Updated on March 20, 2025 01:22:55 PM

Section 8 Company is a type of non-profit organization in India that is established for promoting social welfare, art, science, education, charity, religion, or any other useful object. It is regulated under Section 8 of the Companies Act, 2013, which provides for the incorporation of companies with charitable or not-for-profit objectives. Read the complete page to know everything about the Section 8 Company registration process along with registration fees state wise.

At Professional Utilities, Our Team of experts will help you register your Section 8 company in a seamless manner without you being worried about the documents and registration process. We will take care of all the documents and registration requirements and do the incorporation in the most efficient way due to our years of experience in Company incorporation.

Complete Registration process of Section 8 company can take around 10-15 days of time which is subject to documents processing and verification by the Government.

Section 8 Company Sample Documents

The main objective of a Section 8 company is to promote social welfare, and any profits generated by the company must be used for the furtherance of its objectives, and not for the benefit of its members or shareholders. It enjoys tax exemptions, and the donors to such companies also enjoy tax benefits under the Indian Income Tax Act.

The registration process of Section 8 Company includes submission of relevant documents such as identity proof, address proof, MoA and AoA duly signed by the subscribers of the company, as well as required registration fees state wise. All the legitimate documents must be submitted by the shareholders of the company in the due course on the MCA Portal. Given below is the complete registration process of Section 8 companies state wise in India.

Here you will get to know about the complete Registration Process of a Section 8 Company in India. You need to follow all the steps carefully to get your Section 8 company incorporated within a few days.

The registration process of section 8 company begins with the application of Digital Signature Certificates. A DSC or Digital Signature Certificate is a type of certificate which works as a proof of identity for signing online forms or used in the company registration process. Application process of DSC is completely online and it can be availed from the concerned authorities within 24 hours of application. Once the DSC is received, Form DIR-3 is to be filed with ROC for getting a DIN( Directors Information Number).

To register a section 8 company, a unique name has to be approved by the concerned authority and the process of checking the name availability is completely online through a web application called Reserve Unique Name(RUN), introduced by the Ministry of Corporate Affairs to reserve a unique name for your Section 8 Company.

While reserving a name for a section 8 company, you must keep in mind that you do not include suffixes like Pvt Ltd, Ltd, Public Ltd etc. you can include terms like foundation, federation, council, confederation and many more. You can also use our Name Search tool to check for the name availability.

To register a Section 8 Company, you need to then fill Form INC-12 and submit it to the registrar of the company. This is a very important step as before getting a certificate of incorporation, you need to get License from the Ministry of Corporate Affairs under Section( 1 ) of the Companies Act, 2013. Post approval of the Form from the ministry, ROC will issue a 6 digit Section 8 license number.

The next step after getting DSC, and Section 8 company license, is to file a SPICe form, which is a proforma for getting your Section 8 company incorporated online. The details in the form are given below:

The SPICe, eMoA, and eAoA are important forms which are required to be filed while applying for the Section 8 company incorporation. MoA is defined under Section 2(56) of the Companies Act, 2013 and MoA defines the powers and objectives of any company whereas AoA is defined under Section 2(5) of the Companies Act, 2013 in which internal structure and rules and regulations of the management is defined.

After approval of the aforementioned documents from the concerned ministry, a PAN, TAN and Certificate of Incorporation will be issued by the Ministry of Corporate Affairs. Then the company needs to open a current bank Account for the company within 2 months of getting the incorporation certificate.

Read this - NGO Registration Complete Process and Fees

To register a Section 8 company, you need to submit certain documents on the MCA portal by adhering to all the guidelines by the concerned ministry. Given below is the list of documents required for Section 8 company registration in India statewise:

Also Read -Documents Required for Section 8 company registration

After successful registration of a section 8 company, you will be provided with the following documents.

