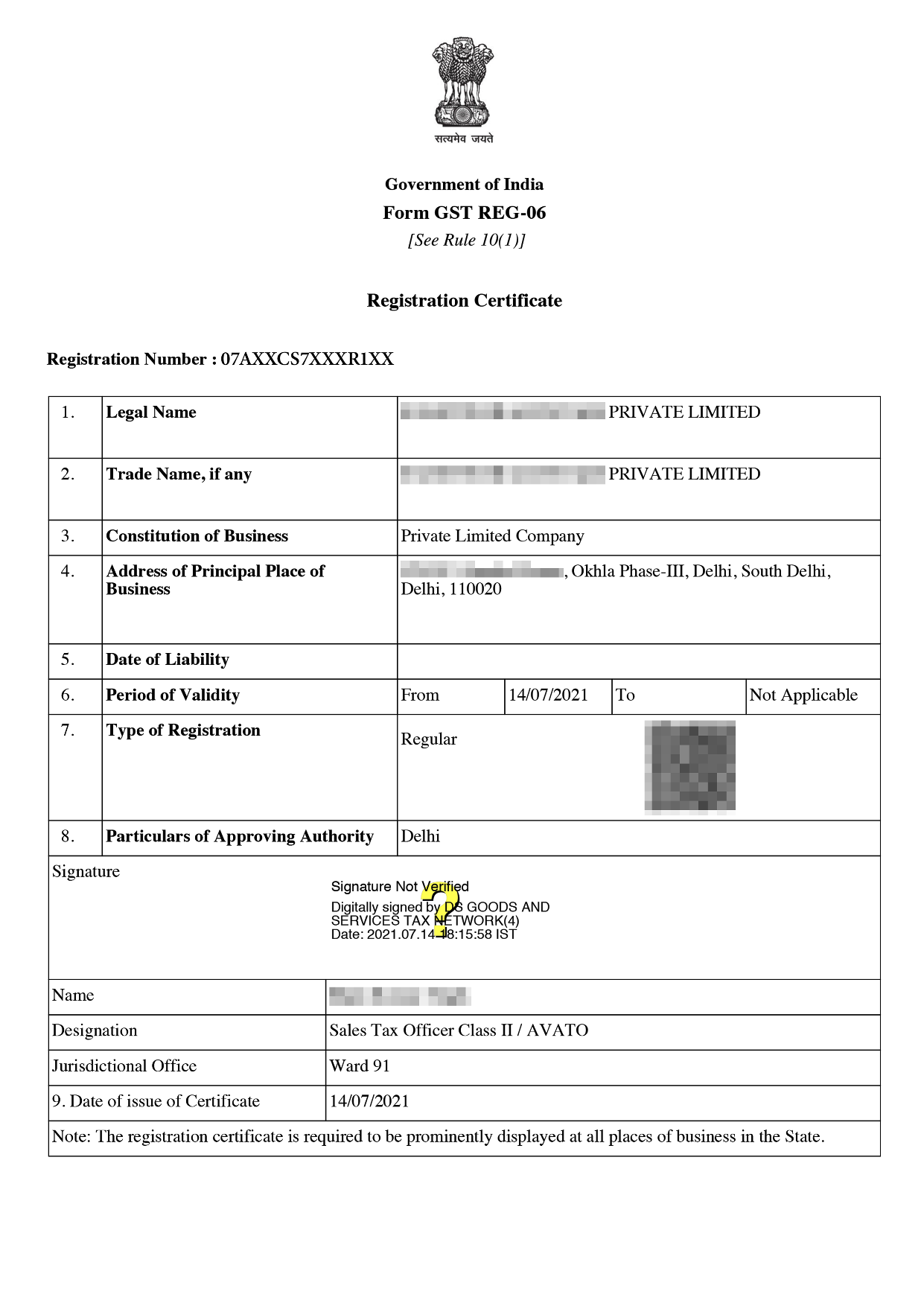

Online GST Registration Sample

GST Registration is one basic condition for every supplier. All Companies like industries, small startups, companies that make turnover more than prescribed limit in Tamil Nadu must register under GST Act. They should have a single tax payment under the GST Act.

The activities that the taxpayer engages in will decide whether or not they are required to register for GST.

Documents required for HUF

Documents required by club or society

Documents for Sole Proprietorship/Individual

Document for LLP/Partnership firm

The cost of GST registration in Tamil Nadu is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Certain steps that must be taken in order to register for GST are listed below:

Multiple tax systems are combined into a single tax system under GST. In addition to increasing business efficiency, this tax change has led to an increase in taxpayers. Getting a GST registration in Tamil Nadu has various advantages. - as stated below

GST Registration in Tamil Nadu gives many benefits like decreasing the cost of the product decreasing, increase in income of the government, reducing cascading effect, simplification of the tax system and many others. All this will have a positive effect on economic development.

For each category of taxpayer, a particular set of documentation must be submitted in order to complete registration. Filling out the paperwork and registering for GST is the process.. With Professional Utilities, you may register quickly and easily for a price of Rs.1499.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisations who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today