Updated on May 29, 2025 01:31:58 PM

TDS return is a vital compliance procedure under the Income Tax Act that reflects all the TDS transactions carried out in a quarter. It allows for the proper reporting of taxes that have been withheld from payments made to employees, landlords, lawyers, interest earned, and contractors. The tax can only be deducted when the amount is credited to the payee’s account or when the payment is made whichever is the earliest.

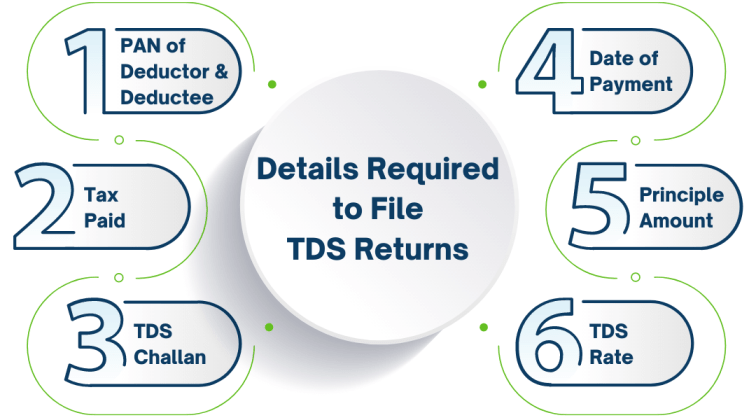

Filing TDS returns on time and with correct information is important to avoid penalties and facilitate the process of tax credits to deductees. Some of the details include challan numbers, PAN information, and deduction amounts. Any mistake or delay relating to the return can attract charges, interest, or rejection of the return. The proper implementation of TDS return filing regulations allows for the enablement of efficiency, transparency, and reduced complaints, for both the deductors and recipients.

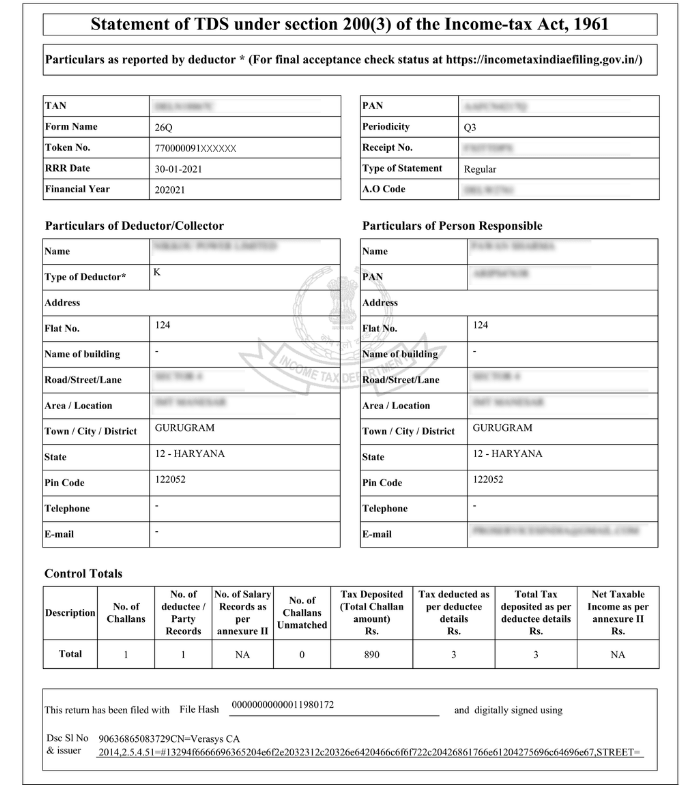

TDS Return Sample

TDS Return is a quarterly statement that needs to be submitted by the deductor to the Income Tax Department. The statement shows a summary of all the entries for TDS collected by the deductor and the TDS paid to the Income Tax Authority. The tax is required to be deducted at the time money is credited to the payee’s account or at the time of payment, whichever is earlier.

Usually, the person receiving income is liable to pay income tax. But the government with the help of Tax Deducted at Source provisions makes sure that income tax is deducted in advance from the payments being made. The recipient of income receives the net amount (after reducing TDS). The recipient will add the gross amount to his income and the amount of TDS is adjusted against his final tax liability. The recipient takes credit for the amount already deducted and paid on his behalf.

