Updated on July 06, 2024 06:26:37 PM

Value added tax, or GST Registration in Kerala, was implemented so that the final consumer would bear the tax cost. GST Registration in Kerala has a number of advantages, including lower product costs, simpler tax laws, improved logistical efficiency, less tax compliance requirements, and many more. You learn everything that you need to know about Kerala GST Registration, including its features, advantages, types, and procedures on the given page.

Get effortless and smooth GST Registration in Kerala with Professional Utilities by filling the contact form.

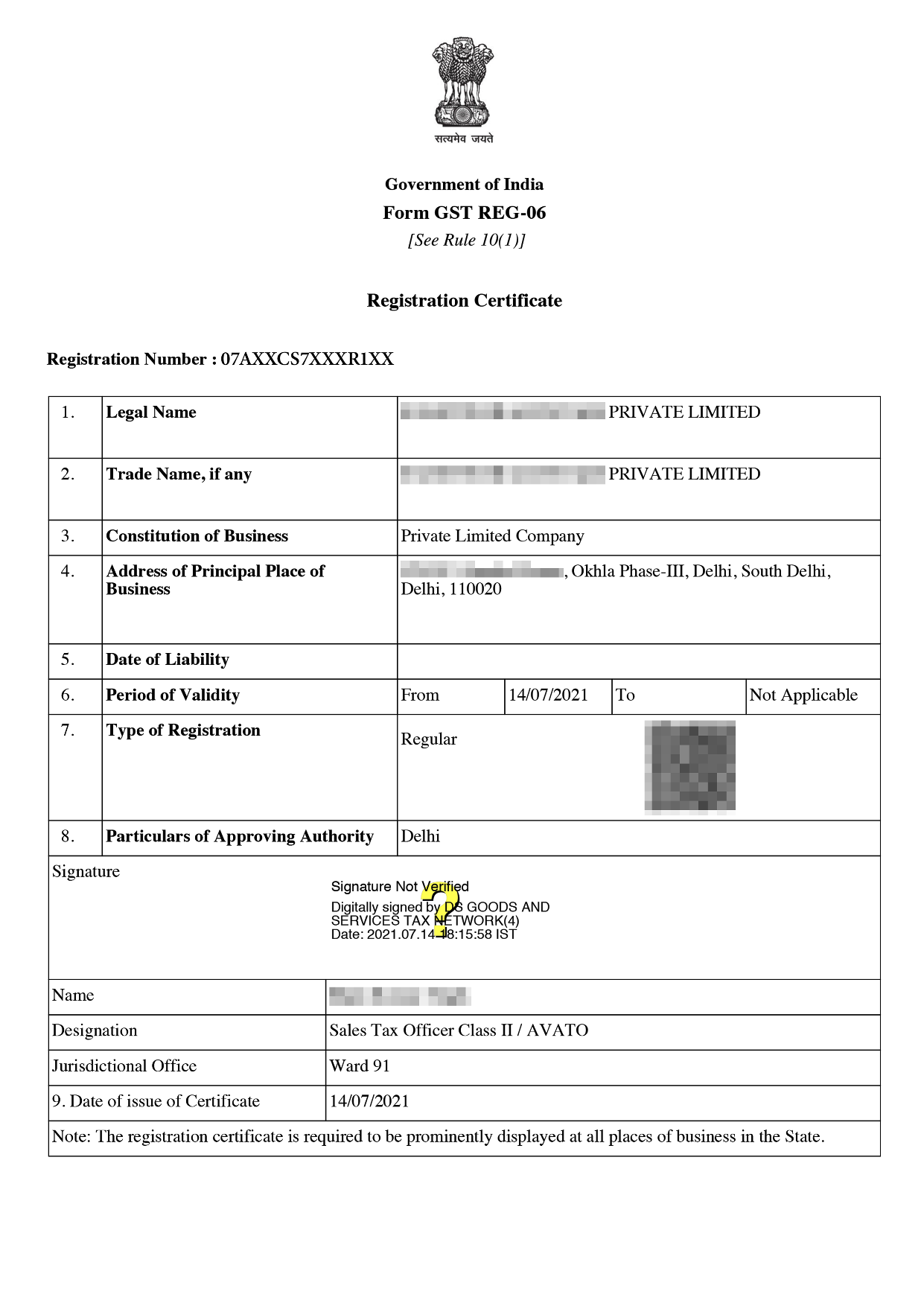

Online GST Registration Sample

GST Registration in Kerala is the process of the identification which needs to be completed within 30 days of reaching the eligibility. Any business that has a turnover of 40 lakhs in supply of the goods and 20 lakhs in supply of the services becomes eligible to get registered.

Below mentioned persons are required to get GST Registration in Kerala

There are various forms of documentation required for GST Registration depending on the type of business, as noted below:

Documents required for LLPs and Partnership:

Documents for Hindu Undivided Families(HUFs)

Document required for Club or Society

The cost of GST registration in Kerala is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

To get GST Registration in Kerala firm has to go through below mention process -

It is suitable for the growth of the economy and the revenue base due to a number of factors.

The complexity of taxes has decreased when Kerala implemented GST Registration. As many different tax systems are abolished and combined into one, the GST.

GST Registration in Kerala helps in establishing a uniform taxation system. It has many benefits such as reduction in price of the product, improvement in efficiency of logistics, availability of the input tax credit to increase the profit of the business. With Professional Utilities get GST Registration done in 1499/- fast and effortless.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today