Updated on April 09, 2025 05:30:13 PM

12A and 80G registration are necessary for NGOs, Trusts, Societies, and Section 8 Companies in Ghaziabad if they engage in charitable, religious, or educational activities. These certificates under the Income Tax Act, of 1961, are critical tax advantages for organizations and their donors and, therefore, to non-profit operations and sustainability.

12A registered organizations can claim income tax exemptions on funds generated through their charitable activities. This means that they will have more of their income left for furthering their mission without paying income tax.

80G Registration provides tax incentives for donors, allowing them to claim deductions on the donations they make to the registered organization. This encourages more people and businesses to contribute, increasing the organization’s fundraising potential and impact.

The Income Tax Department has made the filing of 12A and 80G registration easier with an online filing system. Organizations in Ghaziabad can now apply for these registration through the e-filing portal, making the process more convenient and saving time and paperwork. With these registration, NGOs and non-profit entities in Ghaziabad will have increased credibility and the likelihood of attracting more donations. They will then be able to channel resources efficiently towards their social causes.

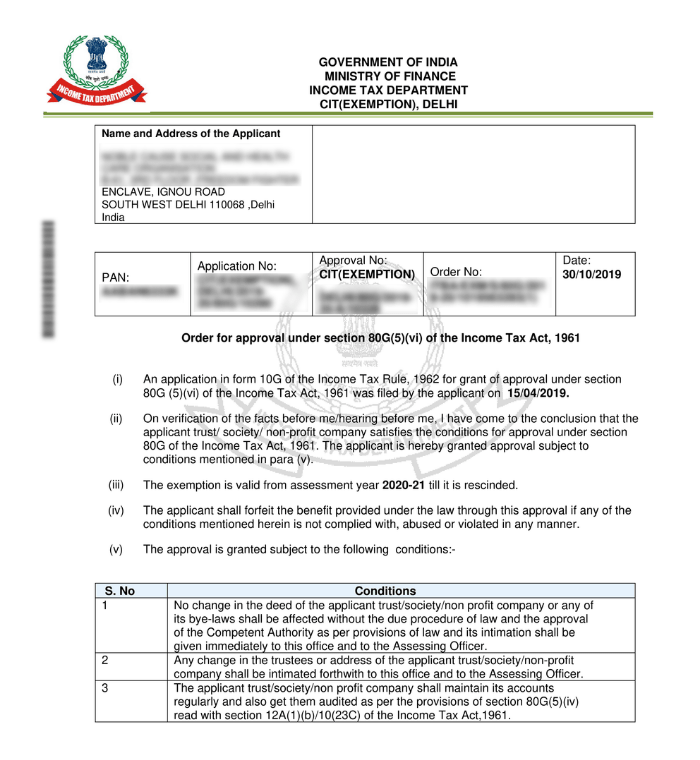

12A & 80G Sample Documents

Table of Content

12A and 80G registration are very essential for the NGOs, Trusts, Societies, and Section 8 Companies based in Ghaziabad which engage in charitable, educational, or religious activities. Income Tax Act, of 1961, regulates 12A and 80G registration, providing significant tax benefits to the organization and its donors; hence, they form a core part of the not-for-profit sector.

12A Registration Income tax exemption: An income tax exemption is allowed on the surplus income arising from the organization's activities as a result of their charitable work. This is where the organization can reinvest its surplus funds in missions that benefit social welfare, education, healthcare, or other charitable services with no income tax liability.

80G Registration helps the donors. The donations made to the registered organization will be considered eligible for a tax deduction, which motivates both the individual and corporate givers to donate more and strengthens the hands of the organization in fundraising.

The organizations based in Ghaziabad require registration under 12A and 80G to increase their donor base, enhance transparency, and establish trust.

The benefits of having 80G and 12A registration for charitable organizations and NGOs are many and far-reaching in day-to-day operational features:

To apply for 12A and 80G registration in Ghaziabad, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

Applying for 12A and 80G registration in Ghaziabad involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

Securing 12A and 80G registration is the most important step for NGOs, Trusts, Societies, and Section 8 Companies in Ghaziabad to maximize their impact and financial sustainability. These registration not only provide tax exemptions for the organization but also encourage more donations by offering tax benefits to donors. The simplified online application process through the Income Tax Department's e-filing portal makes it easier for organizations to apply for and obtain these registration.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

12A registration enables NGOs, Trusts, Societies, and Section 8 Companies to claim tax exemptions on income generated from their charitable activities. This ensures that the organization's funds are used solely for its mission, without the burden of income tax.

80G registration enables the donors to receive tax deductions on their donation, that they make to the registered organization. This encourages individuals and businesses to donate more since the latter have tax incentives.

Any NGOs, Trusts, Societies, or Section 8 Companies are eligible for 12A and 80G registration involved in charitable, educational, or religious activities.

No. The income tax department does not take any fees for 12A and 80G registration. But, it may have some professional or document preparation expenses.

Speak Directly to our Expert Today

Reliable

Affordable

Assured