| Return Type | |

|---|---|

| Period | |

| Turnover | |

| Delay (Days) | |

| CGST Late Fee | ₹ 0 |

| SGST Late Fee | ₹ 0 |

| Total Late Fee | ₹ 0 |

General Rules for Late Fee Calculation:

Interest on Late Payment of GST:

Note: Late fee rules are subject to change by government notification. Please refer to the official GST portal for the latest updates.

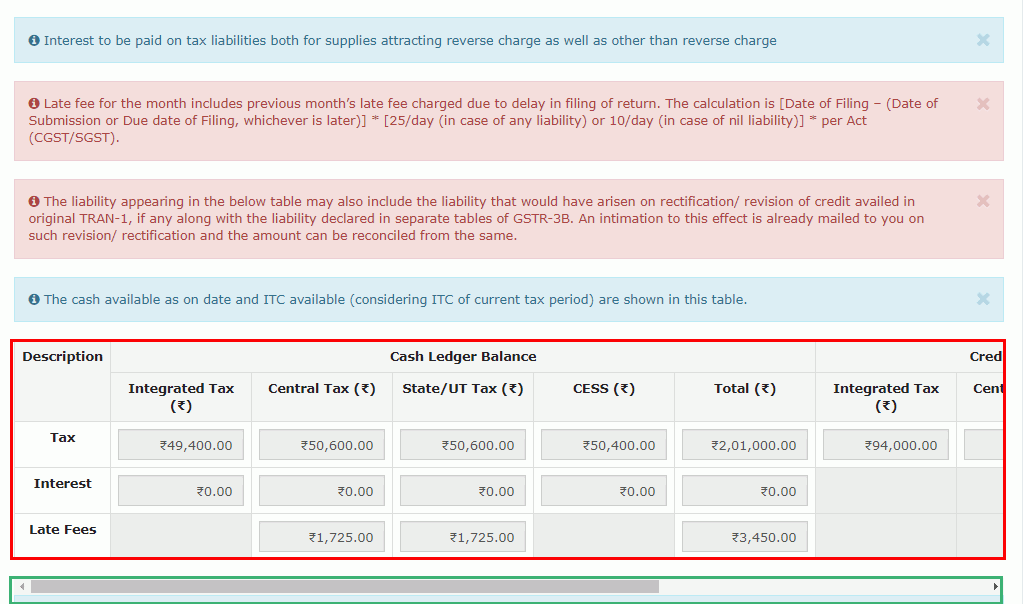

Amount of Late fee applicable will automatically be calculated by the GST portal while submitting the GST returns.

The Late fee is paid in cash separately for CGST, SGST and IGST in separate electronic cash ledgers. GST return cannot be filed without the payment of the Late fee.

Late fee for the month includes previous month’s late fee charged due to delay in filing of the return. Also, non-payment or late payment of GST attracts Interest.

| Return Type | Nil Return Late Fee | Regular Return Late Fee | Maximum Late Fee Cap |

|---|---|---|---|

| GSTR-1 | ₹10 per day (₹5 CGST + ₹5 SGST) | ₹50 per day (₹25 CGST + ₹25 SGST) | ₹10,000 (₹5,000 CGST + ₹5,000 SGST) |

| GSTR-3B | ₹20 per day (₹10 CGST + ₹10 SGST) | ₹50 per day (₹25 CGST + ₹25 SGST) | ₹10,000 (₹5,000 CGST + ₹5,000 SGST) |

| GSTR-4 | ₹10 per day (₹5 CGST + ₹5 SGST) | ₹50 per day (₹25 CGST + ₹25 SGST) | ₹5,000 (₹2,500 CGST + ₹2,500 SGST) |

| GSTR-9 | Not Applicable | ₹200 per day (₹100 CGST + ₹100 SGST) | ₹10,000 (₹5,000 CGST + ₹5,000 SGST) |

**Note**: For taxpayers with nil tax liability, reduced late fees apply as shown in the table above.

The maximum late fee for filing GSTR-1 is ₹10,000 (₹5,000 CGST + ₹5,000 SGST). This cap applies regardless of how many days the return is delayed, providing some protection against excessive penalties for very late filings.

Yes, GST late fees can sometimes be waived or reduced through amnesty schemes announced by the GST Council. These waivers are typically announced for specific periods and may have eligibility criteria based on taxpayer category, turnover, or other factors.

For nil returns (where no tax liability exists), a reduced late fee applies. For GSTR-1, it's ₹10 per day (₹5 CGST + ₹5 SGST), for GSTR-3B, it's ₹20 per day (₹10 CGST + ₹10 SGST), and for GSTR-4, it's ₹10 per day (₹5 CGST + ₹5 SGST), all subject to their respective maximum caps.

Yes, late fee is applicable even if there is no tax liability for the period. Filing returns on time is a compliance requirement regardless of whether you have any tax to pay. However, nil returns typically have a reduced late fee structure compared to regular returns.

Late fee is a penalty for delayed filing of returns, while interest (currently 18% per annum) is charged on delayed payment of tax. The late fee has fixed daily rates with maximum caps, while interest accumulates based on the tax amount and has no upper limit.

No, late fees must be paid through cash only. You cannot use input tax credit (ITC) to offset or pay late fees. The payment must be made to the respective electronic cash ledgers for CGST, SGST, and IGST separately.

If you don't pay the applicable late fee, you won't be able to file the pending GST return. The GST portal automatically calculates the late fee and requires payment before allowing the return to be filed. Continued non-filing can lead to further penalties, notices from tax authorities, and potential legal consequences.

Yes, small businesses with annual turnover up to ₹1.5 crore often receive special considerations in late fee amnesty schemes. Additionally, the government sometimes announces targeted relief measures for small taxpayers. These provisions can include reduced late fees or extended deadlines.

You can check your late fee liability by logging into the GST portal and attempting to file the pending return. The system will automatically calculate and display the applicable late fee. Alternatively, you can use our GST Late Fee Calculator to get an estimate before accessing the GST portal.

Yes, late fees continue to accumulate until you file the return. If you calculate the late fee today but file the return several days later, additional late fees will apply for those extra days, up to the maximum cap for that return type.

At Professional Utilities, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.