Updated on April 08, 2025 04:55:47 PM

Import Export Code registration in Tamil Nadu is required to operate import-export business. You cannot import or export goods in Tamil Nadu without IEC code registration. IEC is issued by the Directorate General of Foreign Trade (DGFT) to ease the foreign trade in India.

Tamil Nadu is the home for Various export-oriented manufacturers. It is the prime exporter of textiles, garments and electronic hardwares. If you want to become a certified exporter in Tamil Nadu, you will definitely need an Import export code.

However, If an individual is importing or exporting goods for personal use and is not involved in any commercial trade are exempted from having an Import Export code as per the foreign trade policy.

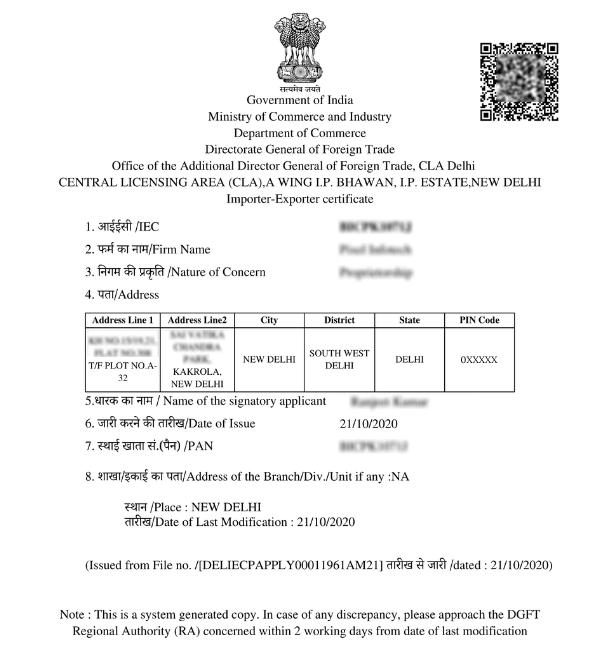

IEC Certificate in Tamil Nadu [Sample]

Table of Content

While an IEC code allows you to operate import-export business in Tamil Nadu, It comes with some additional benefits. Let’s take a look at how obtaining an IEC code will help your import export business :

The IEC code facilitates your overseas trade and legalizes your import and export business. It makes your trade across borders easy and legal.

EFT is a new service offered to exporters that allows them to pay the license fee online via the internet rather than visiting a bank to make the payment.

Register your import and export business with Professional Utilities to get your IEC Certificate . You get the free consultations and quick service at lowest Price with us.

Apply for IEC code Now

Any Proprietorship firm, LLP, Company, Trust, LUF or Individual engaged in any of the following foreign trade activities is eligible for obtaining an IEC Code :

Following documents are required for IEC registration in Tamil Nadu:

You can register for the Importer Exporter code offline as well as online. The online registration process is effortless, and you don’t need to go anywhere. The process is carried out in 5 steps :

Directorate General of foreign Trade(DGFT) is an online government portal where you can register for the import export license in Tamil Nadu. Your first step is to register on this portal.

The second step is the application phase where all your documents are arranged and prepared for application. Refer to the documents required for better understanding.

An importer/exporter is required to file an online application in ANF 2A(i) and submit the required documents for verification. You also need to pay the government fees to complete the application process.

Once your application is submitted, it is sent to DGFT for verification. In case there is wrong or incomplete information, Your license will be canceled. So, make sure you provide correct information.

Your IEC code will be issued after the approval by DGFT. In case of online application you will get e-IEC. Once approved by competent authority, you will be notified through email or SMS that your e-EIC is available on the DGFT website.

Import Export License registration fees include the government fees and professional fees. It also includes the ANF 2A form and filling at DGFT. The fees break up are as follows

| IEC Registration | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 only |

Unlike other government licenses, The Import Export Code was not required to be renewed and was valid for a lifetime. However, after the amendments in the Import Export code related provisions under chapter 1 and Chapter 2 of Foreign Trade Policy on 12th February 2021, the IEC code has now to be renewed every year

This amendment made the renewal of Import Export Code details mandatory for every IEC and e-EIC holder. Even if there are no updates in IEC, the same has to be confirmed online on the DGFT portal. Failing to do so may result in the deactivation of your Import Export code.

The complications in understanding the process and providing appropriate documents are very much hectic. There is a high chance of rejection of the application at each step of document uploading. There are different standards of Digital Signature certificates (DSC) that must be uploaded.

We at Professional Utilities understand completely. That’s why we come forward to help you avoid the hassle and get your Import Export Code done at the minimum price guaranteed. So that you can focus on what you do the best…..Your Business.

You can apply for IEC registration in just three simple steps with us.

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your IEC registered in 2 working days

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions

There is no need to incorporate GST details in the IEC code registration.

DGFT(Directorate General of Foreign Trade) issues and updates the Import Export code.

Yes, Any individual proprietor who is willing to start international trade is eligible for obtaining the Import/Export Code.

Speak Directly to our Expert Today

Reliable

Affordable

Assured