Updated on July 06, 2024 06:26:34 PM

If your company is located in Himachal Pradesh Understanding the GST registration process is essential. India has developed the Goods and Services Tax (GST), a value-added tax, to replace many indirect levies. Businesses must register for GST if their yearly revenue exceeds Rs. 40 lakh.

You can learn all the necessary details about GST Registration in Himachal Pradesh from this page. GST registration will not only assist in tax return filing, tax collection, and tax submission to the government, but it will also boost corporate credibility and government revenue, both of which contribute to the development of the nation.

Professional Utilities can help you get GST Registration in Assam at just ₹1499/- only.

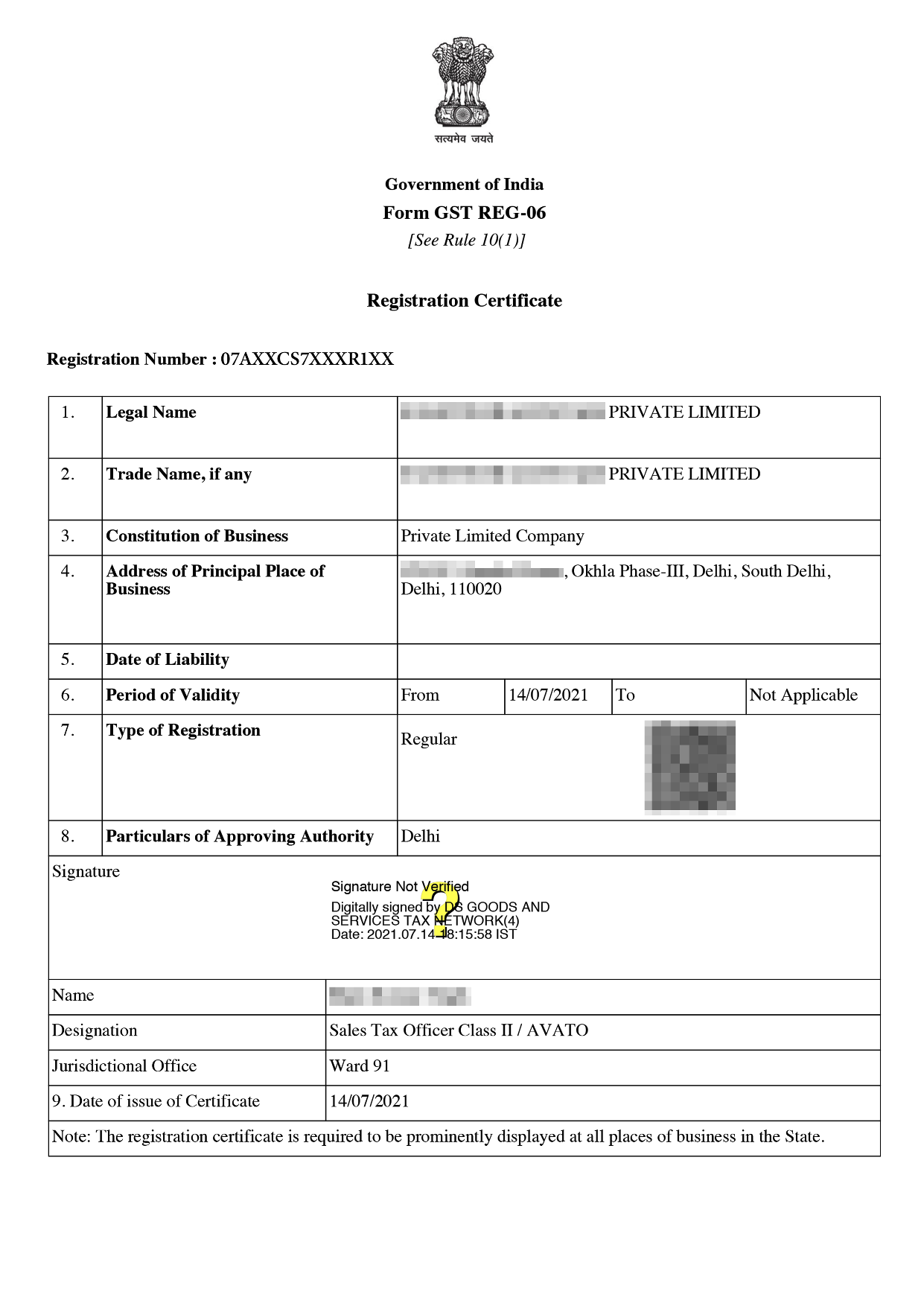

Online GST Registration Sample

GST Registration in Himachal Pradesh is introduced to reduce the tax Complexities. Any business which has turnover of more than 40 lakhs engaged in supply of the goods and 20 lakhs engaged in supply of services need to get GST Registration in Himachal Pradesh.

When goods pass through many different stages at every value addition on each stage GST needs to be levied and suppliers need to get GST registration.

There are many types of GST Registration in Himachal Pradesh as mentioned below -

There are many types of documents required for GST Registration depending on types of the business as mentioned below -

Documents required for LLP and Partnership

Documents for Hindu Undivided Families(HUFs)

Document required for Club or Society

The cost of GST registration in Himachal Pradesh is just ₹1499/- only with Professional Utilities.

Following are the charges of Gst registration for different types of Companies:-

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

GST Registration required certain step those need to be followed are mentioned below-

Various features of GST Registration in Himachal Pradesh as mentioned below-

To get yourself registered under GST registration comes with many benefits as mentioned below -

GST Registration in Himachal Pradesh requires many documents. It is beneficial both to the government as well as taxpayers. Just by paying the fee of 1499/- gets the benefit of the GST Registration in Himachal Pradesh. Any further information related to the registration is given in the article mentioned above.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today