Updated on July 06, 2024 06:09:37 PM

To get GST Registration in any state, Entity, or individual. They need to submit documents for proof. Depending on the type of GST Registration and the business’s constitution different sets of documents are required. Different documents required by the business are PAN Card, Aadhar Card, Memorandum of Association or Articles of Association, certificate of incorporation or partnership deed, Account Statement, and any other documents as per requirement.

Professional utilities helps to get the GST Registration in quick and hassle free manner.

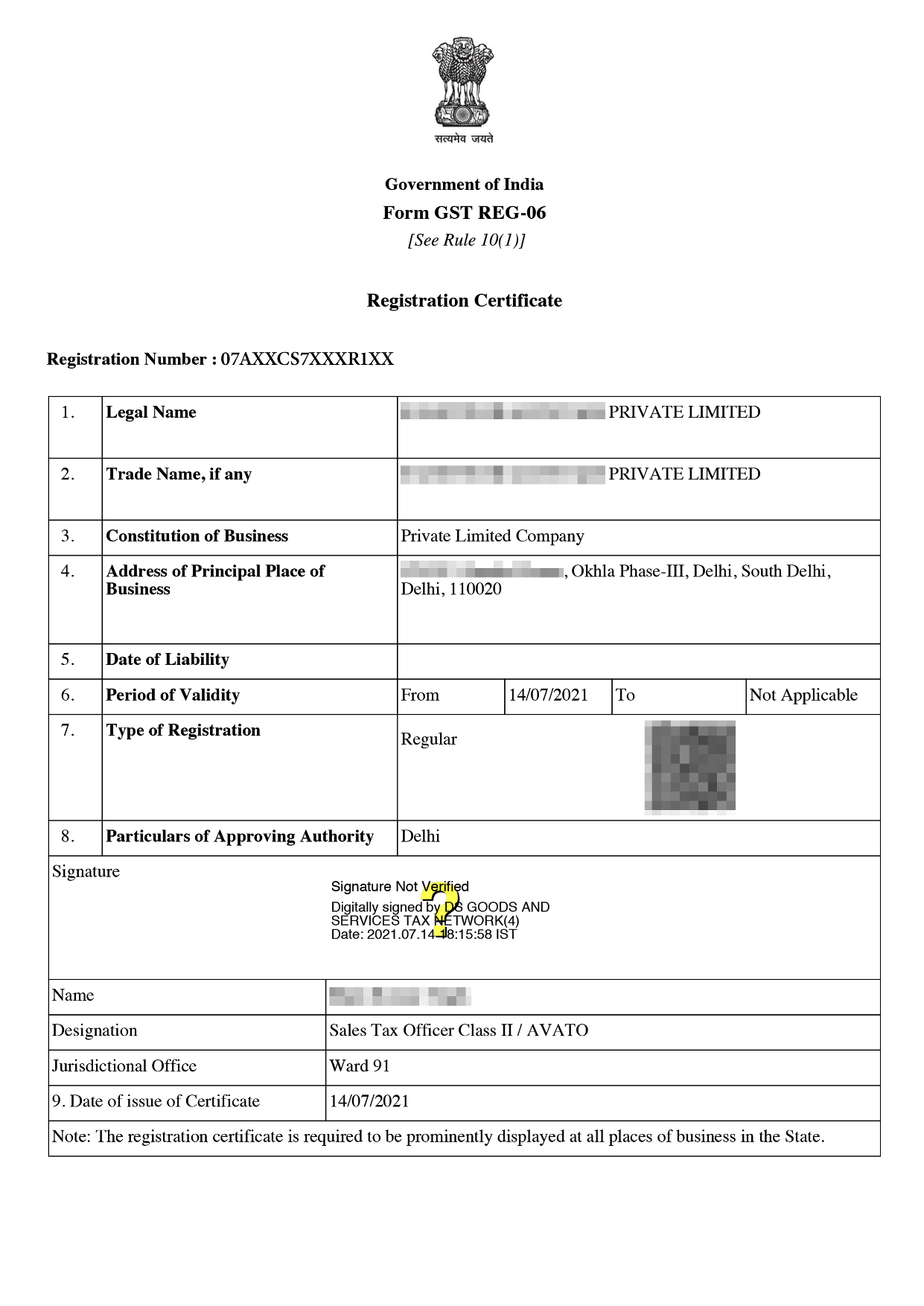

GST Registration Certificate Sample

GST Registration is the identification of the taxpayer under GST Act. After a firm or individual exceeds the prescribed limit they have to get the GST Registration. Some Taxpayers have to get compulsory registration or some do not need it. Limit for the GST Registration is 40 lakhs in supply of goods and 20 lakh in supply of services.

