Updated on September 16, 2025 01:18:50 PM

A Section 8 company in India is a non-profit organization that promotes social welfare under the Companies Act, 2013. Section 8 companies, like other businesses, must comply with certain criteria. Regardless of their non-profit status and commitment to helping others, these companies must follow particular regulatory requirements.

The purpose of forming Section 8 Company is to promote, encourage, and nourish activities related to art, science, sports, commerce, charitable activities, etc. Section 8 Company can be categorized as a Non-Governmental Organization. These companies enjoy the liberty of being treated as ‘Limited Company’, though, word ‘Limited’ is not added at the end of their names. Concisely, Section 8 companies work in the direction of promoting needy communities and sectors in India. These Companies are not liable to give income or dividend to its members.

In India, a Section 8 company is a non-profit organization that serves the goal of promoting commerce, science as well as social welfare research, and conservation of the environment. If you are granted authorization, you can operate your business and make profits. But, you are not able to share the profits among the members of your business.

All Section 8 company is required to perform the annual compliance procedures outlined under the Companies Act of 2013 and the Income Tax Act of 1961. This ensures the company's credibility and trustworthiness and avoids fines for non-compliance. For instance, compliance obligations to be performed during the year can be time-consuming. In the case of non-compliance, could result in severe sanctions, which could impede directors' positions within the firm.

As a non-profit organization striving for social welfare or generating a beneficial influence, section 8 company registration comes with considerable benefits, as indicated below:

The documents required for Section 8 company compliance are extremely important; without them, you cannot operate. Nonetheless, the following are the required documents indicated below:

Section 8 companies must follow legal and regulatory compliances:

Event based, as the name recommends, are the compliances should be documented on the event of explicit occasions. In contrast to annual compliances, these are non-periodical in nature.

Checklist For Event-Based Compliances For Section 8 Company:

