Updated on October 22, 2024 12:35:16 PM

If you operate a business in Odisha It's critical to comprehend the GST registration procedure. India has developed the Goods and Services Tax (GST), a value-added tax, to replace many indirect levies. Businesses must register for GST if their yearly revenue exceeds Rs. 40 lakh. GST registration will not only assist in tax return filing, tax collection, and tax submission to the government, but it will also boost corporate credibility and government revenue, both of which contribute to the development of the nation.This page will give you insight into all the required information related to GST Registration in Odisha.

Professional Utilities can help you get GST Registration in Assam at just ₹1499/- only.

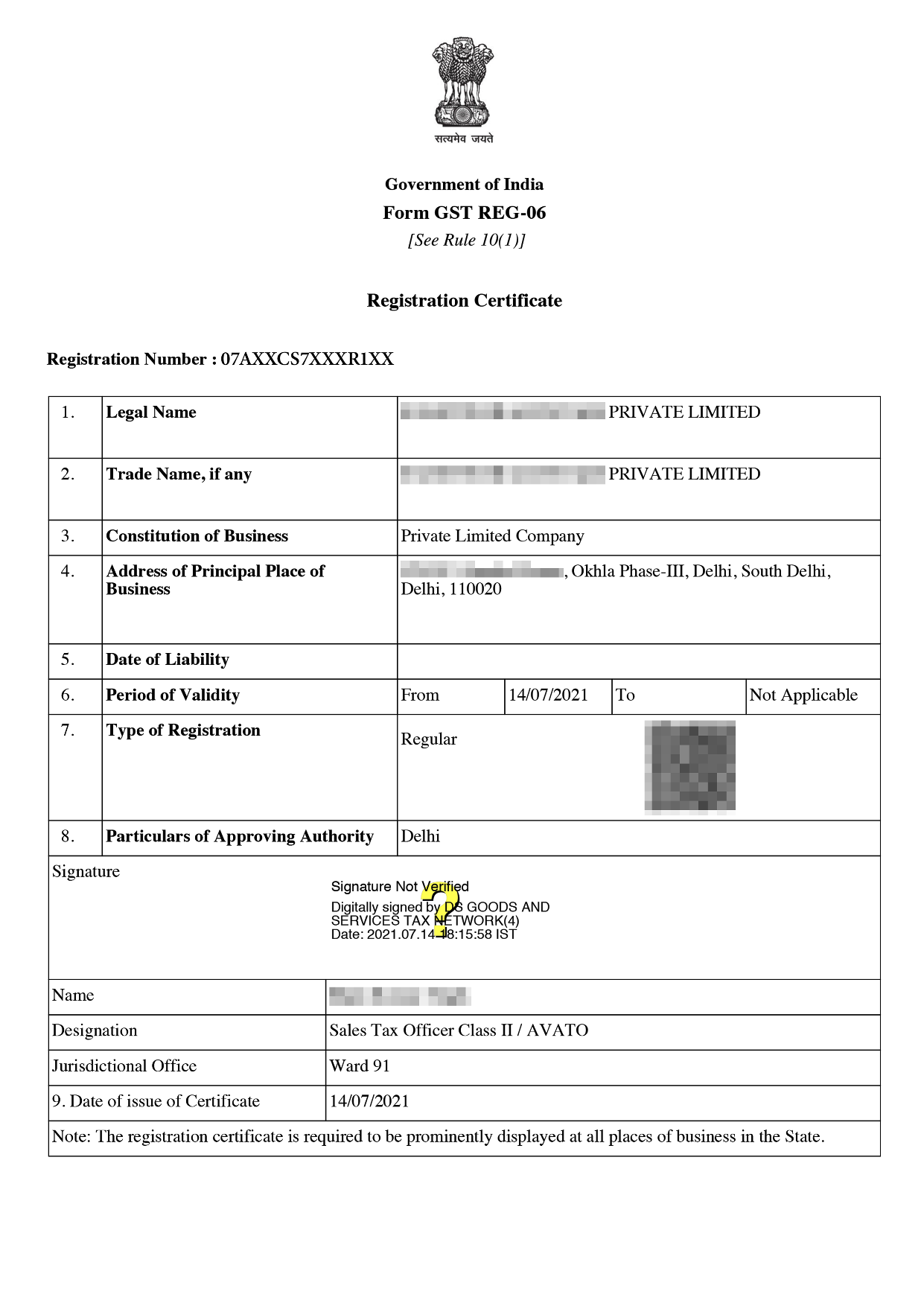

Online GST Registration Sample

GST Registration in Odisha reduces tax complexity by bringing many taxes under one tax regime. Any business with turnover more than 40 lakhs engaged in supply of the goods and 20 lakh in supply of the services need to get registration in Odisha.

There are many types of the person or entities that need to take registration in GST are mentioned below:-

The following documents required as mentioned below -

Documents required for Private Limited Company

Documents required for HUF

Documents required for Proprietorship

Documents required for LLP or for Partnership Firm

The cost of GST registration in Odisha is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

In Odisha, registering for GST is a quick, easy process that only requires a few steps. The following list of steps is related to GST registration:

Various feature of the GST Registration are mention below -

The following are some of the many advantages of GST registration in Odisha:

By getting GST Registration in Odisha, taxpayers get many benefits like increase in the credibility of the business, reduce the cost of the product, taxpayers can take the input tax credit which in turn increases the profit of the business.

To get GST Registration many documents are required to be filled along with documents.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Consumption tax or Destination Tax is a kind of tax which is levied on goods and services where they are consumed. Under this taxation imports are taxed on par with domestic sphere and exports are considered as nil tax amount.

Digital Signature or DSC is required in registration of the LLP, Limited Company etc and not required in case of Partnership firm or proprietorship firm.

Principal Place of Business is the primary location of taxpayer’s business that is performed within the state. It is generally addressed where top management or head of the firm is located and where books of accounts and records are kept.

Whereas Additional Place of Business where in addition to place of business other business related activities are carry out within the state

Yes

Speak Directly to our Expert Today