Updated on July 06, 2024 06:26:41 PM

GST Registration in Sikkim is one of the important ways to have a unified tax system and increase the income of the government which will result in an increase in the welfare of the people. There are many benefits of GST Registration in Sikkim like an increase in the efficiency of the logistics, a reduction in the price of the product, and less compliances. Going through this page will give you detailed information about the What is GST Registration, its procedure, fee, importance, and many others.

We at Professional Utilities can help you to get GST Registration in Sikkim in a smooth and effortless manner.

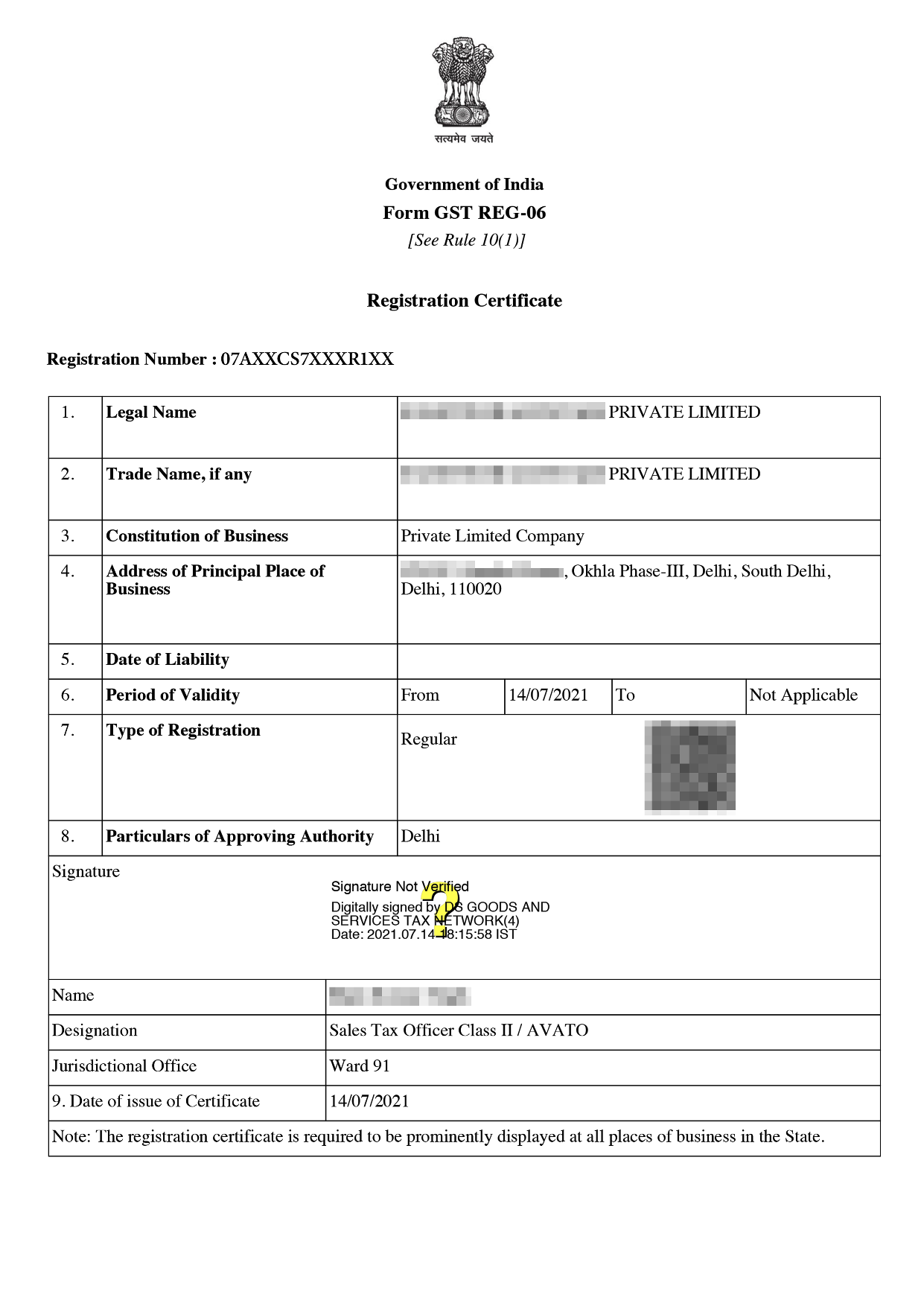

Online GST Registration Sample

Every Company or individual engaged in the supply of goods and services is required to get registered under the GST Regime. The threshold limit is 40 lakhs in case of supply of the goods and 20 lakhs in case of supply of the services. Goods and Services Tax Identification Number is received after GST Registration.

The activities that the taxpayer engages in will decide whether or not they are required to register for GST.

The following documents required as mentioned below -

Documents for Sole Proprietorship/Individual-

Documents for HUF -

Documents for Partnership firm/LLP -

Documents required by club or society

The cost of GST registration in Sikkim is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

Certain steps that must be taken in order to register for GST are listed below:

There are many features of the GST Registration in Sikkim

Multiple tax systems are combined into a single tax system under GST. In addition to increasing business efficiency, this tax change has led to an increase in taxpayers. Obtaining a GST registration in Sikkim has various advantages. - as stated below

To have complete GST Registration in Sikkim full form along with documents are required to be filled. After verification registration is granted. There are many benefits of the GST Registration in Sikkim like simplified procedures, unified taxation regime and many others. With Professional Utilities get GST Registration at 1499/-.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Yes it is mandatory to take GST for all private and public companies.

No It is valid for one registration.

Tax deductors require separate registration.

These are organisation who do not need to register and UIN is allotted.

Refund of taxes are allowed on notified supplies of goods and services

The following do not require registration and are allotted a UIN (Unique Identification Number) instead.

They can take a refund of taxes on notified supplies of goods/services received by them:

Speak Directly to our Expert Today