Certificate of Incorporation Sample

Section 8 Company Sample Documents

PAN Card Sample Documents

TAN Sample Documents

AoA Certificate Sample Documents

MoA Certificate Sample Documents

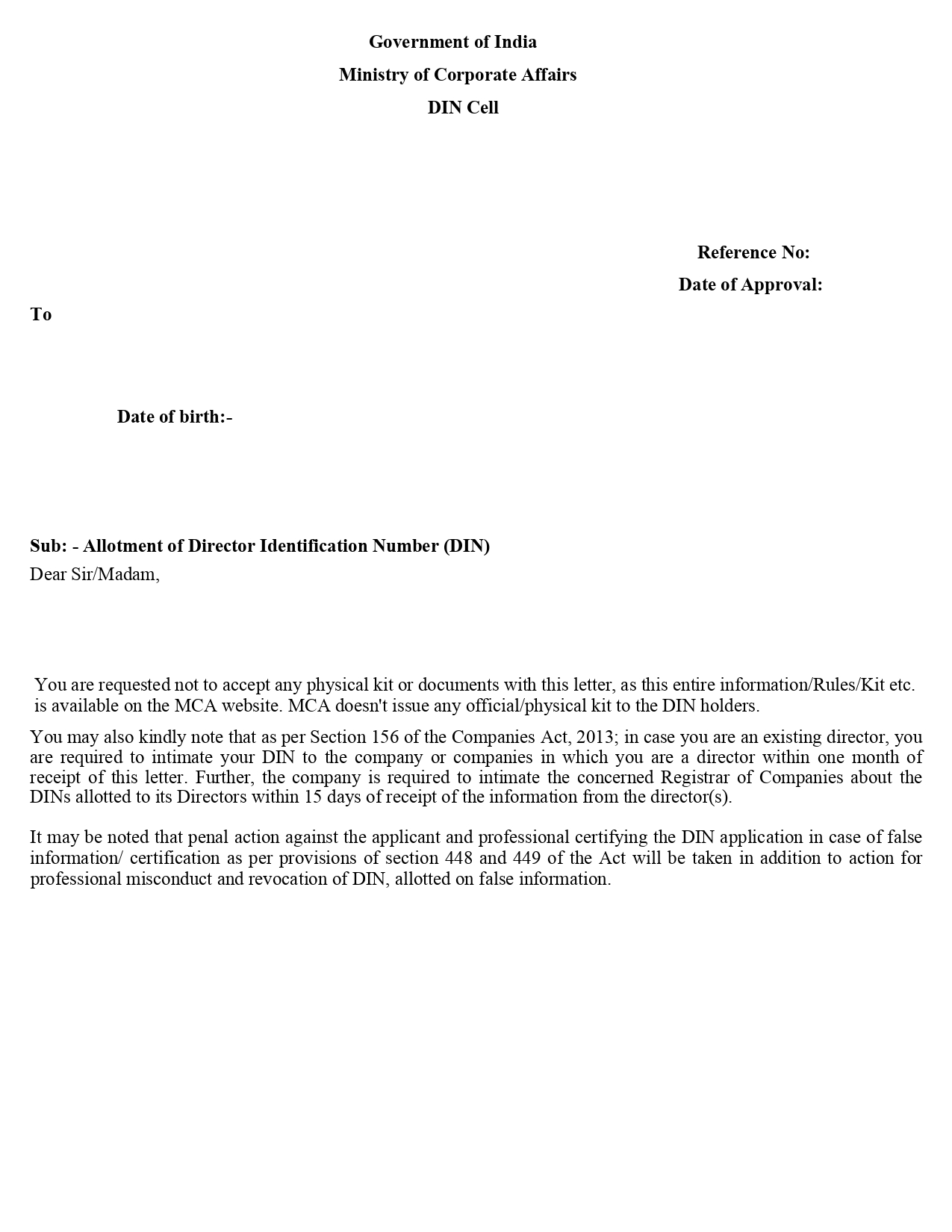

DIN Certificate Sample Documents

DSC Sample Documents

EPFO Certificate Sample Documents

Master data Sample Documents

| Section 8 Company Registration State Wise | Registration Fees |

|---|---|

| ✅ Andhra Pradesh | ₹10,999 |

| ✅ Arunachal Pradesh | ₹9,499 |

| ✅ Assam | ₹9,499 |

| ✅ Bihar | ₹9,499 |

| ✅ Chhattisgarh | ₹9,499 |

| ✅ Dadra & Nagar Haveli | ₹9,499 |

| ✅ Daman & Diu | ₹9,499 |

| ✅ Delhi | ₹9,499 |

| ✅ Goa | ₹9,499 |

| ✅ Gujarat | ₹9,499 |

| ✅ Haryana | ₹9,499 |

| ✅ Himachal Pradesh | ₹9,499 |

| ✅ Jammu & Kashmir | ₹9,499 |

| ✅ Jharkhand | ₹9,499 |

| ✅ Karnataka | ₹17,999 |

| ✅ Kerala | ₹12,499 |

| ✅ Ladakh | ₹9,499 |

| Section 8 Company Registration State Wise | Registration Fees |

|---|---|

| ✅ Madhya Pradesh | ₹17,499 |

| ✅ Maharashtra | ₹9,499 |

| ✅ Manipur | ₹9,499 |

| ✅ Meghalaya | ₹9,499 |

| ✅ Mizoram | ₹9,499 |

| ✅ Nagaland | ₹9,499 |

| ✅ Odisha | ₹9,499 |

| ✅ Puducherry | ₹9,499 |

| ✅ Punjab | ₹9,499 |

| ✅ Rajasthan | ₹12,499 |

| ✅ Sikkim | ₹9,499 |

| ✅ Tamil Nadu | ₹9,499 |

| ✅ Telangana | ₹10,999 |

| ✅ Tripura | ₹9,499 |

| ✅ Uttarakhand | ₹9,499 |

| ✅ Uttar Pradesh | ₹9,499 |

| ✅ West Bengal | ₹9,499 |

Note - The above mentioned state wise registration fees includes registration for 2 members with minimum Authorised capital of Rs 1,00,000, DSC, Government Fees(Stamp Duty) and Professional fees. The fees may vary if the number of members or Capital is increased or decreased.

To register a Section 8 Company, we need to submit all the relevant documents along with the stamp duty or Govt Fees on the MCA Portal and it usually takes around 7-10 working days. You can read about all the documents and fees required statewise from the above information.

In the final words we would like to assert that you can get your Section 8 company incorporated with us at a very minimum cost and become a Founder of your dream company very soon. We have shared a table showing the Registration fees of a Section 8 company Statewise in India.

Contact us to get your Incorporation Certificate soon. You are just a click away from your Dream company Incorporation.

Related Reads:

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

The registration fees for Section 8 companies in Delhi is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Madhya pradesh is Rs 12,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Bangalore is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Uttar Pradesh is Rs 5,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Mumbai is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Chandigarh is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Pune is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

The registration fees for Section 8 companies in Pune is Rs 4,999 for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.