Updated on April 09, 2025 05:58:38 PM

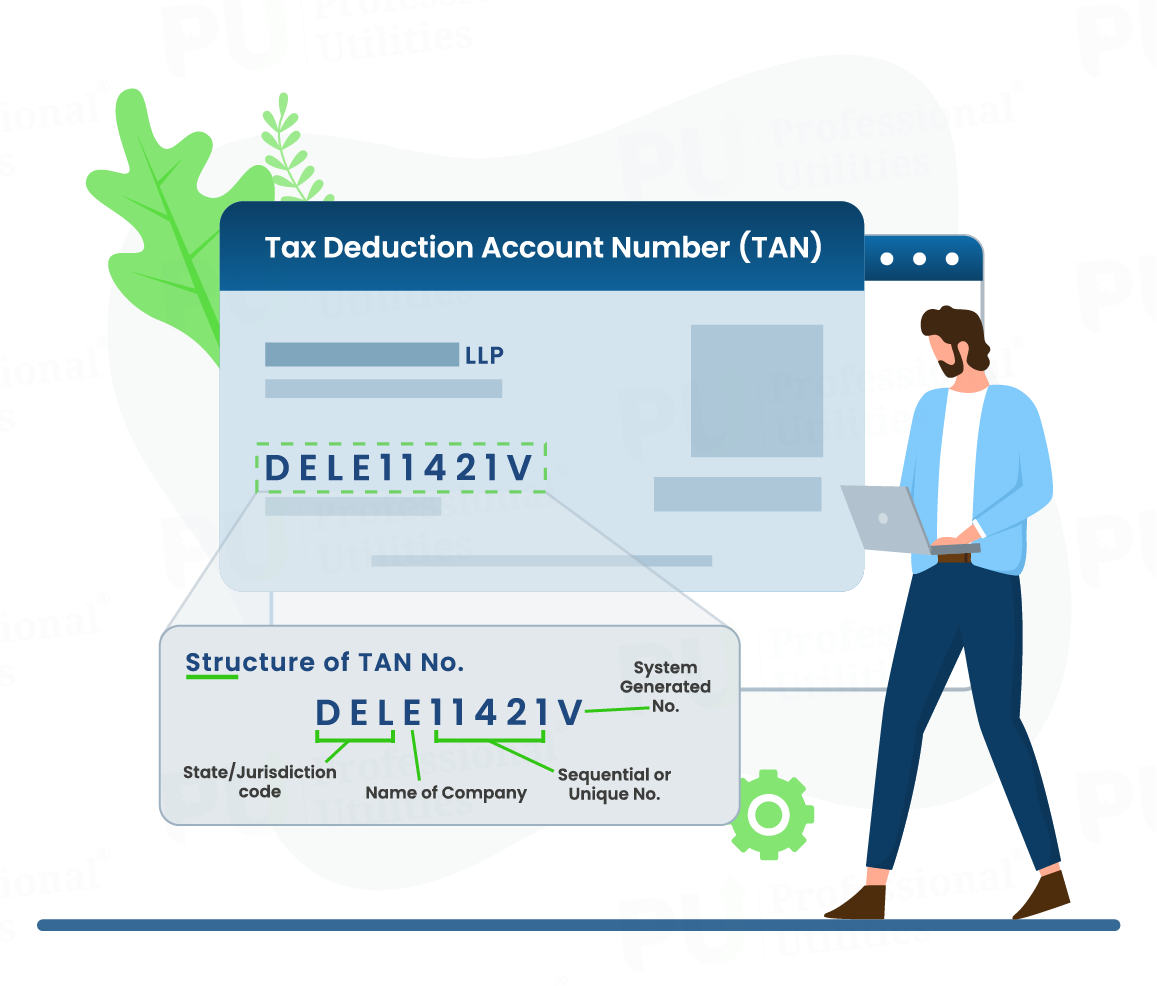

According to the section 203A of Income Tax Act 1961,every person who is liable to collect or deduct tax at source on behalf of government must apply for TAN Registration. TAN Registration can be done online or offline which we will discuss later. Tax Deduction Account Number or Tax Collection Account Number is a 10 digits specified number issued by the Income Tax Department consists of both alphabets and numbers which tells the TAN jurisdiction code, category of TAN number holder i.e whether it is an individual,an Organisation or any other Entity.

TAN Number Sample Document

TAN stands for Tax deduction Account Number or Tax collection Account Number issued by Income Tax Department.It is 10 digit alpha numeric number.

Every Assessee liable to deduct TDS is required to apply for TAN and shall quote this number in all TDS Returns, TDS payments and any other communications regarding TDS with Income Tax Department.

It is compulsory to quote TAN in TDS / TCS return (including any e-TDS / TCS return), any TDS / TCS payment challan and TDS/TCS certificates.

NOTE:Any entity whether an individual, Company, Trusts, Partnership Firms etc can only hold one TAN number.

TAN number smoothens the working of an entity or an individual by complying with the laws of TAN regulations, legal transactions, timely tax payments etc.

The most important benefit for the TAN holders is that it doesn’t need to be renewed again monthly,quarterly or yearly as it is a one time process.

TAN Registration ensures compliance with the provisions of the Income Tax Act, as it is mandatory for entities responsible for deducting or collecting taxes at source. After obtaining TAN, individuals or entities fulfill their legal obligations and avoid any potential penalties or consequences for non-compliance.

TAN Registration also complies the holders to collect and deduct tax at source and remit them legally in the eyes of law.

There is no requirement of minimum paid-up capital for the Section 8 Company registration.

After obtaining TAX number, holders credibility increases in the eyes of their customers.

Following is the process to apply for Online TAN Registration:

NOTE:Get Professionals consultancy for a smooth registration process at Professional Utilities.

When applying for TAN Registration there are certain documents that are needed as per Section 114(4) of Income Tax Rules,1962 at the time of application which are further discuss as follows:

Documents such as aadhar card,PAN card,Passport are required for the identity proof and same can be for the address proof including electricity bill of an individual or company or registration certificates.

Birth certificate, Transfer certificate or even aadhar card can be used as a proof of DOB in cse of an individual. However, in case of a Company it may require a copy of certificate of incorporation, memorandum of association, articles of association or any other document depend on the type of entity.

Recent passport-sized photographs of the applicants should be submitted along with the application form.

NOTE:If any minor wants to apply then the documents of his/her parents above mentioned documents work as the proof of identity and address of applicant.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

TAN Registration is mandatory for the Individuals, Business entities, Trusts, LLP’s etc who are liable to deduct or collect taxes.

Tax deduction at source happens at different rates based on the transaction. TDS rate for salary is determined based on the employees’ salary and tax payable by the employee.

The tax rate varies depending on the type of transaction. A rate of 10% is applicable for deducting TDS on rent of land, building or furniture if rent for entire year exceeds Rs 1,80,000. See a complete list of TDS rate.

15th of every July, October, January, and May are the due dates for filing quarterly TDS return. Any delay in furnishing your return will result in a penalty of Rs 200 per day not exceeding the total amount of TDS for the quarter.

If tax registration is not obtained then a penalty Rs 5000 Rs 200 a day, whichever is higher may be attracted.

Speak Directly to our Expert Today

Reliable

Affordable

Assured