Updated on April 09, 2025 05:30:13 PM

Kerala, being considered a state of high literacy rates, great culture, and social development, is a place of several NGOs, Trusts, Societies, and Section 8 Companies striving to tackle the social issues the state faces. As most require financing through donations and grants for operations and successful implementations of projects, 12A and 80G registration under the Income Tax Act, of 1961, become priceless to maximize efficiency and attract more support.

12A Registration offers tax exemptions on the income of non-profit organizations, ensuring that funds raised through donations or other sources are fully utilized for charitable purposes. This exemption is crucial for NGOs in Kerala, enabling them to channel their resources into areas such as education, healthcare, environmental protection, and rural development without the burden of taxation.

80G Registration The donors receive tax benefits as their contribution is eligible for deduction. Thus, more people and companies come forward to donate lavishly as it increases the organization's fundraising capabilities.

With the streamlined online application procedure offered by the Income Tax Department's e-filing portal, acquiring 12A and 80G Registration has never been easier for Kerala's nonprofits. These certification further contribute to credibility but have a long-term impact on the contribution to be made in an area of community.

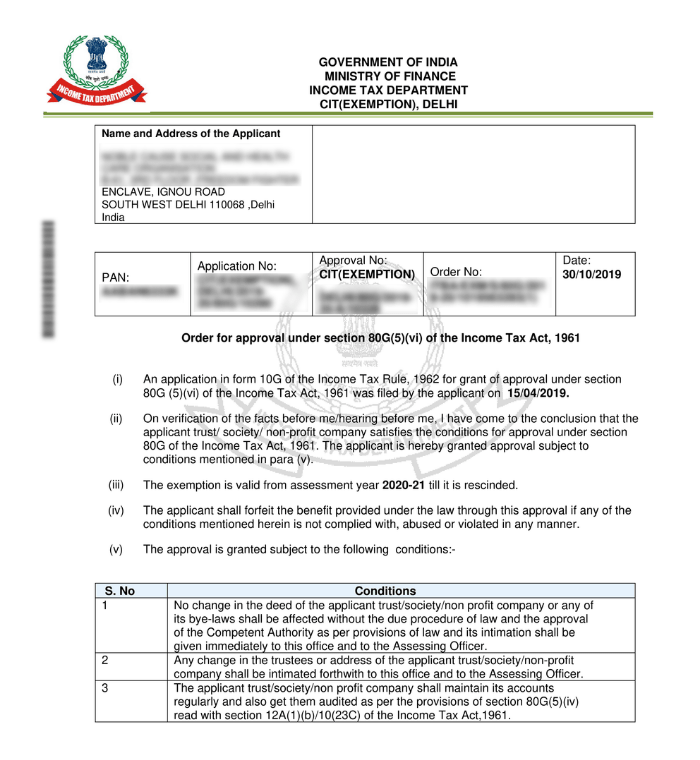

12A & 80G Sample Documents

Table of Content

12A and 80G Registration are the most important Registration under the Income Tax Act, 1961, for NGOs, Trusts, Societies, and Section 8 Companies operating in Kerala. These Registration are of prime importance for the sustainability of finances and for attracting contributions from donors, so that non-profits can concentrate on their charitable goals.

12A Registration allows the earnings of NGOs in Kerala to stay tax-free. This provides NGOs in Kerala with full utilization of all income, from donations and grants, for charitable purposes without the encumbrance of a tax liability. This freedom helps the organizations to expend more resources on the task of social causes like education, health, and ecological activities.

80G Registration offers income tax benefits to donors for contributions to registered charitable organizations. Thus, this tax benefit creates the potential for individuals and corporations to contribute more generously, leading to increased fundraising for the nonprofits in Kerala.

Thus, through 12A and 80G registration, organizations in Kerala would have the credibility to further increase their impact and sustain their operations with the much-needed funds.

The benefits of having 80G and 12A Registration for NGOs and charitable organizations are many and far-reaching in day-to-day operational features:

To apply for 12A and 80G registration in Kerala, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

Applying for 12A and 80G registration in Kerala involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Minor expenses may be incurred, though, in the course of doing so, including:

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such Registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

12A and 80G Registration are very essential tools for NGOs, Trusts, Societies, and Section 8 Companies in Kerala to strengthen their financial framework and amplify their social impact. These certification provide tax exemptions for organizations and tax benefits for donors, fostering a supportive environment for charitable activities and philanthropy. With these Registration, non-profits in Kerala can enhance their credibility, attract greater financial support, and focus on addressing critical social issues.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

12A Registration grants NGOs, Trusts, Societies, and Section 8 Companies income tax exemption based on charitable, religious, or educational activities.

80G Registration offers donors tax deduction benefits from donations to the organization. This builds people's confidence in contributing more and thereby adds to the organization's credibility.

These are charitable, religious, or educational trusts and societies and section 8 companies.

The Income Tax Department does not charge an application. However, incidental costs will be paid to prepare documents, obtain legal assistance, and cover administrative overheads.

Speak Directly to our Expert Today

Reliable

Affordable

Assured