TDS certificates have to be issued by the payer deducting TDS to the payee from whose income TDS was deducted while making payment. Form 16, Form 16A, Form 16B, and Form 16C are all TDS certificates.

| Form | Certificate of | Frequency | Due date |

| Form 16 | TDS on salary payment | Yearly | 31st May |

| Form 16 A | TDS on non-salary payments | Quarterly | 15 days from due date of filing return |

| Form 16 B | TDS on sale of property | Event based | 15 days from due date of filing return |

| Form 16 C | TDS on rent | Event based | 15 days from due date of filing return |

There are mainly 4 types of TDS Return Forms:

Form 24Q is a quarterly statement of deduction of tax on salary under Section 192 of the Income Tax Act, 1961. An employer deducts TDS at the time of paying salary to an employee. TDS Form 24Q is to be filled by the employer for TDS deduction and submitted to the Income Tax Department quarterly.

Details of the salary paid, TDS deducted from it and challan details are reported in Form 24Q. All the companies and firms in India are required to make this declaration and payment every quarter.

Form 24Q contains 2 annexures, namely Annexure-I and Annexure-II. Annexure-I contains details of the deductor, deductees, and challans, while Annexure-II contains the salary details of the deductees.

Form 26Q is a quarterly statement of deduction of tax on all the payments other than salary. The payer has to file a TDS return in Form 26Q quarterly and is applicable for tax deducted at source under section 200(3), 193, and 194 of the Income Tax Act of 1961.

Form 26Q contains only one annexure, unlike Form 24Q which has two annexures. Details of the deductor, deductees, and challan are to be mentioned in Form 26Q. The income on which the tax is deducted at source includes interest on securities, dividend securities, professional fees, directors’ remuneration, etc.

Note: It is compulsory to furnish PAN by the deductors who are non-government deductors. For government deductors “PANNOTREQD” has to be mentioned on the form.

Form 27Q is a quarterly statement of deduction of tax on all the non-salary payments to an NRI. It comprises the details in regards to the payments made to a non-resident in that quarter by the payer. The Indian buyer is required to submit the form 27Q every quarter before the due date and is applicable for tax deducted at source under section 200(3) of the Income Tax Act of 1961.

The income on which the tax is deducted at source includes interest, bonus, any additional income, or any other sum owed to non-resident Indian or foreigner.

Note: Non-government deductors must furnish PAN. For government deductors, the code “PANNOTREQD” has to be mentioned on the form.

Form 27EQ is a quarterly statement that comprises the details and information of the tax collected at source as per section 206C of the Income Tax Act of 1961. Form 27EQ is required to be submitted quarterly and it is mandatory to mention the TAN details of the individual.

Form 27EQ shows the Tax Collected at Source, which is the tax collected by the seller. When a buyer purchases certain goods or commodities, the seller collects the tax from the buyer through the TCS route. This tax is collected on the payment received from the buyer either in cash, credit, cheque, demand draft, or from any other mode of payment.

Note: It is compulsory to furnish PAN by the deductors who are non-government deductors. For government deductors, the code “PANNOTREQD” has to be mentioned on the form.

The due dates for filing TDS return for FY 2021-22 are as follows:

| Quarter | Quarter Period | TDS Return Due Date |

| 1st Quarter | 1st April to 30th June | 31st July, 2021 |

| 2nd Quarter | 1st July to 30th September | 31st October, 2021 |

| 3rd Quarter | 1st October to 31st December | 31st January, 2022 |

| 4th Quarter | 1st January to 31st March | 31st May, 2022 |

TDS returns should be filed at the end of each quarter during the financial year. A person who fails to file the TDS/TCS return or does not file the return by the due dates prescribed under the Income Tax Act, then he is liable to pay late fees under section 234E. Apart from late filing fees, he would be liable to pay a penalty under section 271H too.

As per section 234E, if a person fails to file the TDS/TCS return on or before the due date, then he shall be liable to pay a late filing fee of ₹200 for every day during which the failure continues. TDS return cannot be filed without payment of late filing fees which means the late filing fees shall be deposited before filing the TDS return.

The amount of late fees shall not exceed the amount of TDS. For instance, if the TDS amount is ₹5,000 and your late fee is ₹20,000, then you’ll have to pay a late filing fee of ₹5,000 only.

Note: ₹200 per day is not a penalty but a late filing fee.

As per section 271H, if a person fails to file the TDS/TCS return within 1 year from the due date of filing return, then the assessing officer may direct such person to pay a penalty under section 271H. The minimum penalty can be levied of ₹10,000 which can go up to ₹1,00,000.

Apart from the delay in filing TDS returns, section 271H also covers cases of filing an incorrect return. Penalty under section 271H can also be levied if a person has furnished incorrect information. The penalty levied in case of incorrect TDS return filing is a minimum of ₹10,000 and a maximum of ₹1,00,000.

