Updated on July 06, 2024 11:04:35 PM

Under certain conditions, GST Registration gets closed. Due to the closure of the GST Registration, taxpayers may not be able to claim input tax credit, file GST Return and GSTIN become ineffective. There are certain conditions that make the taxpayer or the Tax Officer close the GST registration. Everything about the close of the GST Registration is mentioned on this page.

For consultation on any issue related to GST Registration contact Professional Utilities for a solution.

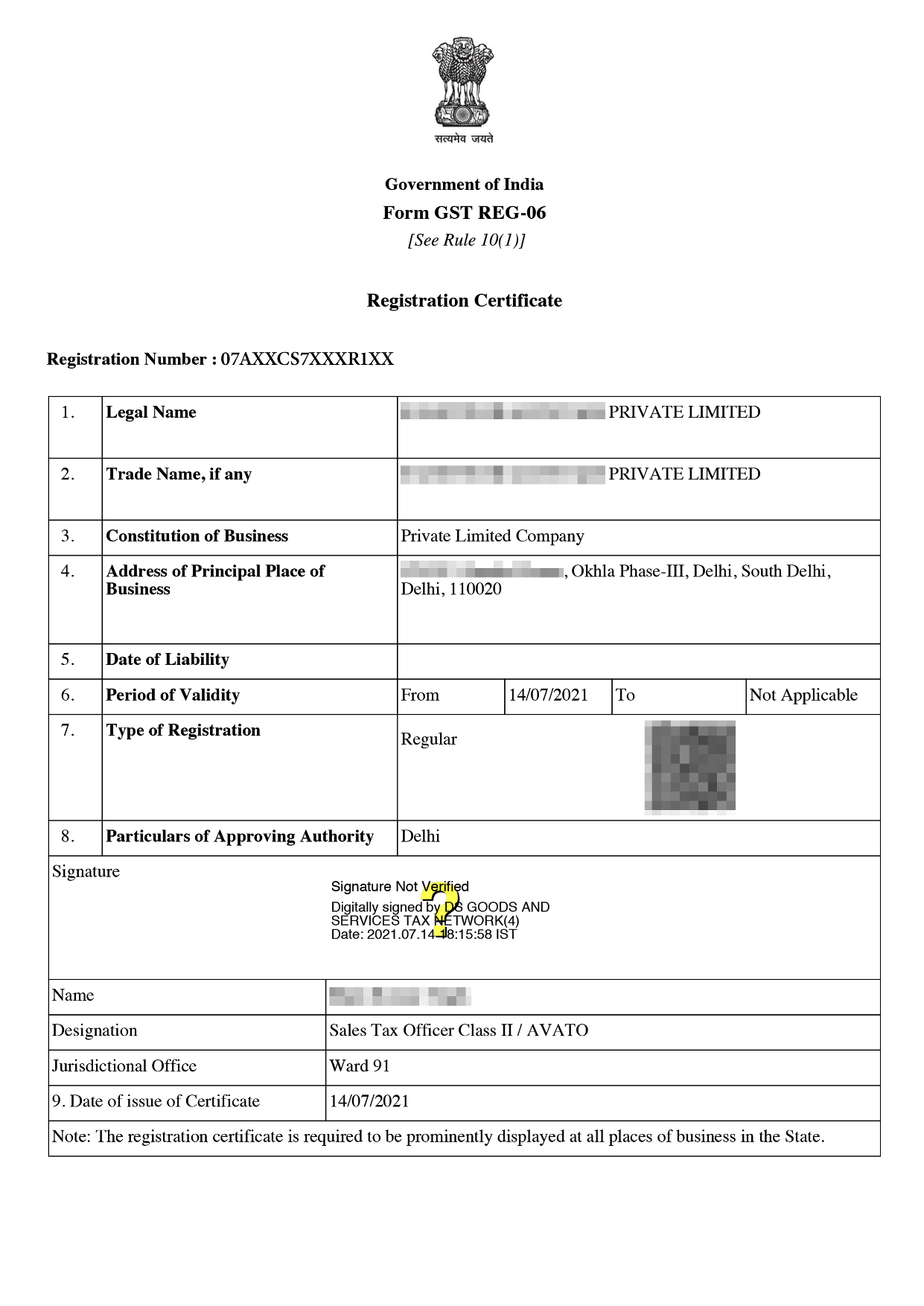

GST Registration Certificate Sample

Due to any circumstances, the taxpayer may close the GST Registration. They can neither collect nor pay the GST or file GST Returns or get the benefit of claiming the input tax credit. Closure of the GST Registration makes GSTIN and GST Number inoperative.

Either Tax Officer or Taxpayer can begin the process of the closure

A registered taxpayer closes the GST Registration according to their will. The request for closure needs to be submitted in Form GST REG-16.

In Form GST REG-19, If the GST Officer is satisfied after evaluating the application, he or she will issue an order to terminate GST registration.

Whenever the tax officer has evidence to support the cancellation. He issues the Show Cause notice in Form GST REG-17 to begin the cancellation procedure. Following are some of the circumstances that trigger the cancellation process:

There are certain documents that need to be submitted for the cancelation of the GST Registration-

There are a few steps to check GST Cancellation status pending processing -

There are certain persons who can not cancel the GST Registration

Any person or entity on the surrender or cancellation of the GST Registration is required to file a Final return in Form GSTR - 10 which is known as Final Return.

Within the date of the cancellation order and the date of the cancellation order whichever is later, final return needs to be filled in form GSTR 10.

The main aim of the Final Return is to make sure that no GST due is pending. Failure on the part of the taxpayer to file the final report in GSTR 10 will get a notice in Form GSTR-3A asking him to file the return in 15 days. If the taxpayer ignores it then steps will be taken to determine the liability of the taxpayer.

Taxpayers may close GST Registration due to any reason like change in constitution, the passing of the director, not being liable to pay tax, discounting of the business, and many others. After filling out the cancellation taxpayer has to clear all its due in GST REG 10. Failure to do so can cause penalties.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

The time taken to cancel GST Registration is 15 days.

It is possible to reinstate the cancelled GST. In Form GST REG-21, a taxpayer who has had their GST registration cancelled by the appropriate officer may request to have it reinstated.

The name of my business is _______ (Business Name) and business address is __________ (Business Address). I beg you to kindly cancel the aforementioned GST number, and I certify that the information provided is accurate; should it turn out that I was mistaken, I will be held accountable.

Speak Directly to our Expert Today

Reliable

Affordable

Assured