Updated on April 17, 2025 01:45:23 PM

GST Registration in lakshadweep is one of the ways which benefit both government as well as taxpayer. It leads to the development of the economy. By getting GST Registration in Lakshadweep taxpayers can get the benefit of increasing the efficiency of logistics, increase in profit of the firm, less compliances in the tax regime. By reading the page mentioned beneath will help you to get complete knowledge about the GST Registration.

Contact Professional Utilities to get GST Registration in a smooth and hassle -free manner .

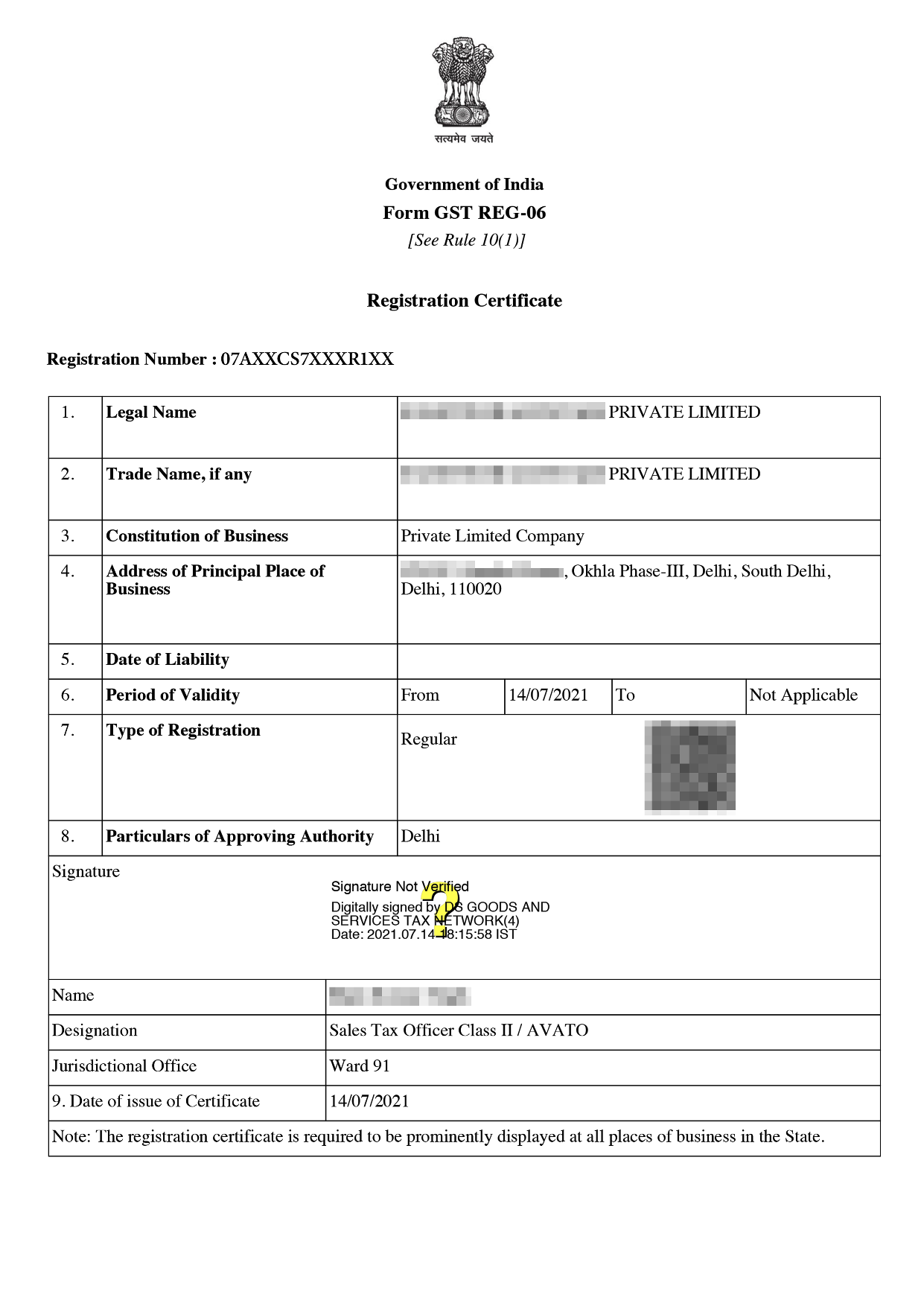

Online GST Registration Sample

Table of Content

GST Registration is to register under the GST Act and to receive a unique GSTIN. GST Registration has to be obtained only if it exceeds the limit of 40 lakhs in case of supply of the goods and 20 lakhs in case of supply of services.

Registration of the taxpayer will depend on the activities they are engaged in. Different types of registration are mentioned below -

Documents for HUF

Documents for Partnership firm/LLP

Documents for Proprietorship/Individual

Documents for Club or society

Documents for Sole Proprietorship/Individual

The cost of GST registration in lakshadweep is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

The following is a list of the actions that must be completed in order to register for GST:

There are many benefit of the GST Registration in Lakshadweep as mentioned below -

Conclusion

GST Registration in lakshadweep is implemented with the aim of promoting the development of the economy. With GST Registration, taxpayers can avail input tax credit and collect GST from the recipient of goods and services. With implementation of the GST Registration profit of the taxpayer increases, price of the product reduces, efficiency of the logistics increases.

To register under GST and avail the benefits. Taxpayers are required to fill the form, submit required documents and after verification by the officer get GST Registration.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisations who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services.

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today

Reliable

Affordable

Assured