Updated on July 06, 2024 06:26:42 PM

GST Registration in Tripura is introduced to have a unified tax regime and eliminate cascading effects. By registering under the GST Act, a person can get the benefit of a reduction in the cost of the product, improve efficiency of the logistics, an increase in profit of the firm, and unified taxation systems. The page below will give a clear idea about the GST features, benefit, and processes.

Get GST Registration in Tripura in an effortless and smooth manner with the Professional Utilities

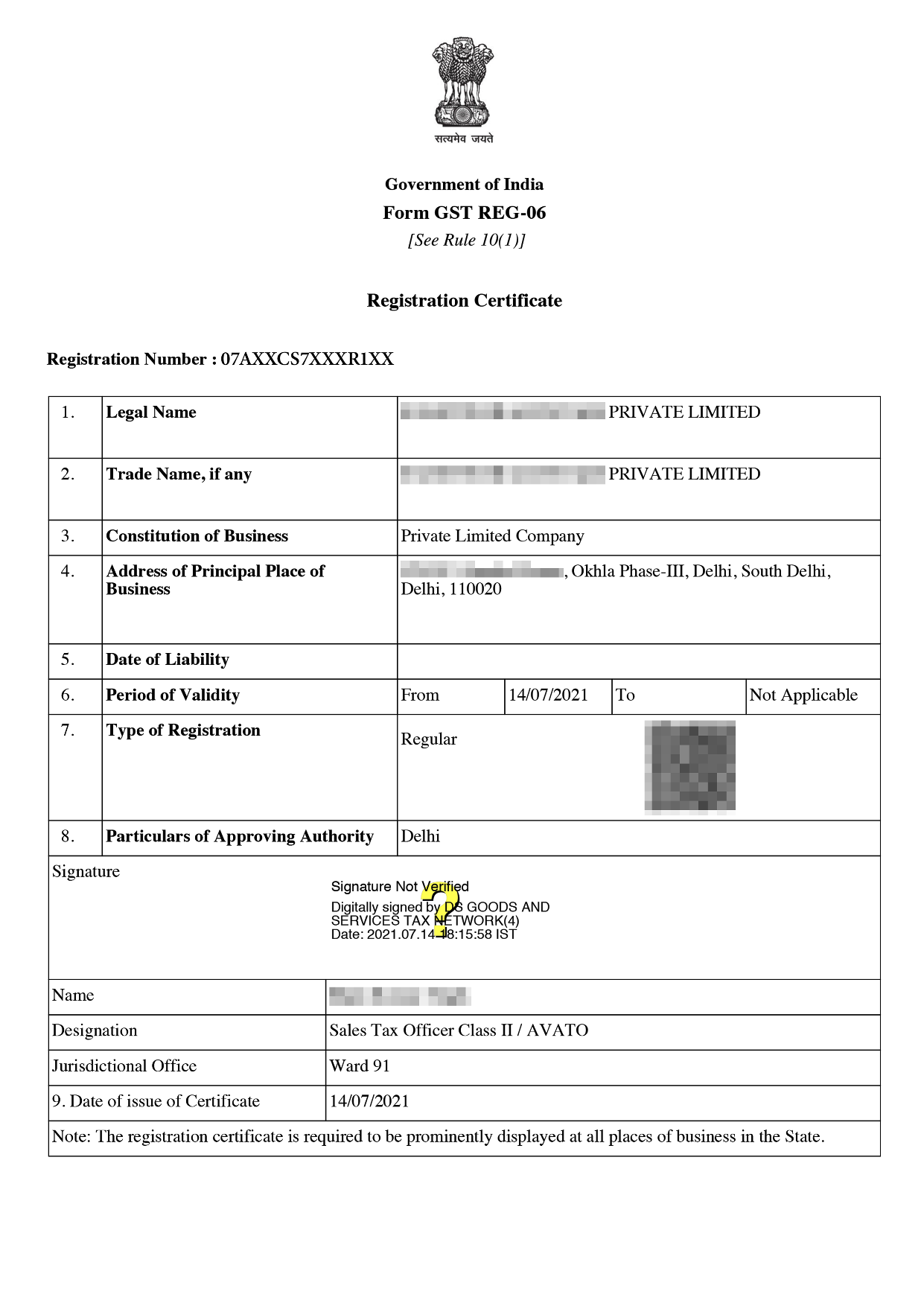

Online GST Registration Sample

GST Registration in Tripura has bought thousands of small businesses under one tax reform due to. Any firm which has an annual turnover of more than 40 lakhs engaged in supply of the goods and 20 lakhs in supply of services. In GST Registration firms gets GSTIN for the purpose of the identification of the firm.

Businesses in Tripura that are registered for GST are mentioned below-

The following documents required as mentioned below -

Documents for HUF -

Documents for Sole Proprietorship/Individual-

Documents required For Company

Documents for Partnership firm/LLP -

The cost of GST registration in Tripura is just ₹1499/- only with Professional Utilities.

Following are the charges of GST registration for different types of Companies

| Particulars | GST Registration Fees |

|---|---|

| ✅ Hindu undivided family ( HUF) | ₹1499/- |

| ✅ Individual and sole proprietors | |

| ✅ LLP and partnership | |

| ✅ Pvt. Ltd and other companies |

There are some fundamental steps that must be taken, as listed below:

The following are some elements of which every firm should be aware:

Both the government and the entrepreneur profit from GST Registration in Tripura. There are numerous advantages, as follows:

GST Registration is one of the ways to have a unified tax regime under which various taxes are bought under one single tax. By getting GST Registration, the taxpayer can get the benefit of taking Input tax credit which in turn increases the profit of the firm. To get online GST Registration required documents and fee is required to fill out with the government.

Complete Digital

Process

Free Expert

Assistance

Best Price

Guarantee

4.9/5 Google Rating

(350 Reviews)

Money Back

Guarantee

Simple & Fast

Process

Inter state supply means supply of goods and services outside the home state for example tripura based companies supplying goods and services to mumbai based companies.

No It is valid for one registration.

No GST is not applied if water is not sold in sealed containers. Different GST rates which are applicable on water and water based products are 5%, 12%, 18% and 28%.

GST returns are filed on the GST portal in the prescribed format. With Professional Utilities filling of the GST Return is made easy.

Speak Directly to our Expert Today