12A and 80G Registration in Andaman and Nicobar: Step-by-Step Guide, Procedure, Fees, and Documents Required

Updated on April 09, 2025 05:30:13 PM

For NGOs, trusts, and Section 8 companies working in Andaman and Nicobar, 12A and 80G registration under Income Tax Act, of 1961 is of paramount importance. The main purpose of such Registration is to enhance their credibility and attract donors while adhering to tax compliance. The two Registration provide great tax benefits and allow the organization to concentrate on its philanthropic goals rather than paying for tax liabilities.

12A Registration: This registration provides exemption of income for charities. Registered NGOs and trusts under 12A are exempted from taxes, meaning more funds can be allocated toward social objectives, such as education, health care, environmental conservation, and the welfare of the community.

The 80G registration encourages people to give because of the tax benefits. Through 80G registration, NGOS can attract increased donations from individuals and corporate sponsors who can see the potential for tax reduction from their contributions.

In Andaman and Nicobar, the process to obtain 12A and 80G Registration is simplified by online applications, through the e-filing portal of the Income Tax Department. This makes it faster with less paperwork to make it easier for organizations.

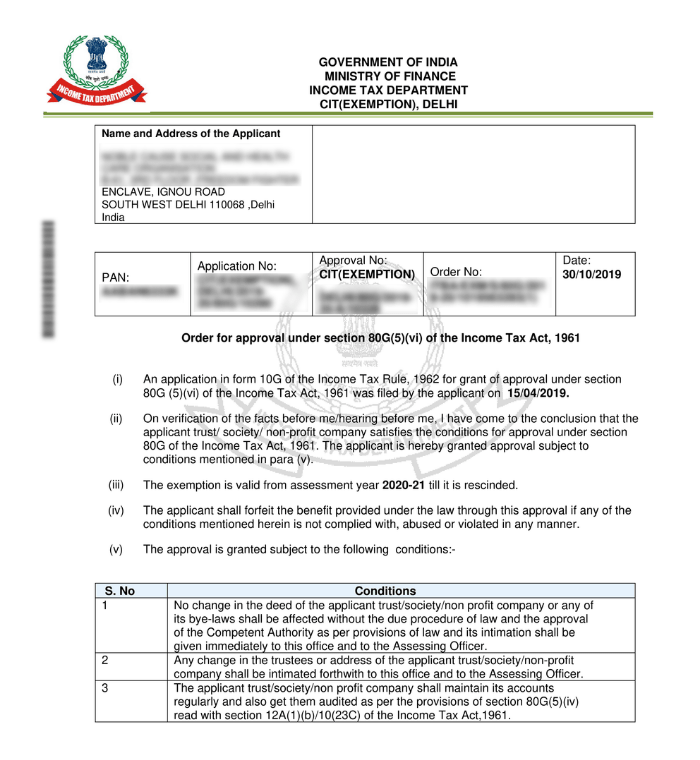

12A & 80G Sample Documents

- 12A Registration Certificate

- 80G Certificate

Table of Content

- What is 12A and 80G Registration in Andaman and Nicobar?

- Benefits of the 12A and 80G Registration

- Documents Required for 12A and 80G Registration in Andaman and Nicobar

- Procedure for 12A and 80G Registration in Andaman and Nicobar

- Fees for 12A and 80G Registration in Andaman and Nicobar

- Validity of 12A and 80G Registration

- Conclusion

- Why Professional Utilities?

- Frequently Asked Questions

What is 12A and 80G Registration in Andaman and Nicobar?

12A and 80G Registration are the most important Registration under the Income Tax Act, of 1961, for NGOs, charitable trusts, and Section 8 companies doing business in Andaman and Nicobar. Such Registration provide a lot of tax benefits and help an organization comply with legal requirements, enhance its credibility, and encourage donations.

12A Registration: This registration provides NGOs and trusts with income tax exemption, provided that the income is used for charitable purposes. Organizations which have been registered under 12A are exempt from paying taxes on the income earned through donations, so long as the income is used for achieving their social objectives. This way, more money will be saved to conduct more charitable activities, including education, healthcare, environmental conservation, and rural development.

80G Registration It is also a registration to encourage the donors by allowing them tax deductions on the contribution made. Donations made to organizations with an 80G registration allow tax deductions, which inspires more individuals and corporations to donate. This is the most potent tool for attracting donors, as it has a direct financial benefit on the contributor's side as well.

