12A and 80G Registration in Karnataka: Step-by-Step Guide, Procedure, Fees and Documents Required

Updated on April 09, 2025 05:30:13 PM

12A and 80G registration are essential for non-profit organizations, such as trusts, societies, and NGOs, in Karnataka, for they provide the necessary tax benefits that help improve its financial sustainability and attract donor support. The Registration under the Indian Income Tax Act, of 1961, provide the organizations with tax exemptions and, therefore, encourage donations through tax incentives to the contributors.

12A Registration recognizes an organization as a charitable entity and exempts its income from taxation, provided it is used for charitable activities. This allows NGOs in Karnataka to direct more funds into their social initiatives, such as education, healthcare, environmental protection, and rural development, rather than paying taxes on their income.

80G Registration would allow donors to claim tax deductions based on their contributions, and by this, corporations as well as other funding agencies are encouraged to donate even more generously. This increased credibility of the organizations raises the steady flow of financing support, making it easier to sustain and expand projects done by NGOs.

With the introduction of online registration, applying for 12A and 80G certification has become easier for NGOs in Karnataka, including those in remote areas. These Registration will help the organizations to strengthen their financial foundation and increase their impact in the state.

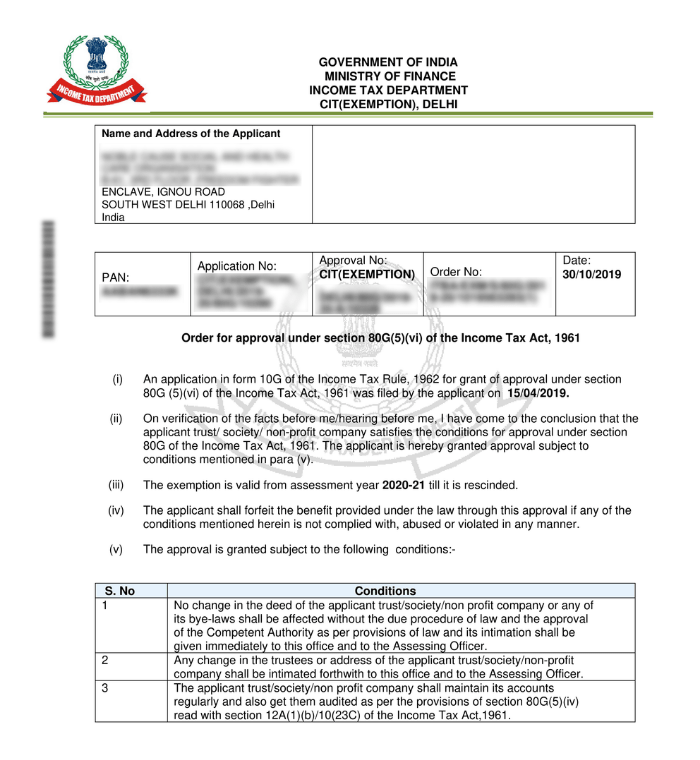

12A & 80G Sample Documents

- 12A Registration Certificate

- 80G Certificate

Table of Content

- What is 12A and 80G Registration in Karnataka?

- Benefits of the 12A and 80G Registration

- Documents Required for 12A and 80G Registration in Karnataka

- Procedure for 12A and 80G Registration in Karnataka

- Fees for 12A and 80G Registration in Karnataka

- Validity of 12A and 80G Registration

- Conclusion

- Why Professional Utilities?

- Frequently Asked Questions

What is 12A and 80G Registration in Karnataka?

12A and 80G Registration in Karnataka are an essential requirement for getting non-profit tax benefits under the Indian Income Tax Act, 1961. They facilitate crucial tax benefits to various kinds of non-profit organizations such as trusts, societies, and NGOs. Registration would make an organization function smoothly and with a reduced tax liability while also attracting funds from donors.

12A Registration: is permitted for an organization to help the organization get recognized as a charitable entity and income accrued is exempted from taxation, provided it goes for charitable purposes. This enhances NGOs in Karnataka to employ more funds for their initiatives like education, healthcare rural development, and social welfare as the burden of income tax levied on them will have no effect.

80G Registration provides tax deductions to donors who contribute to registered charitable organizations. This motivates individuals, corporations, and other entities to donate more, thus ensuring a continuous flow of donations. It also enhances the credibility of the NGO, making it easier to secure funding from various sources.

These Registration enable nonprofits in Karnataka to have a strong financial foundation, attract sustained donations, and focus further on their mission of creating positive social impact.

