Updated on March 22, 2025 03:31:59 PM

The import-export code is a registration code for import-export enterprises that are registered with the Indian Customs Department and specialize in the import and export of goods. The IE Code is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industry, Government of India, in Kochi.

To get the Import Export Code in Kochi., apply to the Directorate General of Foreign Trade, along with the required documents. After submission of the application, the DGFT will issue the entity's IE Code within 15-20 working days. Once you have obtained an IE Code, it is valid for lifetime and does not need to be renewed. The IE code in Kochi. is valid until the business closes.

Unlike GST and PF registrations, IE code registrations do not involve any filing or other compliance requirements.

Thus, once issued, the IE Code Registration is valid forever and does not require renewal. Therefore, most businesses importing or exporting goods and services from India must get an IE code. Most importer merchants are unable to import goods without an IEC code, and exporter merchants are unable to benefit from the DGFT Department's export scheme. Banks require importers' IE Codes when transferring or receiving money abroad, and importers must quote IE codes while clearing customs and sending shipments.

However, running an import-export firm without an IEC code is illegal and can lead to difficulties in clearing goods from ports and completing foreign currency transactions.

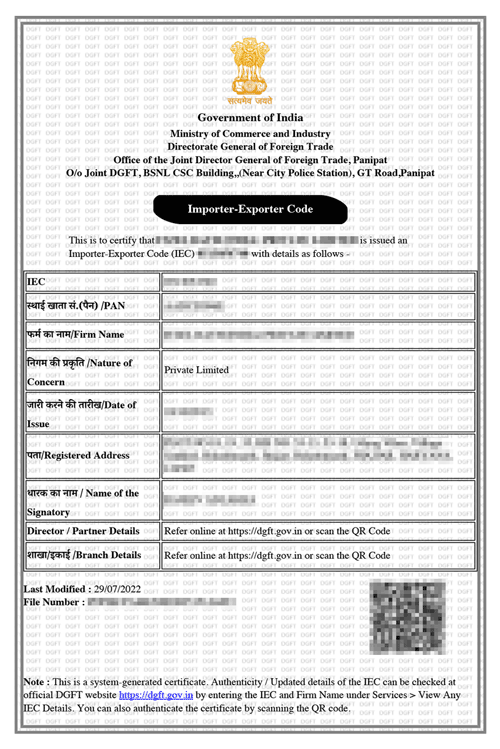

IEC Certificate [Sample]

IEC code is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT) to ease foreign trade in India.

You cannot import or export goods in Kochi without IEC code registration. Once the IEC code is issued, an exporter can apply for port registration on the Ice gate portal with the help of AD Code Registration .

Importer Exporter code is the primary requirement to enter the international market and expand your business. While an IEC code allows you to operate an import-export business in Kochi, it has many additional benefits. Some of them are listed below :

Before beginning the import-export registration procedure in Kochi, it is critical to understand the documentation required to obtain an Import Export Code license online in India. businesses that receive an IEC include sole proprietorships, partnerships, LLPs, private and public limited corporations, trusts, HUFs, and societies.

Any Proprietorship firm, LLP, Company, Trust, HUF or Individual engaged in any of the following foreign trade activities is eligible for obtaining an IEC Code :

You can register for the Importer Exporter code offline as well as online. The online registration process is effortless, and you don’t need to go anywhere. The process is carried out in 5 steps :

The Directorate General of Foreign Trade(DGFT) is an online government portal where you can register for an import-export license. Your first step is to register on this portal.

The second step is the application phase, where all your documents are arranged and prepared for application. Refer to the documents required for better understanding.

An importer/exporter is required to file an online application in ANF 2A(i) and submit the required documents for verification. You also need to pay the government fees to complete the application process.

Once your application is submitted, it is sent to DGFT for verification. In case there is wrong or incomplete information, Your license will be canceled. So, make sure you provide the correct information.

Your IEC code will be issued after the approval by DGFT. In the case of the online application, you will get an e-IEC. Once approved by the competent authority, you will be notified through email or SMS that your e-EIC is available on the DGFT website.

However, it is generally recommended that any person or business that engages in the export or import of goods must obtain an IEC license. Thus, IEC registration is useful in a variety of situations. These are:

Register your import and export business with Professional Utilities to get your IEC Certificate . You get the free consultations and quick service at lowest Price with us.

Apply for IEC code Now

| IEC Registration in Kochi | Fees |

|---|---|

| Government Fees | 500 |

| Professional Fees | 999 |

| Total | ₹1,499 only |

Note: The aforementioned Fees is exclusive of GST.

The Validity of an IEC code is One year . Unlike other government licenses, The Import Export Code was valid for a lifetime. However, after the amendments in Foreign Trade Policy on 12th February 2021, the import-export code has now to be renewed every year.

This amendment made the renewal of Import Export Code details mandatory for every IEC and e-EIC holder. Even if there are no updates in IEC, the same has to be confirmed online on the DGFT portal. Failing to do so may result in your Import Export code deactivation.

The complications in understanding the process and uploading appropriate documents are very hectic. It takes a lot of time and effort. There is a high chance of rejection at each step of document uploading.

We at Professional Utilities understand that completely. That’s why we come forward to help you avoid the hassle and get your Import Export Code registered at the minimum price guaranteed so that you can concentrate on running your business and leave the legal formalities to us.

You can apply for the IEC certificate in just three simple steps with us :

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your IEC registered in 2 working days

To summarize, the Import and Export Code (IEC) is critical for organizations involved in international trade. This will provide you access to global marketplaces and facilitate cross-border transactions. Registering with the IEC allows businesses to simply manage customs procedures, expand their reach, and capitalize on global opportunities. This period is critical for encouraging growth, ensuring compliance, and laying a solid basis in the dynamic world of international trade.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

DGFT(Directorate General of Foreign Trade) issues and updates the Import Export code.

At professional Utilities, It takes less than 3 days for the complete procedure of obtaining an IEC code.

Documents required for Import Export Code registration in Kochi are as follows :

No, You can not do any import/export without the IEC code. Your goods will not be allowed to pass the ports without an IEC code. However, it is not required to import or export goods for personal use.

Speak Directly to our Expert Today

Reliable

Affordable

Assured