Updated on January 16, 2025 11:06:32 AM

If you operate a business in Noida It's critical to comprehend the GST registration procedure. In order to replace numerous indirect taxes, India has established the Goods and Services Tax (GST), a value-added tax. Businesses with an annual turnover of more than Rs. 40 lakh must register for GST.

This page will give you insight into all the required information related to GST Registration in Noida. GST registration will not only help in filing of return , collecting and submitting tax to the government but also increase credibility of the businesses and income of the government which in turn helps in Country development.

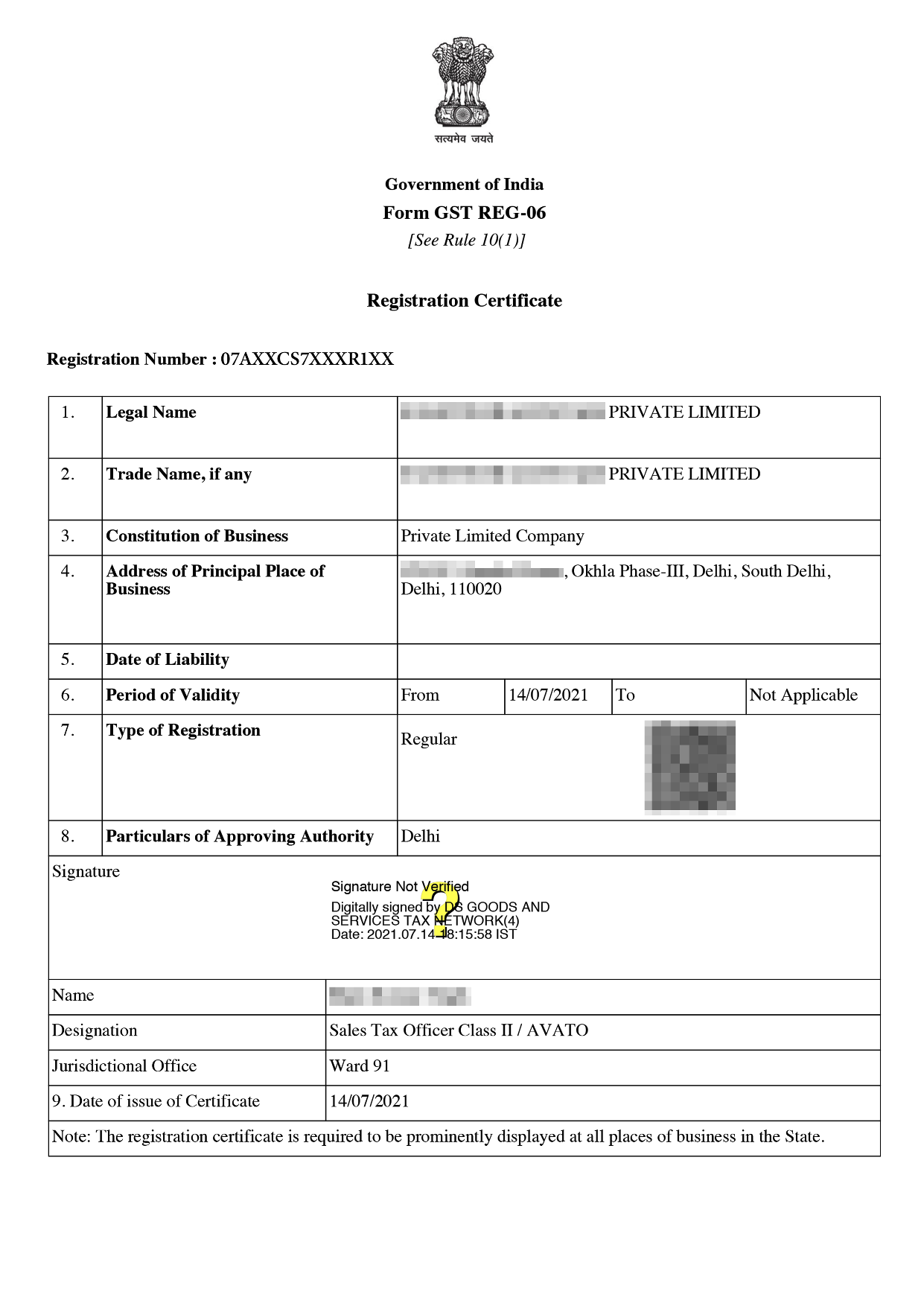

Online GST Registration Sample

GST Registration is to get registered under the GST regime which is mandatory for all the parties whose aggregate turnover is more than 40 lakhs and 20 lakhs in case of services. By getting GST registration in Noida brings many benefits as well as ensures safe taxation.

In implementation of the GST registration plays an important role and also compliance of tax in the economy is certified. As features of the GST registration in Noida with the help of the registration process tax payers are identified.

The activities that the taxpayer engages in will decide whether or not they are required to register for GST.

Documents required for Proprietorship -

Documents required for HUF -

Documents required for LLP or for Partnership Firm:

Documents required for Private Limited Company:

The cost of GST registration in Noida is just ₹1499/- only with Professional Utilities.

Following are the charges of Gst registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

There are many features of the GST Registration in Noida:

GST registration in Noida is a simple process which involves few steps and is quick. Various steps involved in the GST registration are mentioned below -

There are many features of the GST Registration in Noida:

There are many benefits of GST registration in Noida as mentioned below -

GST Registration in noida is compulsory for any business having turnover exceeding 40 lakhs. Failure to do so can lead to many legal and other penalties. Registration under GST is an easy process in Noida.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

Consumption tax or Destination Tax is a kind of tax which is levied on goods and services where they are consumed. Under this taxation imports are taxed on par with domestic sphere and exports are considered as nil tax amount.

Digital Signature or DSC is required in registration of the LLP, Limited Company etc and not required in case of Partnership firm or proprietorship firm.

Principal Place of Business is the primary location of taxpayer’s business that is performed within the state. It is generally addressed where top management or head of the firm is located and where books of accounts and records are kept.

Whereas Additional Place of Business where in addition to place of business other business related activities are carry out within the state

Yes

Speak Directly to our Expert Today

Reliable

Affordable

Assured