Updated on July 06, 2024 06:26:42 PM

Getting GST Registration is mandatory in Uttarakhand. It was introduced to increase the income of the government and simplify the tax regime. By GST Registration companies get many benefits like avail Input tax credit, increase profit of the company, unified taxes all over India. By reading this page will give you full information about the GST Registration.

With the help of Professional Utilities get registration under GST in an effortless and smooth manner.

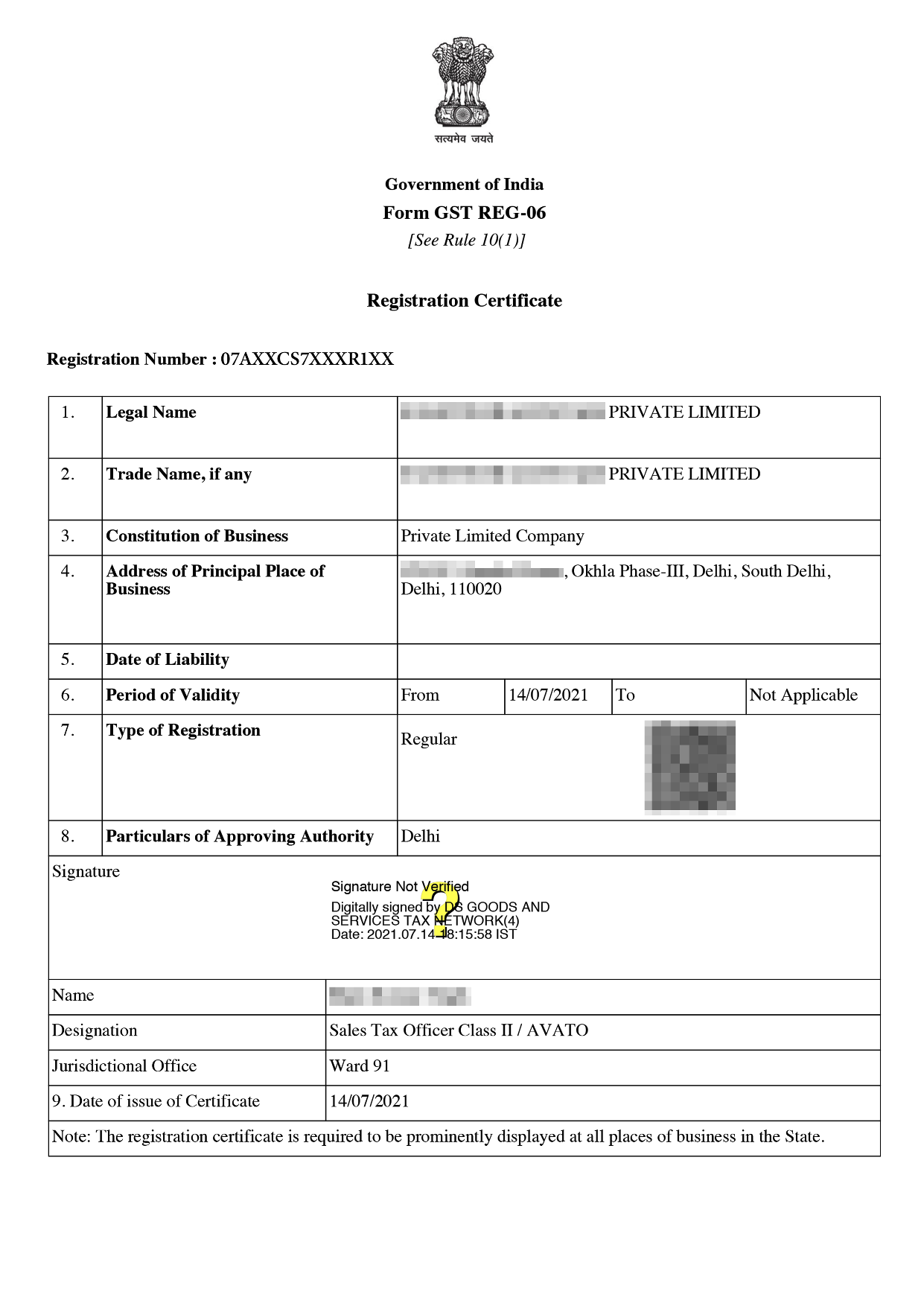

Online GST Registration Sample

Any company having a turnover of 40 lakhs engaged in supply of the Goods and 20 lakhs engaged in supply of the services is required to get GST Registration in Uttarakhand.

GST registration was introduced in Uttarakhand to bring many taxes under one unified tax regime.

The various types of GST Registration that are available in Uttarakhand are listed below.

Documents for Company

Documents for Partnership firm/LLP -

Documents for HUF -

The cost of GST registration in Uttarakhand is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Note: The aforementioned Fees is exclusive of GST.

The following steps must be taken by a company in order to obtain GST registration in Uttarakhand:

The following are some of the features of the Uttarakhand GST Registration:

With the introduction of GST Registration in Uttarakhand, tax complexity has decreased. As many tax regimes are eliminated and merged into one, the GST.

GST registration in Uttarakhand was introduced to simplify the taxation systems by bringing many taxes under one regime like excise duty, service tax, and many others. Unlike any other taxation system, GST Registration is one of the ways to identify. By filling out the form and providing the required documents GST Registration can be obtained in Uttarakhand.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Under section 49 of the CGST Act’ 2017 CGST credit is set off against CGST Liability first then to set off IGST Liability and can not be used to set off SGST liability.

GST is paid every month and it can be offline as well as online. Payment of GST is made through challan.

It is a document which gives details related to the shipment of consignment of goods issued by the carrier. It included a point of origin, name of consignee, name of consignor, destination and route. It is an electronic document generated on the GST portal before the commencement of the good’s movement .

Yes, a GST certificate is compulsory as in India in order to register for GST. Businesses cannot charge GST on services and goods they sell that do not have a GST certificate.

Speak Directly to our Expert Today