Updated on July 06, 2024 06:26:42 PM

GST Registration in Telangana was introduced for reduction of the tax compliances and elimination of cascading effect of taxation. By registering under the GST Act a person enjoys many benefits such as simplification of tax regime, price of the product reduced, improvement in efficiency of the logistics and many other. Going through this page will give you full information about the GST Registration in Telangana.

Get GST Registration in Telangana with Professional Utilities in an effortless and smooth manner.

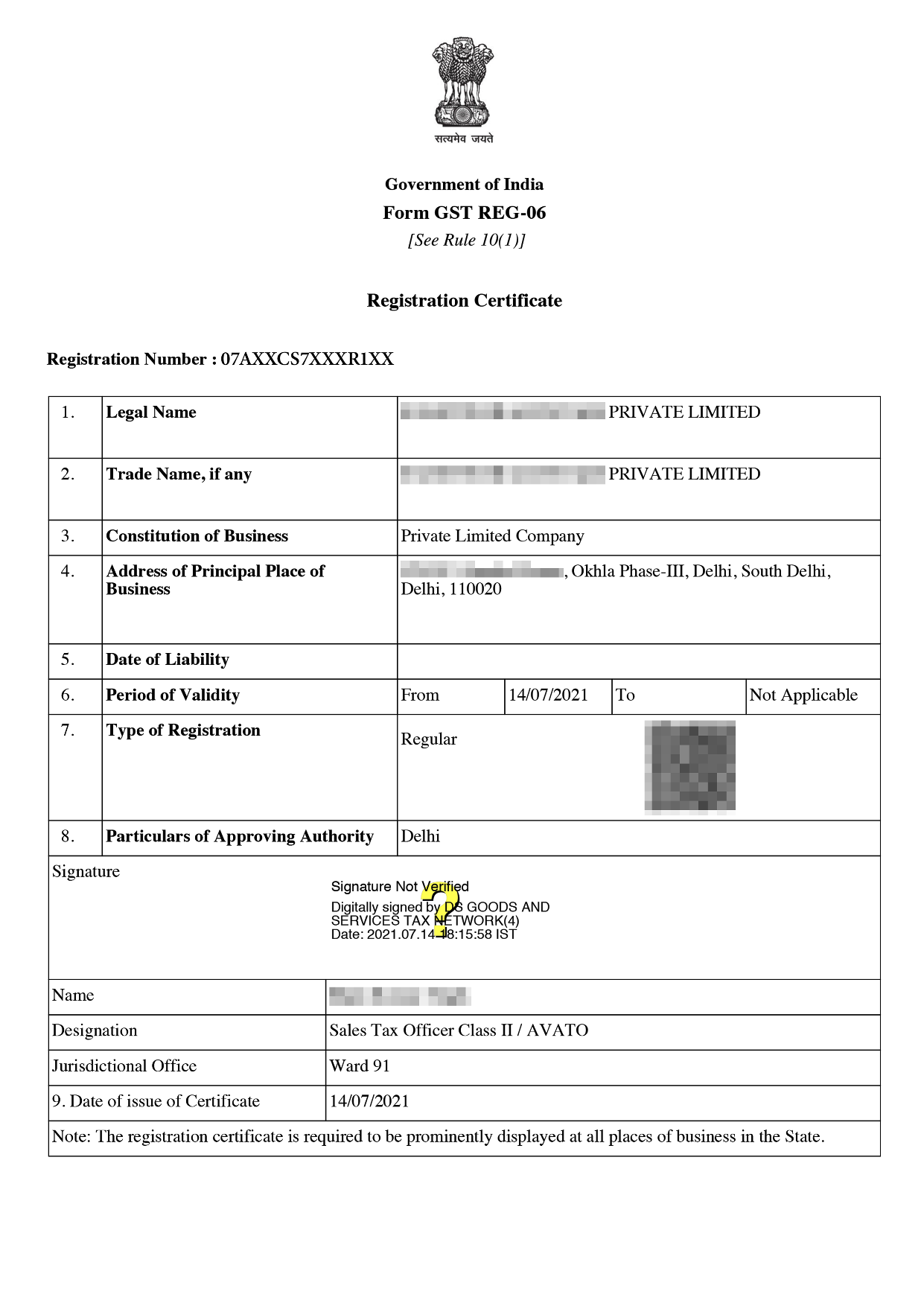

Online GST Registration Sample

GST Registration in Telangana is the process of registration as a taxable person. GST Registration in Telangana has a threshold of 40 lakhs in case of goods and turnover of more than 20 lakhs in case of supply of the services.

Every taxpayer which has business in the state of Telangana needs to get GST registration in Telangana.

Documents required for Proprietorship

Documents required for HUF

Documents required for LLP or for Partnership Firm

Documents required for Private Limited Company

The cost of GST registration in Telangana is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

In Telangana, registering for GST is a quick, easy process that only requires a few steps. The following list of steps is related to GST registration:

There are numerous characteristics of the GST Registration in Telangana

There are numerous advantages of GST registration in Telangana as mentioned below -

GST Registration in Telangana was established to promote economic development in the country. GST Registration in Telangana has many benefits such as simplification of the taxation regime, unified tax system, reduction in the price of the product, decrease in corruption etc . Get GST Registration in Telangana with Profesional utilities at the fee of 1499/-

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Consumption tax or Destination Tax is a kind of tax which is levied on goods and services where they are consumed. Under this taxation imports are taxed on par with domestic sphere and exports are considered as nil tax amount.

Digital Signature or DSC is required in registration of the LLP, Limited Company etc and not required in case of Partnership firm or proprietorship firm.

Principal Place of Business is the primary location of taxpayer’s business that is performed within the state. It is generally addressed where top management or head of the firm is located and where books of accounts and records are kept.

Whereas Additional Place of Business where in addition to place of business other business related activities are carry out within the state.

Yes

Speak Directly to our Expert Today