Cancellation of GST Registration means that the taxpayer will no longer be able to pay or collect Goods and Services Tax.

The registration under GST can be cancelled for various reasons. The cancellation can be initiated either by the tax officials or the registered taxpayer can apply for the cancellation of the GST Registration.

In case of death of a registered person, the legal heirs can apply for the cancellation.

There is a provision for revocation of the cancellation if the registration is cancelled by the department. We'll cover it in this article.

The registration can be cancelled for three main reasons:

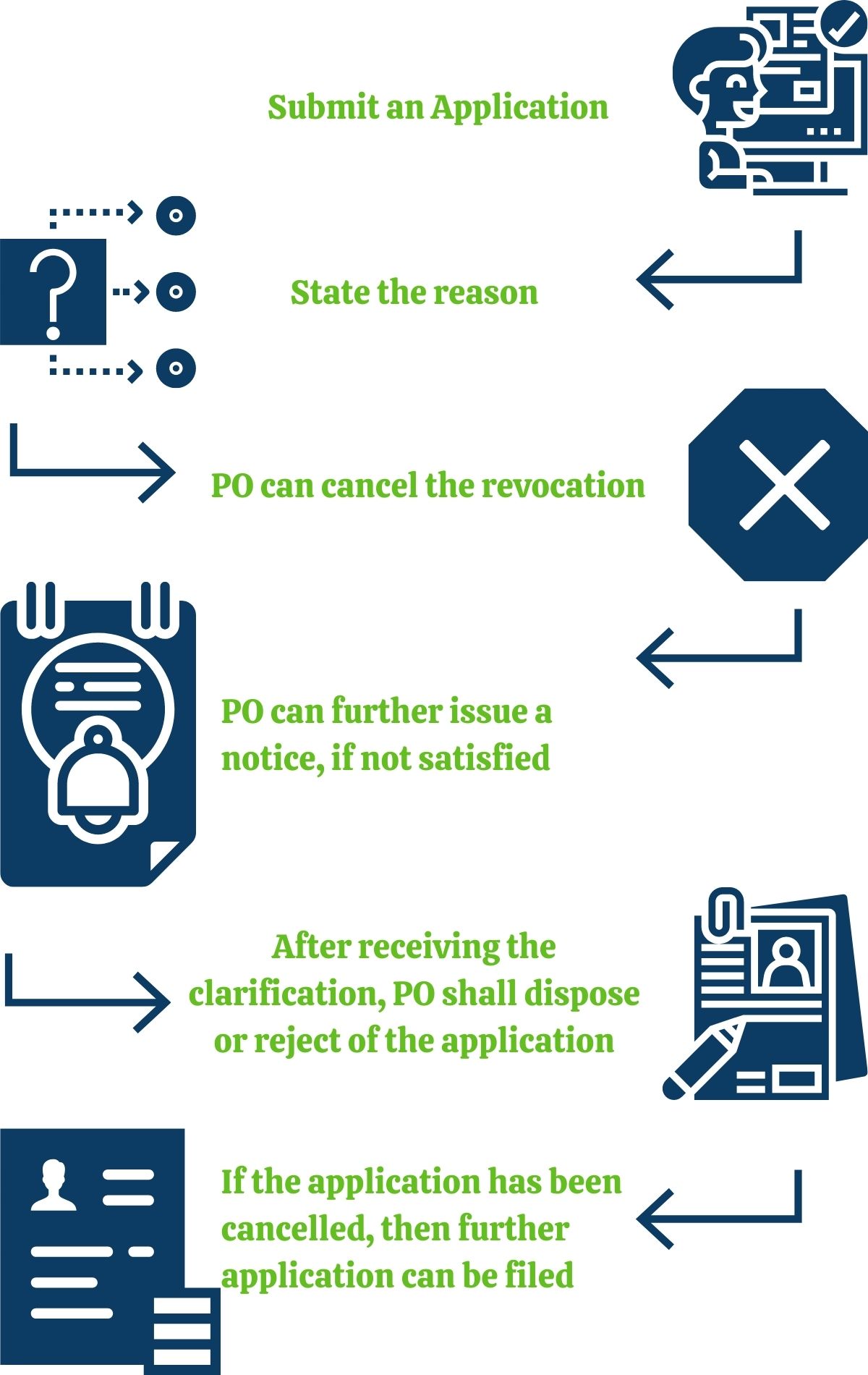

Revocation means official cancellation of a decision. If the GST Registration is cancelled by tax officials on their own motion, then the registered person can apply for the revocation of cancellation of registration within thirty days from the date of cancellation order.