Benefits of 12A and 80G Registration

The benefits of having 80G and 12A Registration for charitable organizations and NGOs are many and far-reaching in day-to-day operational features:

- Tax Benefits to Donors: 80G-certified NGOs provide a tax deduction benefit for the donors on their contributions. This makes donations attractive, which may spur greater donations.

- Increased Credibility and Trust: NGO establishments under Section 12A and 80G enjoy a stamp of approval from the Income Tax Department, thus enhancing their credibility. This trust factor is, however, a major driver for ensuring transparency to the donors and partners.

- Expanded Fundraising Limits: Tax privileges connected with these Registration encourage individuals and business firms to be more generous with their donations. This widens the fundraising pool, which allows NGOs to ramp up their activities and outreach.

- Registration For Government Grants: Most governments impose the registration of NGOs with 12A and 80G for them to qualify for their funding. This opens many doors for the grants that often end up being the lifeblood of a project.

- Sustainable Impact: With the possibility of facilitating tax benefits for interested donors, contributions can be made one-off, but even more determined efforts can produce greater returns on investment. A stable funding source allows NGOs to make generous financial commitments and, consequently, allows long-term project planning and implementation.

- Proper Utilization of Resources: With 12A registration, an NGO follows rigorous funding management and must apply funds only for charitable purposes. This ensures optimal utilization of the resources for the organization's stated goals.

Documents Required for 12A and 80G Registration in Andaman and Nicobar

To apply for 12A and 80G registration in Andaman and Nicobar, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

- Common Documents for 12A and 80G Registration

- Specific Documents of 12A Registration

- Specific Documents of 80G Registration

- Memorandum of Association (MOA)

- Pan Card

- Registration Certificate

- Address Proof

- Financial Statement

- Details of Activities

- Bank Account Details

- Form 10A

- Donor Details

- Activity Report

- Financial Records

- Form 10G

Procedure for 12A and 80G Registration in Andaman and Nicobar

Applying for 12A and 80G registration in Andaman and Nicobar involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

Step 1: Eligibility Check

- Your organization must be a Trust, Society, or Section 8 Company that is undertaking charitable, religious, or educational activities.

Step 2: Preparation of Documents

- Gather the necessary documents, such as registration certificates, trust deeds or MOA/AOA, PAN cards, financial statements, activity reports, and details of governing members.

Step 3: Online Application

- Login to the Income Tax Department's e-filing portal.

- Form 10A is for registration under 12A, and Form 10G is for registration under 80G.

Step 4: Upload Documents

- The applicant needs to upload all supporting documents along with the forms.

Step 5: Authority Review

- The Income Tax Department will scrutinize the application form and may ask the applicant for additional information or documents.

Step 6: Approval

- The department issues 12A and/or 80G certification after successful verification.

Fees for 12A and 80G Registration in Andaman and Nicobar

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Minor expenses may be incurred, though, in the course of doing so, including:

- Preparation of Documents: The costs associated with drafting, notarizing, or obtaining necessary documents.

- Fees related to professional services: legal, accountancy, or consultancy to help prepare the application.

- Administrative Expenses: Photocopies, courier, and internet usage during the submission and chasing of documents.

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

- Professional fee for 12A and 80G Registration in Delhi starts from ₹5,000 Each.

- Note: The aforementioned fees are exclusive of GST

Validity of 12A and 80G Registration

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such Registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

12A and 80G Registration are a must for any NGO, trust, or charitable organization in Andaman and Nicobar as they grant exemptions on taxes and even boost donor appeal. When 12A registration ensures that more funds are given to charitable activities because there is an exemption from payment of income tax on surplus incomes. The 80G registration gives a large incentive to the donors as they can claim a deduction on the contributions made, thus an organization that is registered in 80G is appealing to a donor.

Why Professional Utilities?

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

One Stop Corporate Solution

PAN India

Services

Free Expert

Assistance

Google Verified

Business

Dedicated Support

Staff

Money-Back

Guarantee

Frequently Asked Questions (FAQs)

What is the 12A Registration?

12A Registration grants NGOs, Trusts, Societies, and Section 8 Companies income tax exemption based on charitable, religious, or educational activities.

Why is 80G Registration important?

80G Registration offers donors tax deduction benefits from donations to the organization. This builds people's confidence in contributing more and thereby adds to the organization's credibility.

Who can get registered for 12A and 80G?

These are charitable, religious, or educational trusts and societies and section 8 companies.

What is the fee for 12A and 80G Registration?

The Income Tax Department does not charge an application. However, incidental costs will be paid to prepare documents, obtain legal assistance, and cover administrative overheads.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

.svg)