Updated on July 06, 2024 06:26:32 PM

It's critical to comprehend the GST Registration procedure if you operate a business in Chhattisgarh. In order to replace numerous indirect taxes, India has established the Goods and Services Tax (GST), a value-added tax. Businesses with an annual turnover of more than ₹20 lakh must register for GST. This article will guide you through the complete process of GST registration in Chhattisgarh.

Get GST Registration in Chhattisgarh with Professional Utilities in an effortless and smooth manner.

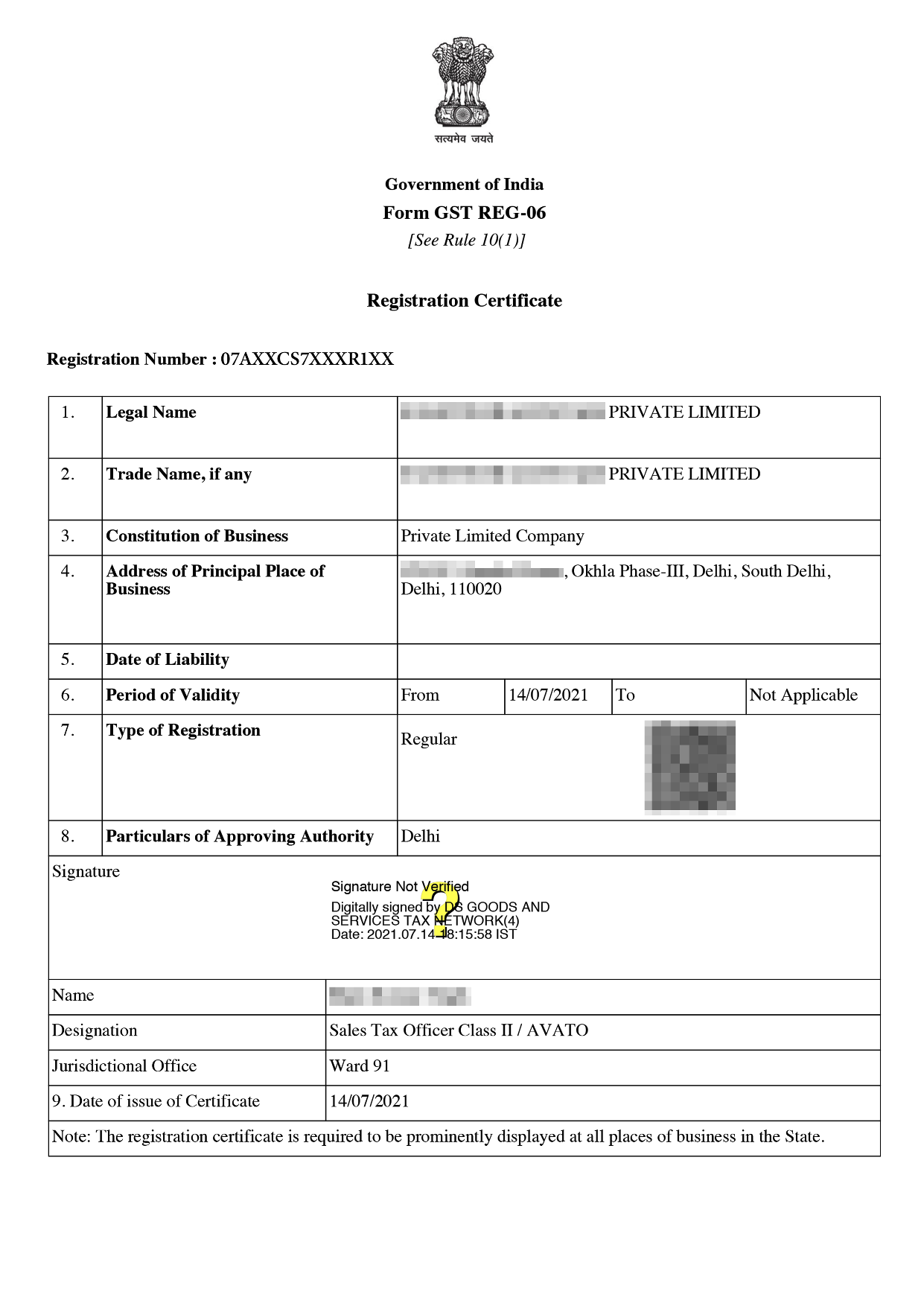

Online GST Registration Sample

GST registration in Chhattisgarh means the process of registering business under the GST regime in the National Capital Territory of Chhattisgarh. After registration GST Number is allotted to the business in which the first two digits are state codes.

Under GST Law where Suppliers affect supply has to register in each and every such state. If a business entity has branches in different states then that business has to take separate state wise registration for those branches in different states and If a business has many branches in one state then it has to take one registration in one state.

Businesses may register under the several categories listed below:

Documents required for LLP or for Partnership Firm are mentioned below -

Documents required for HUF

Documents required for company

The cost of GST registration in Chhattisgarh is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu Undivided Family ( HUF) | ₹1499/- |

| ✅ Individual and Sole Proprietors | |

| ✅ LLP and Partnership | |

| ✅ Pvt. Ltd and other companies |

Certain steps that must be taken in order to register for GST are listed below:

Multiple tax systems are combined into a single tax system under GST. In addition to increasing business efficiency, this tax change has led to an increase in taxpayers. Getting a GST registration in Chhattisgarh has various advantages, as stated below.

GST registration in Chhattisgarh gives many benefits like decreasing the cost of the product decreasing, increase in income of the government, reducing cascading effect, simplification of the tax system and many others. All this will have a positive effect on economic development.

For each category of taxpayer, a particular set of documentation must be submitted in order to complete registration. Filling out the paperwork and registering for GST is the process.. With Professional Utilities, you may register quickly and easily for a price of Rs.1499.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes, it is mandatory to take GST for all private and public companies.

No, it is valid for one registration.

Tax deductors require separate registration.

These are organisations who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today