Updated on April 09, 2025 05:30:13 PM

12A and 80G registration are a sine qua non for trust, societies, NGOs, etc. in Tripura to achieve financial stability and tax-related benefits in light of the Indian Income Tax Act, 1961. Their registration advances the organizational credibility to raise funds and garner resources that help to fulfill the state's socio-economic requirements.

12A Registration grants an organization tax exemption on its income, provided the funds are used for charitable purposes. This allows NGOs in Tripura to channel more resources into their initiatives, such as education, healthcare, rural development, and environmental conservation, without the burden of income tax.

80G Registration offers tax deductions to donors, encouraging individuals and corporate entities to give more liberally. This helps organizations have a steady inflow of funds, enabling them to reach out and impact more people.

The online application process for 12A and 80G registration has made it easier for non-profits, even in remote parts of Tripura, to apply and benefit. These certification help NGOs enhance their operational efficiency and create a lasting impact in the state by addressing critical challenges and fostering development in communities that need it the most.

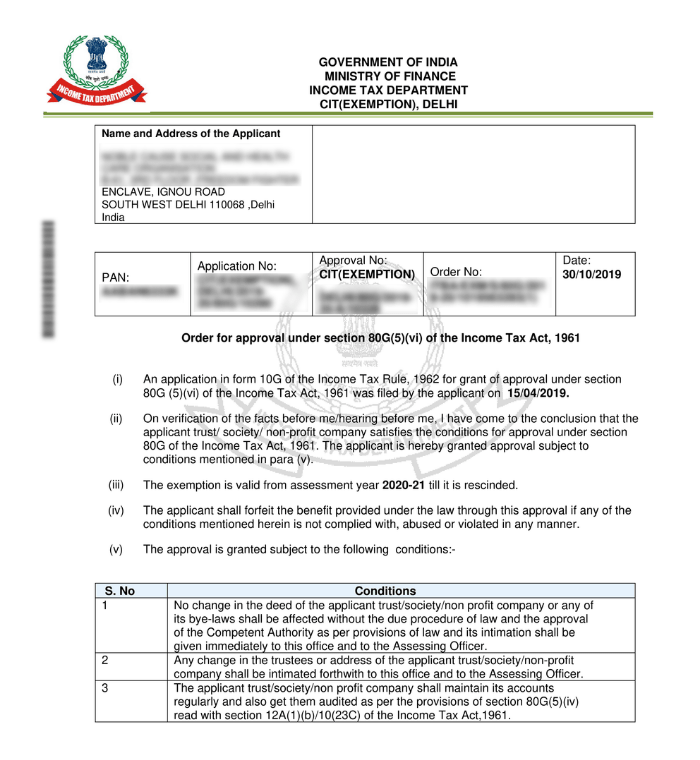

12A & 80G Sample Documents

Table of Content

12A and 80G Registration in Tripura are the most important certification under the Indian Income Tax Act, 1961, aimed at supporting non-profit organizations, including NGOs, trusts, and societies. These Registration provide tax benefits and financial advantages, enabling organizations to focus more on their social welfare missions and less on financial constraints.

12A Registration The charity body is recognized by an organization and tax exemptions on income. All funds should be employed towards charitable activities. As such, this enables Tripura's NGOs to devote their maximum resources toward education, healthcare, skill development, and conservation of the environment.

80G Registration gives donors the right to claim tax deductions on their contributions, thus encouraging more individuals and corporates to donate generously. Organizations with 80G certification gain credibility and attract sustained donor support, which is essential for long-term operations.

In Tripura, where developmental challenges are prevalent in most communities, these certification play a vital role in empowering non-profits to drive impactful change.

The benefits of having 80G and 12A Registration for charitable organizations and NGOs are many and far-reaching in day-to-day operational features:

To apply for 12A and 80G registration in Tripura, NGOs, Trusts, Societies, and Section 8 Companies must provide specific documents to establish their eligibility and compliance. Below is a comprehensive list:

Applying for 12A and 80G registration in Tripura involves a streamlined online process through the Income Tax Department’s e-filing portal. Here is a step-by-step guide:

There are no fees levied by the Income Tax Department for the 12A and 80G registration process. The procedure is free for those eligible organizations that apply.

Minor expenses may be incurred, though, in the course of doing so, including:

Note: Although the fee is variable, the entire cost will depend upon the level of applicability and the requirement for professional aid.

Surely, the validity of Sections 12A and 80G registration starts from provisional registration which is for three years. To maintain the status of the provisional registration, an application can be initiated either six months before its expiration or six months from the inception of operations, whichever is earlier, for renewal purposes. Upon renewal, such Registration get another five years. The same process will go on every succeeding five years to remain covered.

Conclusion

12A and 80G Registration are important for NGOs in Tripura to increase their financial viability, get tax exemption, and attract donor support. Such Registration enable NGOs to allocate more resources to their charitable cause and encourage philanthropy by way of tax benefits to donors. Even organizations in remote corners of Tripura can benefit from these schemes with the ease of the online application process.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions (FAQs)

12A Registration grants NGOs, Trusts, Societies, and Section 8 Companies income tax exemption based on charitable, religious, or educational activities.

80G Registration offers donors tax deduction benefits from donations to the organization. This builds people's confidence in contributing more and thereby adds to the organization's credibility.

These are charitable, religious, or educational trusts and societies and section 8 companies.

The Income Tax Department does not charge an application. However, incidental costs will be paid to prepare documents, obtain legal assistance, and cover administrative overheads.

Speak Directly to our Expert Today

Reliable

Affordable

Assured