Note: Penalty under section 271H will be in addition to late filing fees prescribed under section 234E.

TDS returns should be filed at the end of each quarter during the financial year. A person who fails to file the TDS/TCS return or does not file the return by the due dates prescribed under the Income Tax Act, then he is liable to pay late fees under section 234E. Apart from late filing fees, he would be liable to pay a penalty under section 271H too.

As per section 234E, if a person fails to file the TDS/TCS return on or before the due date, then he shall be liable to pay a late filing fee of ₹200 for every day during which the failure continues. TDS return cannot be filed without payment of late filing fees which means the late filing fees shall be deposited before filing the TDS return.

The amount of late fees shall not exceed the amount of TDS. For instance, if the TDS amount is ₹5,000 and your late fee is ₹20,000, then you’ll have to pay a late filing fee of ₹5,000 only.

Note: ₹200 per day is not a penalty but a late filing fee.

As per section 271H, if a person fails to file the TDS/TCS return within 1 year from the due date of filing return, then the assessing officer may direct such person to pay a penalty under section 271H. The minimum penalty can be levied of ₹10,000 which can go up to ₹1,00,000.

Apart from the delay in filing TDS returns, section 271H also covers cases of filing an incorrect return. Penalty under section 271H can also be levied if a person has furnished incorrect information. The penalty levied in case of incorrect TDS return filing is a minimum of ₹10,000 and a maximum of ₹1,00,000.

Note: Penalty under section 271H will be in addition to late filing fees prescribed under section 234E.

The step-by-step process to file TDS Returns online is as follows:

Form 27A contains multiple columns that must be filled properly. In case a hard copy of the form is filled, then it must be verified with the e-TDS return filed electronically.

Now, the tax deducted at source and the total amount that has been paid must be correctly filled and should be matched with their respective forms (24, 26, 27, 27A).

Next, the assessee that is filing the TDS return must mention the Tax Deduction Account Number (TAN) in Form 27A as dictated by sub-section (2) of section 203A of the Income Tax Act in India.

Note: It should be noted that the details like challan number, PAN of deductee, and the tax details must be mentioned on the TDS returns accurately because failing to do so would make the verification process more difficult.

The basic form that is used for filing e-TDS returns must be used because it brings consistency and better understanding in filling the forms and it is recommended by the department. It is necessary to mention the 7-digit Bank Branch Code to facilitate easy tallying.

Physical TDS returns must be submitted at the TIN-FC managed by NSDL. If returns are filed online, they can be submitted on the official website of the NSDL TIN. The deductor has to sign the TDS return through a digital signature.

If all the information mentioned is correct, then a provisional receipt or token number would be issued. This is considered as an acknowledgment that confirms that the TDS return has been filed. In case the return is not accepted, then a non-acceptance memo along with the reasons for rejections is issued. In such cases, the TDS return must be filed again

TDS is payable on the earnings so it is important to note that the liability to pay TDS is applicable only in the event of earnings taking place. TDS is deducted before making payments. Deductions are to be made on payments that are made in cash, cheque, or credit. The amount deducted under TDS is further deposited with various government agencies.

Payment of TDS has various advantages which are as follows :

Deductors must submit a TDS correction statement if the original return filed is found to be incomplete or inaccurate. The mistake could be incorrect TAN, challan details, or PAN of the deductee. Deductors are required to submit one statement in a single form for a particular TAN every quarter.

Conclusion

TDS returns is an essential compliance formality that every individual or business entity is required to fulfill in case of making specified payment under the Income Tax Act. Ensuring accurate filing within due dates helps avoid penalties and ensures smooth tax credit processing for deductees. At Professional Utilities, we take care of all your TDS return filing needs and provide you with expert services to avoid any errors and ensure compliance and timely filing of the return. Our services are ideally suited for businesses, employers, or any other deductor who needs a convenient way of managing their TDS responsibility.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions

TDS Return is a summary of all the transactions related to TDS made during a quarter. It is a quarterly statement that needs to be submitted by the payer or deductor to the Income Tax Department.

24Q is a quarterly statement of tax deducted at source from Salaries and 26Q is a quarterly statement of tax deducted at source from all payments other than salaries.

26Q TDS return is a quarterly statement of tax deducted at source on all payments other than salaries. The deductor is liable to file TDS return in Form 26Q quarterly under section 193, 194 and 200(3) of the Income Tax Act, 1961.

TDS return is filed every quarter by the deductor or payer to inform the Income Tax Department about the tax deducted at source.

Speak Directly to our Expert Today

Reliable

Affordable

Assured