Updated on July 06, 2024 06:26:39 PM

If you are looking for a solution to all GST-related queries contact Professional Utilities. You need to understand that GST is a value-added tax under which all suppliers having 40 lakhs of turnover need to register themselves. This tax was introduced by the government to simplify the taxation system. The Central Excise Duty, the Service Tax, and other indirect taxes were all replaced with the GST, a comprehensive indirect tax.

All businesses in Mizoram either engaged in selling or purchasing the goods or offering any types of services or both are required to get GST registration in Mizoram. Otherwise, they will not be able to charge GST and attract legal action against them.

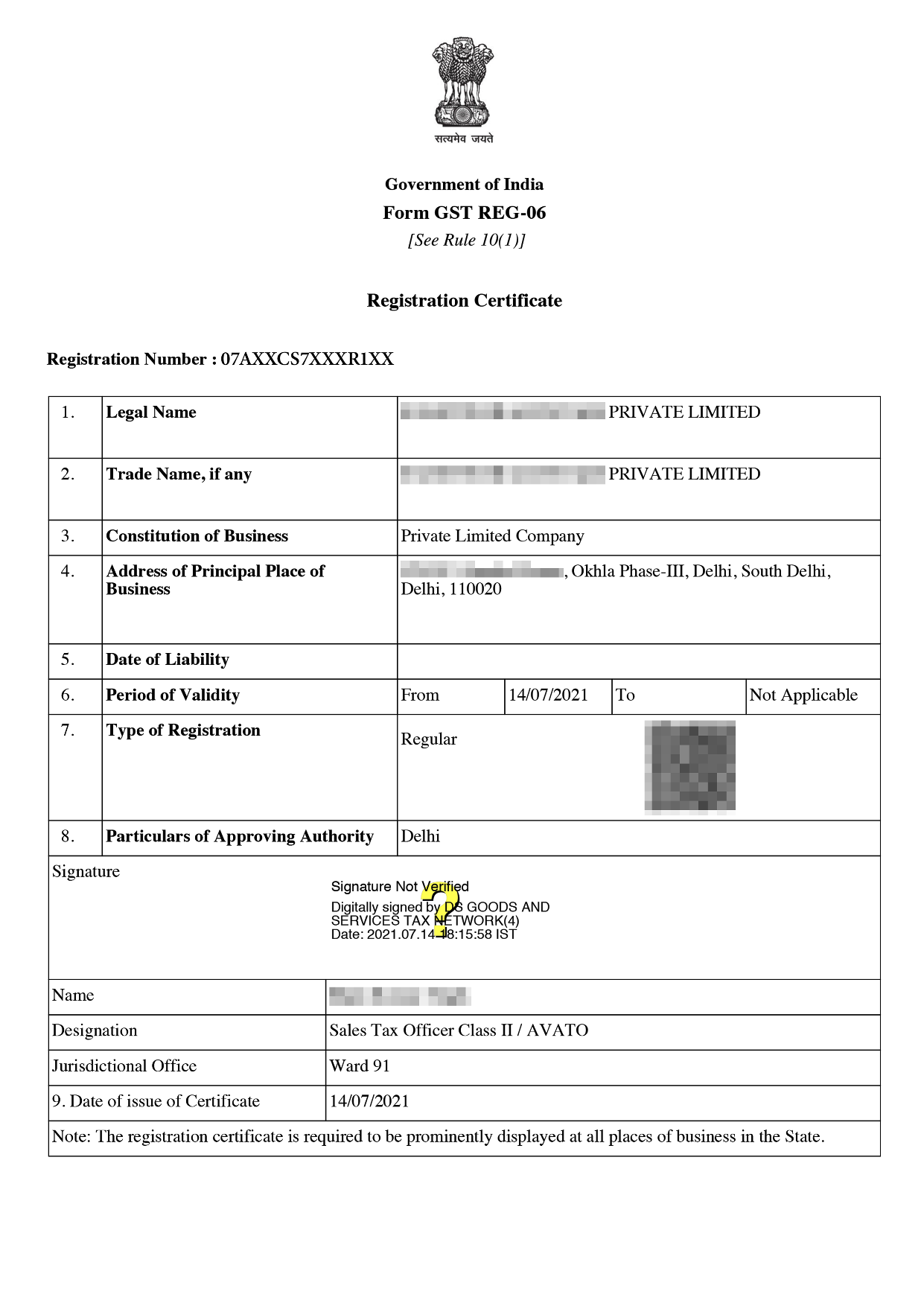

Online GST Registration Sample

Getting a Goods and Services Tax (GST) registration number for a company or person operating in the Indian state of Mizoram is referred to as GST registration in Mizoram.

Any firm or individual having a turnover of more than 40 lakhs in the supply of goods and 20 lakhs in supply of the services.

Documents required for LLP or for Partnership Firm

Documents required for HUF are mentioned below -

Documents required for the Company are mentioned below:-

The cost of GST registration in Mizoram is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| GST Registration Online | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Whether or not a taxpayer must register for GST will depend on the activity they engage in.

Getting GST Registration involves the below-mentioned steps-

The following list includes some of the features of the GST Registration in Mizoram -

Under the GST, various tax systems are integrated into one tax system. This tax adjustment has increased taxpayers in addition to improving corporate efficiency. In Mizoram, registering for GST has many benefits. - as described below.

When a business exceeds a certain turnover while engaging in particular activities GST Registration is mandatory in Mizoram. It includes the claiming input tax credit, collection of GST, and following the GST Registration. To get the GST Registration forms are filled, documents are submitted, and after verification of the form GSTIN and GST Certificate are issued. Firms get many benefits for registration under GST.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Mizoram, Tripura, Manipur, and Nagaland must adhere to the threshold limit of 10 lakh. There are 11 Special Category States as defined by Article 279A(4)(g) of the Constitution, including the States of Arunachal Pradesh, Assam, Jammu, and Kashmir.

The threshold limit for GST registration is a yearly turnover of Rs. 20 lakhs (for the supply of goods) and Rs. 10 lakhs (for the provision of services) for companies operating in special category states like Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, and Sikkim.

Yes, it is feasible to have numerous GST Registrations at the same address as long as the applicant complies with the requirements for having unique and different business verticals.

The Governor of Mizoram hereby notifies the rate of the state tax as (i) 2.5 percent, in accordance with subsection (1) of section 9 of the Mizoram Goods and Services Tax Act, 2017 (6 of 2017).

Speak Directly to our Expert Today