Updated on July 06, 2024 06:26:32 PM

GST Registration in Bihar has many benefits such as increase in the income of the government to increase the welfare of the society. By getting GST Registration firm credibility increased , cost of the product decreased,increasing the profit of the business, increase in efficiency of logistics and many others. This page will give full detail about the GST registration Process, its fee and benefits.

Get GST Registration in Bihar with the help of Professional Utilities in a smooth and effortless manner.

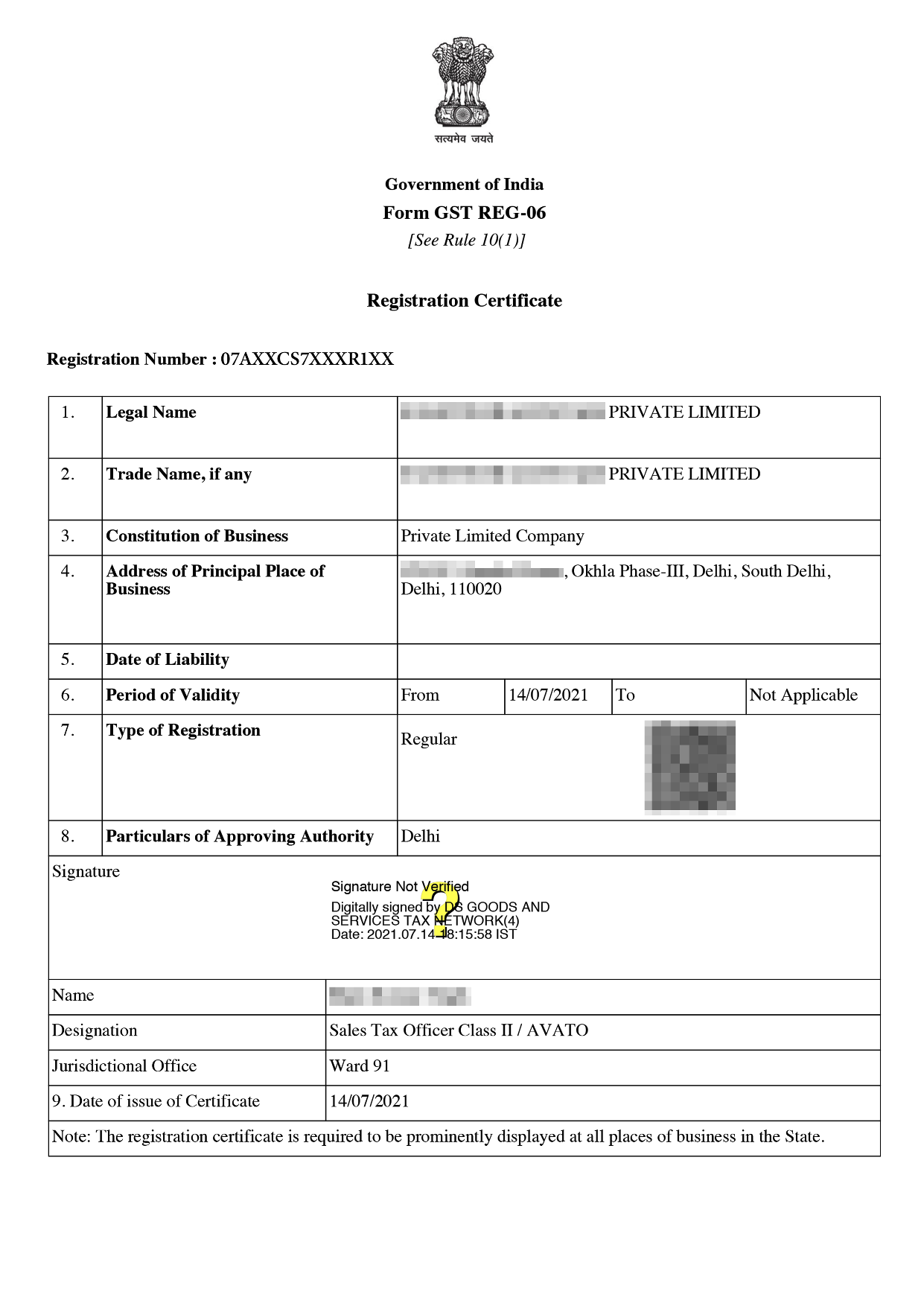

Online GST Registration Sample

GST Registration in Bihar is a compulsory step that needs to be taken to avoid any penalties. Any business having turnover more than 40 lakhs in supply of the goods and 20 lakh in supply of services are required to get registered under GST Act.

The following list includes some of the various sorts of people or companies that must register with GST:

The following documents required as mentioned below -

Documents for Sole Proprietorship/Individual-

Documents for Partnership firm/LLP -

Documents for HUF -

Documents for Company

The cost of GST registration in Bihar is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

To obtaining GST Registration entails the following steps as mentioned below -

It is suitable for the growth of the economy and the revenue base due to a number of factors.

It's crucial for firms to register for GST in Bihar because failing to do so could result in the loss of significant economic prospects.

In the end it can be said that GST Registration is one of the best ways to incorporate best practice in the taxation regime. GST Registration has many benefits such as increase in efficiency of the logistics, decrease in cost of the product, increase in profit of the firm, government income also increase and many other benefits.

GST Registration can be obtained by filling of form , submission of the required documents and after verification GSTIN and GST Certificate is granted.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today