Updated on April 09, 2025 05:58:38 PM

E-commerce platforms and firms must follow the LMPC Certificate standards to provide transparency and consumer protection. For all applicable pre-packaged items offered on their platforms, companies must make disclosures that are consistent with the information on the product's label. The LMPC Certificate for E-commerce comprises product weight, dimensions, production date, maximum retail price (MRP), and other information required by the Legal Metrology Packaged Commodity Rules.

According to Rule 19 of the LMPC rules, e-commerce companies are considered packers if they pack items in their own materials before delivering them to clients. The LMPC Certificate for E-commerce puts particular requirements on e-commerce businesses to meet the same criteria as traditional packers. They must verify that the labeling, packaging, and disclosures adhere with the LMPC rules.

Noncompliance with the LMPC Certificate requirements may result in fines, legal action, or operational interruption. The LMPC Certificate for e-commerce not only enforces conformity but also protects fair trade practices, which fosters consumer trust by protecting their rights. By following these requirements, e-commerce enterprises demonstrate their dedication to preserving openness, accuracy, and ethical procedures, building a favorable market reputation while fulfilling the legal duties of the LMPC Certificate.

-.png)

-.png)

Table of Content

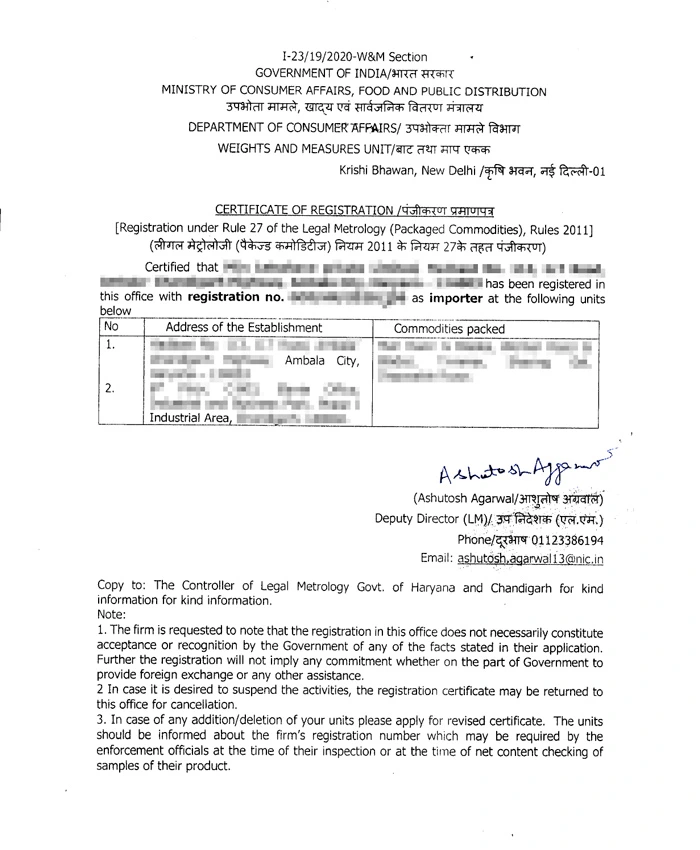

The LMPC Certificate for E-Commerce Sellers is for businesses who offer pre-packaged items on online marketplaces. The Legal Metrology Packaged Commodity Rules require vendors to make accurate claims about product attributes that are identical to those stated on the product label. The LMPC Certificate for E-Commerce comprises information such as weight, dimensions, production date, MRP, and other parameters.LMPC Certificate The provides openness and conformity with legal obligations, therefore safeguarding consumer rights. E-commerce merchants must follow these guidelines to preserve confidence and avoid fines. The LMPC Certificate promotes fair trade practices and ensures that customers obtain accurate information about the items they buy online.

Here are the documents required for obtaining an LMPC registration certificate.

Below mentioned steps need to be followed to get the LMPC Certificate -

There are different declarations that need to be made on all the pre-packed goods as mentioned below -

Further changes are amended as mentioned below -

For LMPC Registration the government fee is ₹500 and the professional fee is ₹4,999/-. LMPC Certificate is granted after inspection by the registration authorities. It takes 7-10 days to complete the process.

Below mentioned LMPC Certificate fee for the Manufacturer, Importer, Packer

| Particulars | LMPC Certificate Fee |

|---|---|

| Government Fees | ₹500 |

| Professional fees | ₹4,999 |

| Total Cost | ₹5,499 |

| On Urgent Basis | ₹9,999 |

There are various benefits of the LMPC Certificate for E-commerce as mentioned below -

The validity period for an LMPC Certificate is a minimum of 1 year (12 months) to a maximum of 5 years (60 months). Renewal of LMPC Certificate is required after every five years or after expiration of specified time period since its issuance. The LMPC import license must be renewed before the expiry period to avoid hassle and penalties during customs clearance.

There are certain exemptions to the LMPC Rules for E-Commerce as mentioned below -

Conclusion

The Legal Metrology Rule 2011 requires that laws apply for LMPC Certificate for E-Commerce industry to provide transparency and consumer protection. Every e-commerce platform must disclose vital product facts such as the sales price, net amount, manufacturer's name and address, importer information, and manufacturer's location. Because customers cannot physically inspect product labels on online platforms, merchants, dealers, and manufacturers are responsible for providing correct declarations. The LMPC Certificate for E-Commerce guarantees that buyers obtain accurate and trustworthy product information prior to purchase. Compliance with these regulations fosters trust, supports fair trading practices, and helps to defend consumer rights in the digital economy with LMPC Certificate for E-Commerce.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Frequently Asked Questions

E-Commerce entity means a company incorporated under the Companies Act, 1956 or the Companies Act, 2013 or a foreign company covered under section 2 (42) of the Companies Act, 2013 or an office, branch, or agency in India as provided in Section 2 (v) (iii) of FEMA 1999, owned or controlled by a person resident outside.

E-commerce is valid if there is lawful consideration involved in contact and there is free consent of the parties.

Various examples of E-commerce are Olx, Amazon, Shopify, Quikr, Flipkart, Myntra, eBay etc.

Speak Directly to our Expert Today

Reliable

Affordable

Assured