Updated on April 09, 2025 05:30:13 PM

The Non-Profit Organisations in Sikkim - Trusts, Societies, and NGOs- 12A and 80G registration to get their resources in the best order and sustained donor support. Indian Income Tax Act, 1961 registration helps with the exemption that can free up resources to undertake more social welfare activities with less tax burden.

12A Registration allows an organization to be recognized as a charitable entity, exempting its income from tax if it is used exclusively for charitable purposes. This allows NGOs in Sikkim to distribute more resources to key areas like education, healthcare, environmental conservation, and rural development.

Registration under 80G secures tax benefits to the donor for donations given to registered entities. It encourages individuals and corporations to donate more liberally, ensuring a steady flow of financial support and an enhanced credibility of the organization.

The availability of online registration processes helps the organizations operating in Sikkim, especially in remote areas, to easily apply for such certification. An NGO can further ensure its financial sustainability, build the trust of donors, and have a more meaningful impact on solving the state's social and developmental challenges by acquiring 12A and 80G Registration.

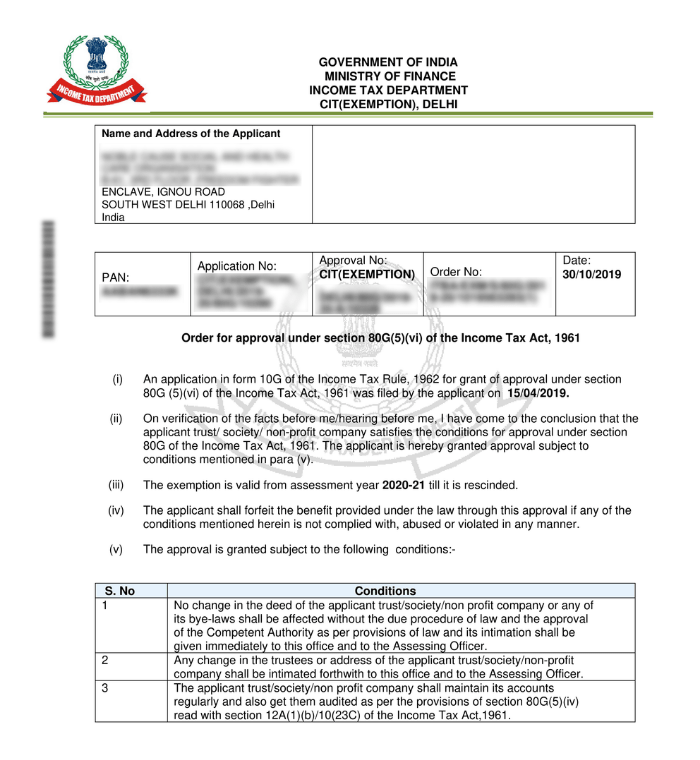

12A & 80G Sample Documents

Table of Content

12A and 80G Registration in Sikkim are essential registration procedures under the Indian Income Tax Act, 1961, aimed at supporting NGOs like trusts, societies, etc. These Registration offer tax benefits to such organizations, enabling them to work with their missions and attract funding support from donors.

12A Registration: recognizes an organization as a charitable entity. Its income is exempt from taxation if the funds are applied for charitable purposes. It is particularly beneficial for NGOs in Sikkim to invest more resources into initiatives like education, healthcare, rural development, and environmental conservation without the financial burden of taxes.

80G Registration enables donors to claim the tax deductions made for contributions, which increases donations from people, companies, and others. This certification further enhances the credibility of non-profits and thereby eases fundraising processes and long-term relationships with donors.

Through 12A and 80G Registration, NGOs in Sikkim can increase their financial strength and build trust with their donor base, hence enhancing their impact on socio-economic and developmental challenges facing the state.

The benefits of having 80G and 12A Registration for charitable organizations and NGOs are many and far-reaching in day-to-day operational features:

To apply for 12A and 80G registration in Sikkim, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

Applying for 12A and 80G registration in Sikkim involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Minor expenses may be incurred, though, in the course of doing so, including:

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such Registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

12A and 80G Registration are essential to the non-profit organizations in Sikkim for financial sustainability, donation collection, and credibility. The certification avail tax exemptions for the organization and tax benefits for donors, thus ensuring a transparent and sustainable funding model. The ease of online application ensures NGOs in Sikkim, even from remote areas, can also access these benefits.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

12A Registration grants NGOs, Trusts, Societies, and Section 8 Companies income tax exemption based on charitable, religious, or educational activities.

80G Registration offers donors tax deduction benefits from donations to the organization. This builds people's confidence in contributing more and thereby adds to the organization's credibility.

These are charitable, religious, or educational trusts and societies and section 8 companies.

The Income Tax Department does not charge an application. However, incidental costs will be paid to prepare documents, obtain legal assistance, and cover administrative overheads.

Speak Directly to our Expert Today

Reliable

Affordable

Assured