Updated on August 30, 2024 05:26:02 PM

Online GST Registration is the best way to establish a unified tax regime in Jharkhand which not only increases the income of the government but also leads the country to the road of development. By getting GST Registration in Jharkhand taxpayers have the benefit of increase in efficiency of the logistics, unification of the tax regime, increase in profit of the firm and simple taxation. This page will give full information about the GST Registration in Jharkhand.

Professional Utilities helps in getting GST Registration in Jharkhand in an effortless and smooth manner.

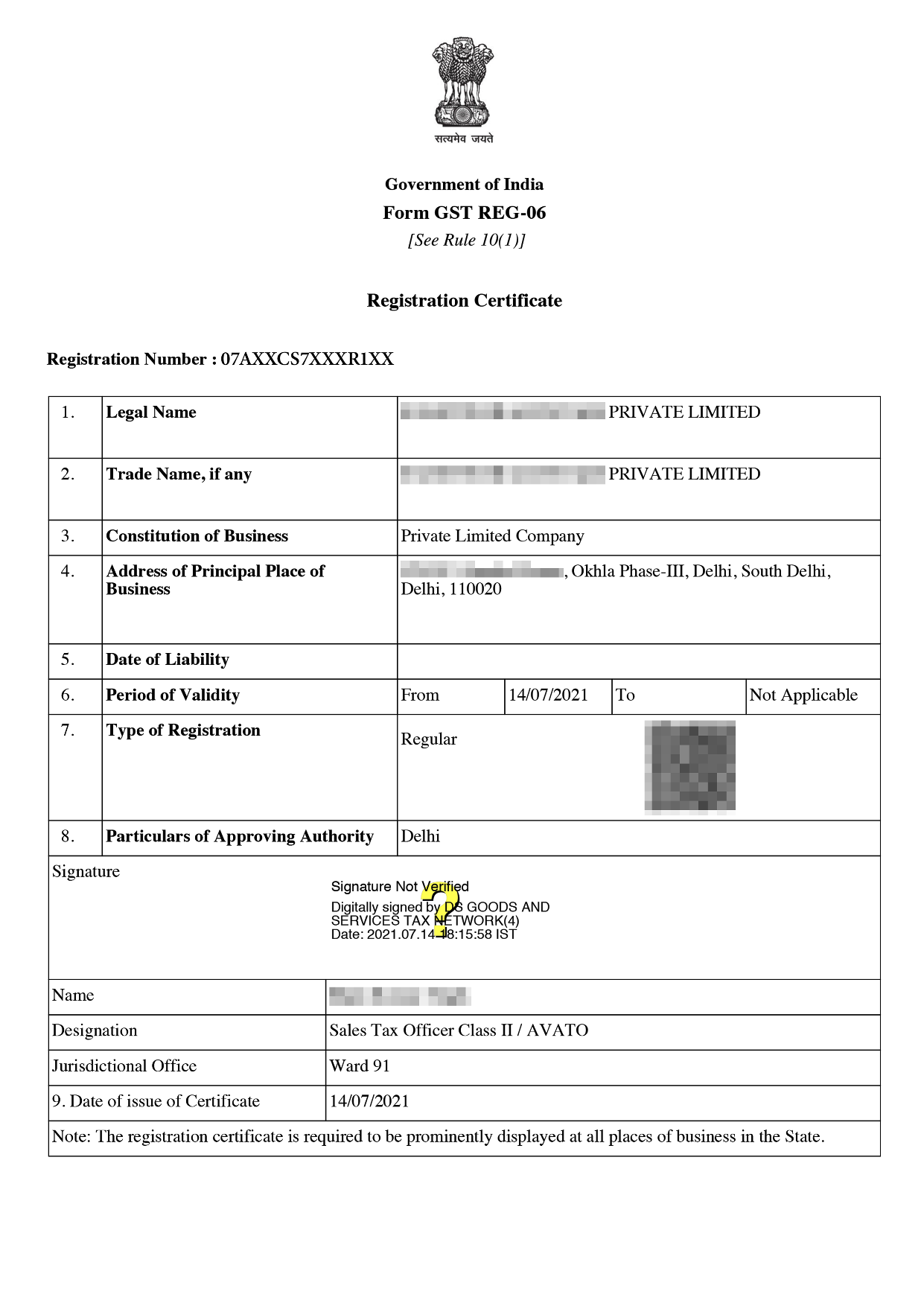

Online GST Registration Sample

After exceeding the threshold limit of 40 lakhs in case of supply of goods and 20 lakhs in case of supply of services every final customer needs to get GST Registration online. GST Registration gives legal benefit to the firm along with the reduction in tax burden.

There are many types of self-listing required for businesses in jharkhand that are GST registered:

Documents required for HUF

Documents for registration of Sole Proprietorship/Individual

Documents required for Private Limited Company

Document for LLP/Partnership firm

The cost of GST registration in Jharkhand is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

These are step Taxpayer has to followed to get GST Registration in Jharkhand:

There are some of the elements which every firm should be aware as mentioned below -

GST Registration in jharkhand is profitable for both the government and the business owner. There are several benefits, including the following:

GST Registration in jharkhand is one of the ways to establish a unified taxation system. This will increase the income of the Government and profit of the firm. By GST Registration in Jharkhand cascading effect is eliminated. There are many benefits of the GST Registration like building credibility, taking input tax credit and many others.

To get the GST Registration in Jharkhand there are different documents that need to be filled according to different types of the taxpayer with form and after verification GST Registration is alloted.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Inter state supply means supply of goods and services outside the home state for example jharkhand based companies supplying goods and services to mumbai based companies.

Main compliances after getting the GST number are -

No GST is not applied if water is not sold in sealed containers. Different GST rates which are applicable on water and water based products are 5%, 12%, 18% and 28%.

GST returns are filed on the GST portal in the prescribed format. With Professional Utilities filling of the GST Return is made easy.

Speak Directly to our Expert Today