Benefits of 12A and 80G Registration

The benefits of having 80G and 12A Registration for charitable organizations and NGOs are many and far-reaching in day-to-day operational features:

- Tax Benefits to Donors: 80G-certified NGOs provide a tax deduction benefit for the donors on their contributions. This makes donations attractive, which may spur greater donations.

- Increased Credibility and Trust: NGO establishments under Section 12A and 80G enjoy a stamp of approval from the Income Tax Department, thus enhancing their credibility. This trust factor is, however, a major driver for ensuring transparency to the donors and partners.

- Expanded Fundraising Limits:Tax privileges connected with these Registration encourage individuals and business firms to be more generous with their donations. This widens the fundraising pool, which allows NGOs to ramp up their activities and outreach.

- Registration For Government Grants: Most governments impose the registration of NGOs with 12A and 80G for them to qualify for their funding. This opens many doors for the grants that often end up being the lifeblood of a project.

- Sustainable Impact: With the possibility of facilitating tax benefits for interested donors, contributions can be made one-off, but even more determined efforts can produce greater returns on investment. A stable funding source allows NGOs to make generous financial commitments and, consequently, allows long-term project planning and implementation.

- Proper Utilization of Resources: With 12A registration, an NGO follows rigorous funding management and must apply funds only for charitable purposes. This ensures optimal utilization of the resources for the organization's stated goals.

Documents Required for 12A and 80G Registration in Karnataka

To apply for 12A and 80G registration in Karnataka, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

- Common Documents for 12A and 80G Registration

- Specific Documents of 12A Registration

- Specific Documents of 80G Registration

- Memorandum of Association (MOA)

- Pan Card

- Registration Certificate

- Address Proof

- Financial Statement

- Details of Activities

- Bank Account Details

- Form 10A

- Donor Details

- Activity Report

- Financial Records

- Form 10G

Procedure for 12A and 80G Registration in Karnataka

Applying for 12A and 80G registration in Karnataka involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

Step 1: Eligibility Check

- Your organization must be a Trust, Society, or Section 8 Company that is undertaking charitable, religious, or educational activities.

Step 2: Preparation of Documents

- Gather the necessary documents, such as registration certificates, trust deeds or MOA/AOA, PAN cards, financial statements, activity reports, and details of governing members.

Step 3: Online Application

- Login to the Income Tax Department's e-filing portal.

- Form 10A is for registration under 12A, and Form 10G is for registration under 80G.

Step 4: Upload Documents

- The applicant needs to upload all supporting documents along with the forms.

Step 5: Authority Review

- The Income Tax Department will scrutinize the application form and may even ask the applicant for additional information or documents.

Step 6: Approval

- The department issues 12A and/or 80G certification after successful verification.

Fees for 12A and 80G Registration in Karnataka

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Minor expenses may be incurred, though, in the course of doing so, including:

- Preparation of Documents: The costs associated with drafting, notarizing, or obtaining necessary documents.

- Fees related to professional services: legal, accountancy, or consultancy to help prepare the application.

- Administrative Expenses: Photocopies, courier, and internet usage during the submission and chasing of documents.

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

- Professional fee for 12A and 80G Registration in Karnataka starts from ₹5,000 Each.

- Note: The aforementioned fees are exclusive of GST

Validity of 12A and 80G Registration

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such Registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

12A and 80G Registration are highly essential for Karnataka-based nonprofit organizations to increase their viability and sustainability in terms of the financial aspects of their charitable activities. The registration processes offer these organizations considerable tax exemptions as well as donors by encouraging philanthropy. It has become very easy with the online registration process so that NGOs operating in Karnataka can enjoy these benefits and focus more on their social missions.

Why Professional Utilities?

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

One Stop Corporate Solution

PAN India

Services

Free Expert

Assistance

Google Verified

Business

Dedicated Support

Staff

Money-Back

Guarantee

Frequently Asked Questions (FAQs)

What is the 12A Registration?

12A Registration grants NGOs, Trusts, Societies, and Section 8 Companies income tax exemption based on charitable, religious, or educational activities.

Why is 80G Registration important??

80G Registration offers donors tax deduction benefits from donations to the organization. This builds people's confidence in contributing more and thereby adds to the organization's credibility.

Who can get registered for 12A and 80G?

These are charitable, religious, or educational trusts and societies and section 8 companies.

What is the fee for 12A and 80G Registration?

The Income Tax Department does not charge an application. However, incidental costs will be paid to prepare documents, obtain legal assistance, and cover administrative overheads.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

.svg)