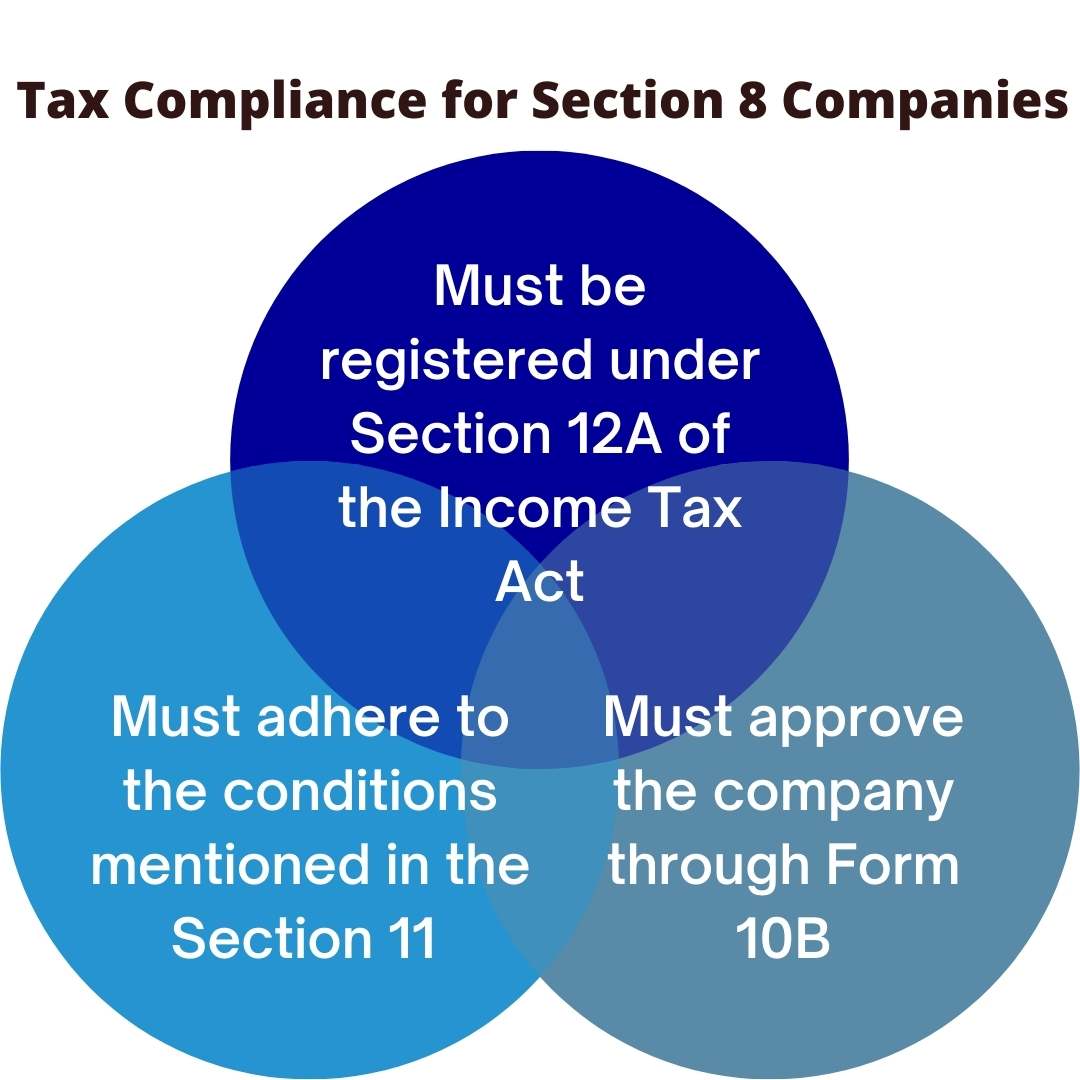

Section Company is bound to pay corporate tax as mentioned in the Income Tax Act. But by adopting certain measures the Company can exempt its certain income from the income tax. To entertain such exemptions Section 8 Company needs to fulfil the following compliances:

The Ministry of Corporate Affairs has the authority to impose certain penalties in case it encounters any non-compliance with the procedures.

Penalties to be imposed are as follows:

Non-compliance can lead to penalty and for the Section 8 Company the best way to ignore penalty is quite smooth, all the company has to do is follow the compliances within the stipulated period of time.

| COMPLIANCE | DUE DATE |

|---|---|

| AGM (Annual General Meeting) | 30thSeptember |

| AOC-4 | Within 30 days of AGM |

| MGT-7 | Within 60 days of AGM |

| Income Tax Return | 30th September |

Note: The aforementioned Fees is exclusive of GST.

Conclusion

Annual compliance requirements for Section 8 companies are not just a legal requirement, but also a way to capitalize on the benefits that come with its status. By strictly complying to these requirements, Section 8 firms can avoid the penalties associated with noncompliance, assuring their continuing operation and commitment to their specific social goals. Professional Utilities streamlines Section 8 corporation compliance. Our professionals ensure that your non-profit organization follows all the rules and regulations outlined in the Companies Act 2013. We handle everything, from submitting documents to maintaining records and compiling financial statements, so you may focus on your nonprofit activity. We may help you avoid penalties and remain compliant.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes, it is the candidate's decision to incorporate a Section 8 Company as a private or public limited company in the wake of meeting the consistence necessity for example 2 Directors and 2 individuals if there should arise an occurrence of privately owned business and 3 Directors and 7 individuals in the event of Public Limited Company. However, One Person Company (OPC) can't be joined as a Section 8 Company according to Rule 3 of the Companies (Incorporation) Rules, 2014.

The prescription under section 149(1) of Companies Act 2013 as to having Minimum of three directors for public limited company and two directors for private limited company and maximum of fifteen directors is not applicable to section 8 company and thus there is no prescription with respect to minimum or maximum directors in a section 8 Company. However, second proviso to section 149(1) requires a woman director in prescribed class of companies. Also section 149(3) requires every company to have a resident director.

No, there is a particular exemption to Section 8 and One Person Company from conforming to the Secretarial Standards. In any case, Companies must hold fast to Secretarial norms so as to raise the corporate governance standards.

Tax Benefits: Section 8 Company is a non-benefit association that is the reason they are excluded from certain arrangements of the personal expense. They are additionally given various different conclusions and other tax reductions. One of such exclusion is under Section 80G of the Income Tax Act, 1961, whereby contributors to non-benefit associations may guarantee a half discount against gifts made. The registration done under Section 80G will be legitimate for regularly a time of one-three years.

Inability to document Annual Returns is punishable with a fine of Rupees 50,000 which may stretch out to Rupees five lakh.

Section 2(42) of the Companies Act, 2013 defines the term “Foreign Company” and means any company or body corporate incorporated outside India which– (a) has a place of business in India whether by itself or through an agent, physically or through electronic mode; and (b) conducts any business activity in India in any other manner. Now since a Company or a body corporate incorporated outside India for doing not for profit activit es, which has opened a branch/liason office in India, cannot fall in definition of a foreign company as business activity is missing. Therefore, such company cannot be termed as foreign company. However, subject to compliance of FEMA regulations, it can open branch/liason offices. Such not for profit companies or bodies corporate incorporated outside India can promote and register a Section 8 Company in India as a distinct entity.

Yes. Section 8(1) of the Companies Act, 2013 allows person or association of persons to be registered as a Section 8 Company on fulfilment of certain conditions and procedure as prescribed therein. The term “person” has not been defined in the Companies Act, 2013. Section 2(41) of the General Clauses Act, 1897 provides that “person” shall include any Company, or association or body of individuals, whether incorporated or not. Accordingly, a Society registered under the Societies Registration Act, 1860 is a person. Therefore, Society can be registered/converted as a Section 8 Company.

Stamp duty on issue of share certificates is governed by Indian Stamp Act, 1899 as adapted by respective state or stamp act of respective state, as the case may be. No relaxation of special rate of stamp duty has been provided by any of the state in respect of stamp duty payable on issue of share certificates by Section 8 Company.

There are special requirements to be complied with under the Foreign Contribution and Regulation Act, 2010 before a Section 8 Company can receive any contributions or donations from overseas/outside India from non-residents. The provisions of the said Act are in addition to the provisions under the Companies Act.