Updated on July 06, 2024 06:26:38 PM

GST Registration is introduced in India to have a unified tax regime and value-added tax to tax products at every stage. By GST Registration, taxpayers get the benefit of the increase in efficiency of the logistics, a decrease in the cost of the product, reduce the cascading effect, an increase in the income of the government, and many more. Going through this page will give full information regarding GST Registration in Manipur.

Get GST Registration in Manipur quickly and fast with the services of the Professional Utilities.

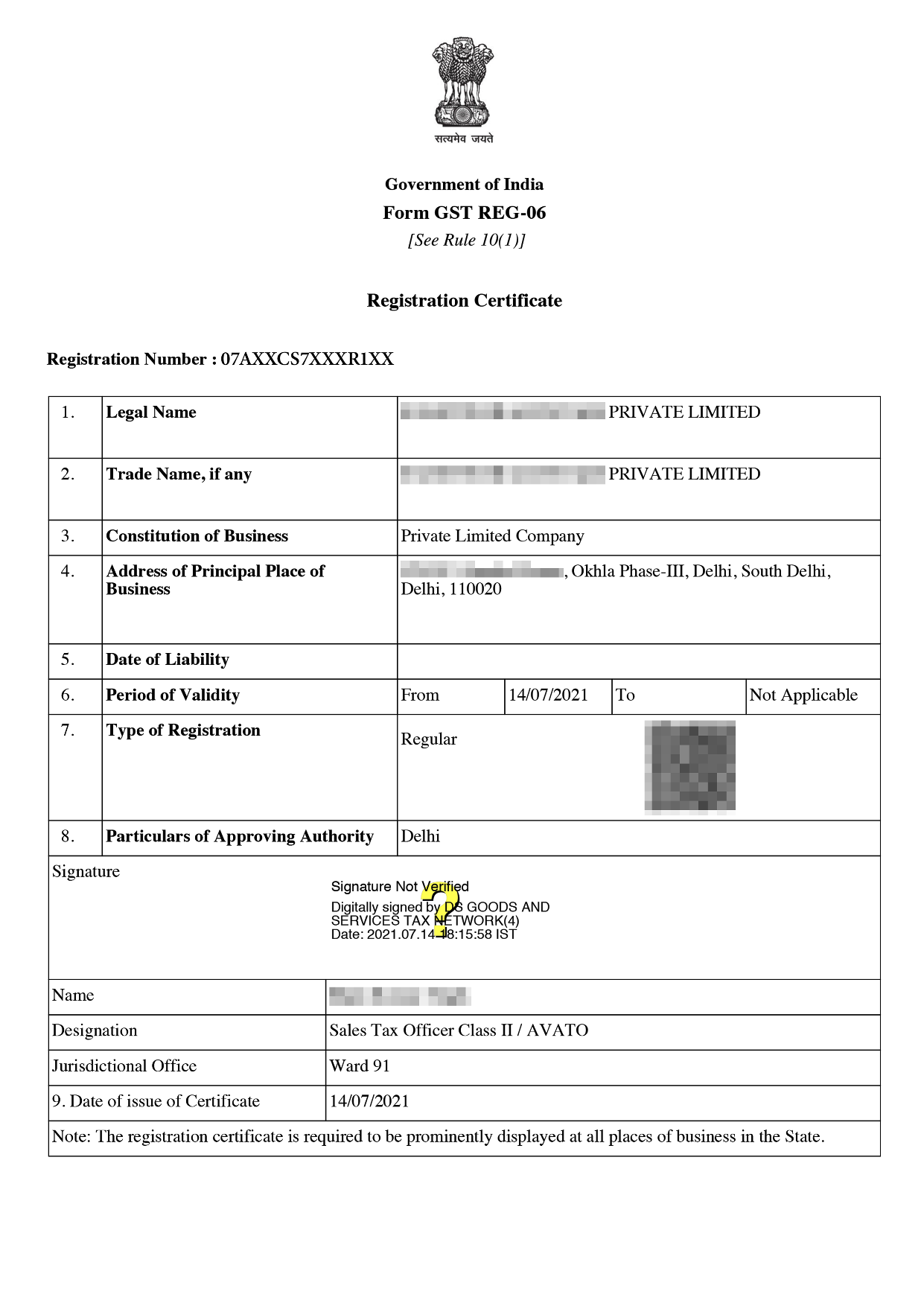

Online GST Registration Sample

Suppliers making taxable supplies of goods and services or both are required to be registered under GST ACT. If its aggregate turnover exceeds 10 lakhs in the financial year. GST Registration in Manipur is PAN Card based and it is easternmost corner of the northeast.

There are various methods of registration for various entities as mentioned below -

The cost of GST registration in Manipur is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| GST Registration Online | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

If you meet the requirements to register for GST, to get GST Registration below mention steps have to be followed-

The following benefits of Manipur GST registration are mentioned below.

GST Registration in Manipur is established to promote development in the economy. There are many benefits of GST Registration in Manipur like the elimination of the cascading effect, increase in the income of the government, reduction in the cost of the product, increase in profit of the company, and many others.

GST Registration can be obtained just by filing the form, submission of the required documents, and verification of the documents.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisations who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services.

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today