Requirement of the documents depend upon the GST Registration process’ types or business. GST Registration of the different types of business or constitute required different documents as mentioned below

PAN CARD - PAN Card is the proprietor's tax identification. In which details about the financial transaction are provided.

Aadhar Card - This document serves as the Taxpayer's identification.

Digital Signature - This is used as a mark of validity. This shows that authorised signatory have given their approval for the registration process.

Photograph of Authorised signatory/Owner - Passport size of the partner, owners and authorised signatories are given for registration.

Detail of Bank Account - Even though bank details are not important documents. Its detail may be asked like

The Indian Financial System Code (IFSC) for the account.

Bank statement, First and last page of your passbook or cancelled cheque.

Details of the many bank accounts are given.

Digital signatory - Digital Signature of the authorised signatory for LLP and companies is necessary. It is a sign of validity.

Incorporation Certificate - It is a proof of constitution of business which is given by the Ministry of Corporate Affairs. It may be required by Input Service Distributor (ISD), composition dealers and government departments

Memorandum of Association - The legal document describes registered address,distribution of its shares, Company’s constitution,company’s name and name of the shareholders.

Place of Business’ Proof - It is the place where taxpayer business accounts and records are stored. It serves as the central point for conducting business.

Proof of ownership of the premises are-

Electricity Bill

Property tax receipt

Municipal khata

Copy of ownership deed

Lease Agreement or valid rent

Certificate of the Pension - During the process of the GST Registration pension certificate is provided by the retired government officials in special cases.

Passport and Visa Detail - This is applicable in cases where businesses are incorporated outside India. Non-Resident engaged in taxable supply of goods and services in India need to provide visa and passport’s scan copies.

Trade Licences and Clearance Certificates - Clearance certificate and Trade licence issued by the Government of india or by country where business operated. These are applicable when the place of business of an online service provider is not in India.

For the GST Registration Taxpayer has to follow below mention process -

Step 1 - Filling of the Part A of GST REG O1 is done in which details such as name , name of the company, mobile number and email address is entered. With OPT Mobile Number and Email Address is verified and TRN No. is issued.

Step 2 - Filling of the Part B of GST REG O1 is done in which details such as companies permitted signatories and banks are entered. ARN Number is generated after that.

Step 3 - Required documents like Bank statements, Aadhar cards, PAN cards, and other paperwork are uploaded in the required format. Documents

Step 4 - Form and documents are verified by the officier. If he is not satisfied then the officer will issue a show cause notice and the taxpayer will be given 3-4 days to clarify the doubt. According to the authentication of the required documents he will accept and reject the form.

Step 5 - On acceptance in GST REG 06 GST certificate and GSTIN is issued.

GST Registration is not mandatory but it has many benefits as mentioned below -

GST Registration is mandatory for all the taxpayers who become liable to pay taxes.

Professional Utilities helps to get GST Registration at Rs. 1499/-.

Note: The aformentioned Fees is exclusive of GST.

GST Registration is mandatory in the GST Regime. Failure to do so attracts penalties. Even with the voluntary registration firms can get the benefit of the GST Registration. To get GST Registration there are certain documents which are required as per types of the GST Registration. To get GST Registration documents along with the form need to be filled. Get Registration with the Professional Utilities at 749/-

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Some of the documents required -

While registering for the GST Scheme functional current account is used. As a result, there is no GST due on the establishment or operation of a current bank account for the business owner.

Yes, Subject to meeting the requirements outlined in the CGST Act, ITC for GST on bank charges is available. As a result, if you are a regular (registered) taxpayer under the GST, you may claim an ITC for the GST assessed on bank fees.

Speak Directly to our Expert Today

Reliable

Affordable

Assured